By Michael Kagan and Stephen Rigo, CFA

Broad Bullishness Creates More Risk, Not Less – 4Q 2024

Market Overview

A powerful post-election rally propelled the S&P 500 Index up 2.4% in the fourth quarter, the S&P 500’s fifth consecutive quarterly advance (and eighth over the past nine quarters). The index’s 25% total return for calendar 2024 marked back-to-back years of at least 25% returns, an ascent only achieved four times since 1929 (1936, 1955, 1998, and today). At this point, we’re running out of superlatives to describe the market’s relentless advance over the past two years.

Consumer discretionary stocks led the advance in the quarter (+14.3%), the only sector to post a double-digit quarterly return. This was almost exclusively driven by Tesla (TSLA), which rose 52% as investors chased the open-ended optionality of an Elon Musk/Donald Trump alliance. Travel and consumer stocks (including Amazon (AMZN)) also fared well with investors optimistic that robust consumer spending would continue beyond the holiday shopping season. Communication services and information technology (IT) also outperformed on continued optimism around artificial intelligence. Finally, financials performed well as investors looked forward to a lighter regulatory touch for banks and credit card issuers under a Republican administration.

“Investor expectations for lower interest rates remain too aggressive and could act as a ceiling to materially higher stock market returns.”

Materials and health care stocks were the worst-performing sectors in the quarter, declining -12.4% and -10.3%, respectively. Metals, mining and chemicals stocks lagged as the industrial economy remains sluggish and investors feared stubbornly high mortgage rates would keep a lid on real estate activity. Within health care, large managed care companies trailed as investors fretted about the industry’s claims-paying practices following the tragic murder of Brian Thompson, a UnitedHealth executive. Drug stocks were weak as anemic current growth collied with worries about the potential impact RFK Jr. could have on the industry should he be appointed as head of Health and Human Services.

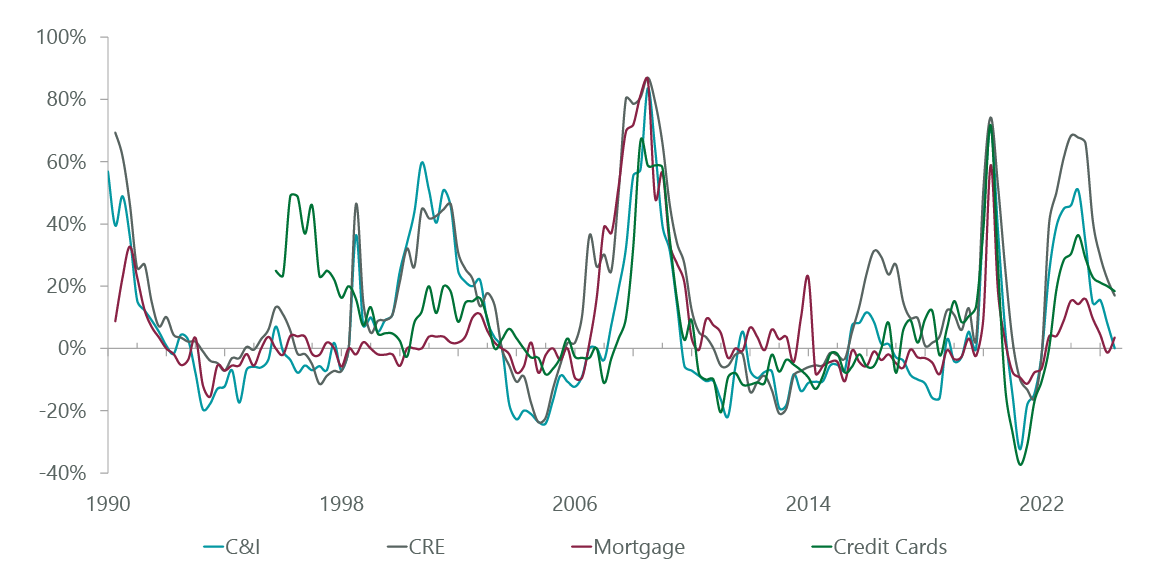

Liquidity, the primary driver of bull and bear markets in our view, remains plentiful, with credit spreads at 20-year lows suggesting little fear of a corporate credit cycle. Bank loan officers — as measured by the Senior Loan Officer Opinion Survey (SLOOS) — are normalizing underwriting criteria following the largest non-recessionary tightening in credit standards in survey history, a tailwind for credit availability (Exhibit 1). Finally, expectations for capital markets activity (IPOs, debt issuance, M&A) are high as investors expect the Trump administration and Republican majority to lessen scrutiny on corporate deal making. However, it is not all blue skies as we start 2025. A year-end market swoon brought a spike in volatility sending nearly 80% of S&P 500 stocks below their 50-day moving average.

Exhibit 1: Credit Availability Is Increasing

As of December 31, 2024. Source: ClearBridge Investments, Barclays Research and Federal Reserve.

Outlook

Although conditions today remain conducive for risk assets, we see high expectations and sticky inflation as risks to the 2025 outlook. As evidenced by the post-election rally, markets expect Trump’s policies will unleash a capital investment cycle while technological innovation will drive a rise in productivity. However, inflation remains stubbornly close to 3%, versus the Fed’s 2% target, while wage inflation remains above 4%. A data-dependent Fed is likely done reducing interest rates given relatively easy current financial conditions and GDP growth trending around 2.5%.

Interest rates are a key medium-term risk, in our view. Investor expectations for lower interest rates remain too aggressive and could act as a ceiling to materially higher stock market returns. We believe that real interest rates in the future are more likely to be in line with longer-term historical levels, not the post–Global Financial Crisis era to which many equity investors are anchored (especially considering the likelihood for higher deficit spending). While equity markets have been willing to absorb higher discount rates to date, the gradual acceptance of a “back to the future” rate regime, as well as the indeterminable effect of future government policy actions, will likely play a greater role in equity returns in 2025.

Expectations of the impact generative AI will have on capital investment and economic growth remain sky high. Agentic AI, a type of artificial intelligence that can make decisions autonomously with limited human supervision, has replaced copilots as the buzzword in Silicon Valley. However, despite the changing terminology we see this as a “copilot 2.0” efficiency tool more akin to table stakes for software services than a step function monetization opportunity. With America’s largest technology companies committed to AI infrastructure capex, we remain focused on investor willingness to fund this massive outlay in the absence of a tangible returns on investments. With power costs and compute intensity increasing, the investment required to chase artificial general intelligence (AGI), the ability of a machine to understand or learn any intellectual task that a human being can, continues to march higher. In our view, we remain many iterations away from having humanoid robots doing our cooking or cleaning or fully autonomous driving.

Despite robust GDP growth, there remain many anemic areas in our economy, a dynamic we see as difficult to improve should rates remain at current levels. Housing remains unaffordable (Exhibit 2) and with mortgage rates sticky at ~7% (Exhibit 3); it is hard to see activity pickup without price concessions or better financing rates (or both). Manufacturing remains in a slump with the ISM Manufacturing PMI highlighting contracting activity in 25 of the past 26 months. Forward-looking demand indicators continue to suggest sluggish activity. Finally, despite currently robust consumer spending and near-full employment, the rise in credit card delinquency rates should be monitored for consumer stress at the lower-end of the income curve.

Exhibit 2: Home Affordability Is Low

As of December 31, 2024. Source: ClearBridge Investments, National Association of Realtors, Bloomberg Finance.

Exhibit 3: And Mortgage Rates Are High

As of December 31, 2024. Source: ClearBridge Investments, Bankrate.com, Bloomberg Finance.

In sum, we believe that the economy will continue its expansion in 2025 driven by incremental fiscal support, productivity gains and stable employment trends, with wage growth sustaining consumer spending. However, we feel the effect on economic growth that potential policy changes floated by the Trump administration will have — be they tax extensions, tariffs, immigration or a change in government size — are largely factored into today’s market valuations. We do expect reduced regulatory scrutiny to unlock investment and drive an M&A upcycle, which would be positive for capital markets, all else equal.

Shorter term, we worry that current expectations have become too complacent or, said more plainly, too bullish. While we agree the impact of generative AI is likely to create game-changing technologies and opportunities for investors over the next decade, we feel that this cohort of companies, which have been market leaders and where expectations are sky high, could face some volatility while digesting recent gains. They also face risks from the reality of non-linear adoption rates for new technologies, changing business models and unanticipated bottlenecks (particularly power availability and cost).

Our longer-term worry relates to the sustainability of government debt and the burden of debt service on the budget deficit. At some point the U.S. will need to increase taxes or cut spending to prevent debt costs from spiraling out of control. Deficit spending at current levels cannot last forever. Current presidential plans offer an impractical budget that would greatly increase the deficit, an outlook that worries us further. Should investors require a greater risk premium (yield) to own a risk-free Treasury, the next administration and Congress will face stark choices not in anyone’s current playbook. By no means is the U.S. dollars status as reserve currency our birthright.

Conclusion

Our expectation is that 2025 will be a more subdued, but positive, year in terms of overall equity returns, but we admit this is not a bold prediction given the excess returns of the past two years and the currently benign backdrop. Overall longer-term fundamentals remain on a solid footing. We expect small and mid cap companies, as well as more cyclical businesses, to benefit from continued growth of the U.S. economy. We believe the current backdrop has heightened the risk to the investment landscape should there be any stall in the disinflationary trend, disappointment in AI-driven capex, or government policy hiccups. We believe when everyone is bullish there is more risk to markets, not less.

We are long-term investors focused on the risk-adjusted returns a diversified portfolio can deliver through a market cycle. Rather than trying to bet on near-term earnings trends or government policy speculation, we believe it is better to look out two to three years and make investment decisions based upon our assessment of a company’s longer-term, sustainable growth rate relative to what is implied in today’s share price.

Portfolio Highlights

The ClearBridge Appreciation Strategy modestly underperformed the benchmark S&P 500 Index in the fourth quarter. On an absolute basis, the Strategy had positive contributions from seven of 11 sectors. The IT and financials sectors were the main positive contributors to performance, while health care was the main detractor.

In relative terms, an overweight to materials and an underweight to consumer discretionary caused negative sector allocation effects to outweigh positive stock selection, which was driven by strong selection in the industrials, energy and materials sectors. Selection in health care detracted.

On an individual stock basis, the biggest contributors to absolute performance during the quarter were Amazon.com, Broadcom (AVGO), Nvidia (NVDA), Apple (AAPL) and Visa (V). The biggest detractors were Eli Lilly (LLY), American Tower (AMT), Thermo Fisher Scientific (TMO), ASML (ASML) and Adobe (ADBE).

During the quarter, we initiated new positions in BJ’s Wholesale Club in consumer staples and Starbucks in consumer discretionary, and we exited Nestle in consumer staples, PPG Industries in materials and ICON in health care.

Michael Kagan, Managing Director, Portfolio Manager

Stephen Rigo, CFA, Managing Director, Portfolio Manager

|

Past performance is no guarantee of future results. Copyright © 2024 ClearBridge Investments. All opinions and data included in this commentary are as of the publication date and are subject to change. The opinions and views expressed herein are of the author and may differ from other portfolio managers or the firm as a whole, and are not intended to be a forecast of future events, a guarantee of future results or investment advice. This information should not be used as the sole basis to make any investment decision. The statistics have been obtained from sources believed to be reliable, but the accuracy and completeness of this information cannot be guaranteed. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information. Performance source: Internal. Benchmark source: Standard & Poor’s. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here