This is pretty wild. Investors in agency mortgage REITs have got to be thrilled right now. These REITs are achieving outstanding price-to-book ratios. Even Orchid Island Capital (ORC) has a premium to our estimate of current book value.

When does that happen? Not very often. Some analysts would run estimates about once per quarter, but The REIT Forum runs new estimates on a weekly basis. While our charts here will use the price-to-trailing book, the commentary will focus on price-to-current-projected-book-value.

What Do You Mean Estimates?

You understand that mortgage REITs are holding a large amount of mortgages and a ton of hedges. Right? I think most people who click my articles understand that. The thing about having all these positions is that the positions are disclosed every quarter. They usually don’t have dramatic changes in the position between quarters. Therefore, if you were willing to spend enough time on it, you could model out the projected change in the value of every asset and every liability. Of course, you can also account for things like interest accrual. That is how you create an estimate for the REIT’s performance.

You don’t have to predict where rates will go in the future. Why not? Because if you could do that consistently you’d be richer than Warren Buffett. Instead, you can model based on what has happened and what would happen if rates simply followed the forward yield curve. Being able to adjust for where rates are today is already more than most investors are doing.

The Gap

The gap between AGNC Investment Corp. (AGNC) and other agency mortgage REITs narrowed. AGNC still has the highest price-to-book ratio, but there are two others with significant premiums using our current estimates for book value. Orchid Island Capital also has a premium to projected book value, but it’s smaller. Around 3%, using today’s values and our estimated valuation for every position within their portfolio as of last Friday night. If I were management at Orchid Island Capital, I would be smashing the “issue new shares” button. Of course, that’s assuming we are right about the current book value. Historically, we usually do a pretty good job with those estimates.

Dividends Getting Mugged

If paying a huge premium and then getting a dividend sounds like “income” to you, you’ll love this idea. Some stores offer “rebates.” If you ignore the price you paid for the item, you can count the rebate as “income.”

For new readers, yes, that was sarcastic. Hi. Welcome to CWMF’s articles.

Thoughts About the Sector

The spread between agency MBS and Treasuries is still pretty good. That’s really nice for earning higher levels of net interest income. However, the premiums to book value are getting pretty wide. That makes the risk/reward profile much worse. Think mortgage REITs can’t trade at a discount to book value? Just look at any other kind of mortgage REIT. Discounts to book are very common. Some of the other mortgage REITs should really consider changing their strategy to being an agency mortgage REIT.

Agency mortgage REITs don’t take a ton of skill. However, AGNC and Annaly Capital Management (NLY) are so large that they aren’t particularly nimble. It’s harder to rapidly reposition their portfolio. So if someone with no expertise wanted to run an agency mortgage REIT, they could copy those portfolios and update them once per quarter. Then they could spend the rest of the time on the beach. To be fair, some teams have performed much worse than that. On the other hand, some REITs like Dynex Capital (DX) have a better history. They ran a smaller portfolio and repositioned the portfolio more effectively to take advantage of adjustments in the market. That’s a nice strategy for the extremely small number of people who can do it.

Some Historical Context

I keep running my mouth about the price-to-book ratio. Some people (awful investors) think price-to-book doesn’t matter. Those investors thoroughly disagree with the executives of the REITs, so that’s pretty funny. There are times when price-to-book can be overshadowed by other factors. For instance, if a REIT was fatally flawed. That’s pretty rare, but it can happen. There once was a REIT called “RAIT Financial Trust.” It was a good example of being fatally flawed. Book value was low and management was paying themselves way too much of it.

Anyway, I pulled this chart showing the price-to-trailing-book-value ratio for Annaly Capital Management from the start of January 2014 through today. See what you think:

The REIT Forum

Now we could be more precise by using estimates for book value throughout every quarter. However, I’m simply not going to that level of extra work. Maybe someday, but not right now.

By our estimates, NLY’s book value quarter-to-date is up moderately. Our projections indicate it has probably increased by a bit more than the net interest accrual would account for. However, we’re still looking at a pretty high valuation. That’s unusually high and NLY isn’t the only mortgage REIT where this is happening. Not even close.

What Should Investors Do?

My preferred choice, sorry bad pun, is to play it safe. I typically lean more toward the preferred shares. When I venture into the common shares, usually it’s for a short-term trade. I’m not interested in jumping into the common shares to see if management can deliver some outstanding performance with their portfolio. Yuck! When I jump into common shares, I want to see the price-to-book ratio do something that’s extremely common in most fields around the world: “regression to the mean.” That’s it. I just want to see the price-to-book ratio normalize. When I can get a big discount to the normal valuations, then that’s probably attractive. Otherwise, I can sit in some of the less volatile securities.

Preferred shares are often one of my favorite areas. I can collect a respectable yield while waiting for relative values to swing or for big opportunities to show up in the common shares. A few preferred shares are still trading below my targets, but not very many. It’s a significant contrast to a few years ago. We were spoiled for choice for a while. Lately, I’ve been much more cautious in our portfolio strategy.

I’ll still trade in some of the preferred shares. I still own a bit of common shares. I might buy a bit more. My allocation to common shares in the sector is pretty low. I wouldn’t be going with the agency mortgage REITs where price-to-book ratios are at historically high levels though. I would be picking other mortgage REITs, or possibly BDCs. I currently have a much larger allocation to Treasury bill ETFs than normal.

I think investors in the agency mortgage REITs should be looking to capture gains.

Treasury Bill ETFs

I’m using three Treasury bill ETFs:

- SPDR Bloomberg 1-3 Month T-Bill ETF (BIL)

- iShares 0-3 Month Treasury Bond ETF (SGOV)

- iShares Short Treasury Bond ETF (SHV)

I have quite a bit more invested there than normal.

Equity REITs

However, I also have more in equity REITs than “normal.” There are some great equity REITs trading at substantial discounts to the net value of their assets. Great equity REITs at much lower AFFO multiples than normal. The yields aren’t as high as mortgage REITs. They will never be as high.

When you purchase an equity REIT with a fat dividend yield, you’re at risk of getting Medical Property Trust-ed (MPW). We can make that a verb, right?

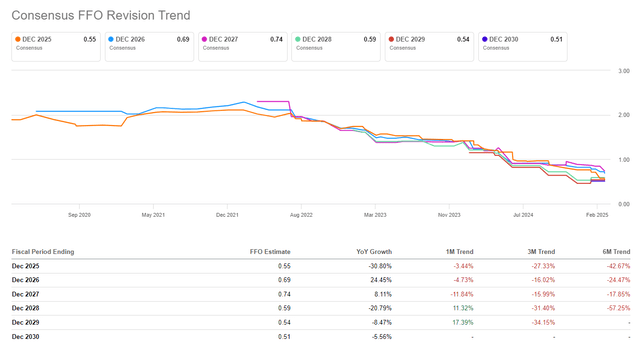

Come on, look at these FFO estimates:

Seeking Alpha Premium

Note: This is a feature from Seeking Alpha Premium. Search the ticker, then click “Earnings” then “Earnings Revisions.”

Even in 2022, the 2025 estimate was around $2.00 per share. The current estimate of $.55 per share is much smaller. Raw deal. MPW is clearly not one of the great equity REITs.

All The Stocks

The charts compare the following companies and their preferred shares or baby bonds:

- BDCs: (CSWC), (BXSL), (TSLX), (OCSL), (GAIN), (TPVG), (FSK), (MAIN), (ARCC), (GBDC), (OBDC), (SLRC)

- Commercial mREITs: (GPMT), (FBRT), (BXMT)

- Residential Hybrid mREITs: (MITT), (CIM), (RC), (MFA), (EFC), (NYMT)

- Residential Agency mREITs: (NLY), (AGNC), (CHMI), (DX), (TWO), (ARR), (ORC)

- Residential Originator and Servicer mREITs: (RITM), (PMT)

Embedded Charts

Mortgage REITs and BDCs:

|

The REIT Forum |

The REIT Forum |

The REIT Forum |

|

The REIT Forum |

The REIT Forum |

The REIT Forum |

Preferred shares and baby bonds:

|

The REIT Forum |

The REIT Forum |

The REIT Forum |

|

The REIT Forum |

The REIT Forum |

The REIT Forum |

|

The REIT Forum |

The REIT Forum |

The REIT Forum |

Thanks for reading and I hope you enjoyed the charts.

Some terminology:

- FTF = Fixed-to-floating. Share is currently fixed but will begin floating based on SOFR. We may reference LIBOR, but that’s assumed to be SOFR + 0.26161%.

- FTR = Fixed-to-reset. Share is currently fixed. It will eventually begin resetting every five years based on the five-year Treasury rate.

- FTL = Fixed-to-lawsuit. The company decided that their FTF shares could be “fixed-to-fixed” despite clearly violating the original intent of the contract.

- Floating = A share that was FTF, but is now floating. The dividend rate is updated every three months.

Read the full article here