In the 1960s, war, peace, freedom, equal rights, and economic inequality were the issues of the day. In his 1962 song, Bob Dylan declared “the answer, my friend, is blowin’ in the wind”. Today, we face the same difficulties. Government leadership and cooperation will be critical to the outcome.

Post-election, our forecast for the markets, interest rates, and economic activity are also “blowin’ in the wind.” We remain mindful of the geopolitical and macroeconomic crosscurrents, but as bottom-up, value investors, we will remain disciplined in allocating capital to durable businesses while on the lookout for opportunities. Still, it is critical to remember that price matters – paying ever higher prices without fundamental support is rarely a recipe for investing success.

Crosscurrents in the Market

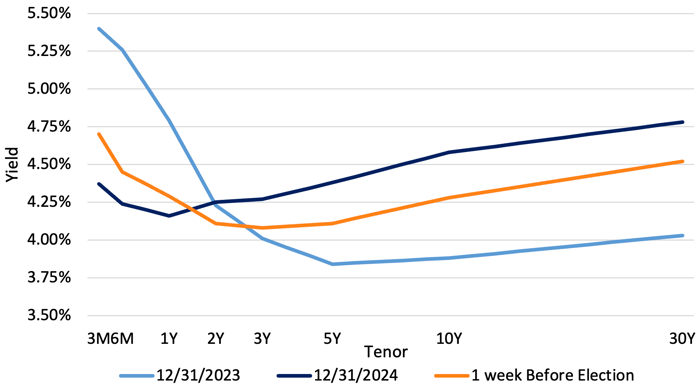

US Treasury Yield Curves1

Un-inverting Yield Curve – In early September 2024, the U.S. Treasury yield curve began to normalize after being inverted for over two years, the longest period in history.2 Since the beginning of 2024, we were adamant that the curve would un-invert and we remain steadfast that, ultimately, investors will need to be paid more for term/maturity, liquidity and investment quality. Prior un-inversions were the precursor to the last four recessions (1990, 2000, 2008 and 2020). Looking ahead, the jury is out. A significant distinction between the past and current Federal Reserve (the Fed) cuts is that, in the prior periods, the cuts were an attempt to stimulate a faltering economy. In contrast, recent Fed actions were a change from a restrictive policy intended to rope in inflation. A funny thing happened in the most recent un-inversion, the 10-year Treasury yield (US10Y) rose, rather than declined, at the same time the Fed was cutting rates. Some market pundits have stated that this suggests that the Fed may have been too early to declare victory over inflation.

This is echoed by the rise in the yield curve post the Presidential election, likely reflecting concerns that the new administration’s policies may stoke inflation. Alternatively, noted economist John Mauldin, points to increasing Federal deficits as the impetus for the rise in long-term rates, suggesting that “A borrower whose debt is growing faster than their ability to repay is rightly considered riskier and must pay higher rates.”3 As credit analysts, we see merit in this perspective. Regardless, we trust the Fed when it says that their future actions will be “data dependent”.4 Whether rates go up or down from here, we do not have clarity, but we are confident that the curve will remain normalized and steep.

NY Fed 10-Year ACM Term Premium5(12/30/94-12/31/24)

Rising Term Premium6 – But for a few brief periods since early 2016, the term premium has been negative, effectively eliminating any compensation for duration risk.4 The negative term premium encouraged speculation by making the cost of money artificially low. With the term premium at -0.3333 at the end of 2023, we predicted that it would rise. Indeed, the term premium rose to 0.4877 by year-end 2024. Still, this is below the term premium’s 30-year average, 0.8018, and its 1.3803 average from the end of 1994 until the beginning of the GFC at the end of 2007.8 We believe that the term premium may continue to increase over time. We think, in absolute terms, the most attractive part of the yield curve is in maturities that are four years or less because these maturities will be less sensitive to future increases in spread and term premium. Further, the normalized yield curve provides the benefit of bonds “rolling down the curve”9 as they move toward maturity. That said, with the yield curve relatively flat beyond the 7-year maturity, we see little benefit in investing farther out the curve.

Difference Between Actual and Estimated High Yield Credit Spreads10

Tight Credit Spreads – In our 3Q24 investor letter, we commented that most asset classes were too rich. Specifically addressing high yield debt, credit spreads were historically tight relative to the last 25 years. Moreover, given that the yield advantage provided by high yield bonds over investment grade bonds was particularly narrow, we were “leaning into higher quality credit”. Well, this trend continued as the option-adjusted credit spread for the ICE BofA US High Yield Index fell further during the quarter from 303 basis points (‘bp’) to 292 bp at year-end.11 As discussed in prior letters, there may be some fundamental justification for this in a general improvement in credit quality as a result of the ongoing economic expansion. There may also be a technical rationale in the record low duration of the index and high proportion of secured bonds.12 Based on these factors and a comparison to conditions in May 2007 when the high yield index reached its all-time tight level at 233 bp, Barclays recently made the case that the average high yield credit spread could justifiably fall to 199 bp.13 The assertion that the high yield spread could tighten further is uncontroversial. Nothing says that an overvalued asset class cannot become more overvalued. Whether the present spread is justified by the fundamentals or sustainable is a different matter. Longtime high yield market observer and friend of the firm, Martin Fridson,14 employs an econometric model of the ICE BofA US High Yield Index, incorporating factors such as credit availability, key economic indicators, default rate, underlying Treasury yield, and the presence/absence of quantitative easing to determine a theoretical fair value for credit spreads. As reflected in the graph above, Fridson recently told us that “The year-end spread was 132 basis points tighter than fair value.” He went on to say that “Investors should not mistake such an occurrence for confirmation that changes in the high yield index’s composition justify a dramatically smaller risk premium for a given level of risk than prevailed in the past.” We concur. Having been active in the high yield market for nearly 30 years, we are getting a little bit of déjà vu when we recall that credit spreads were at similar levels in 2005-06 just before the GFC. That did not work out so well for many credit investors.

Fixed Income Spread and Yield Percentiles15(January 2000 to December 2024)

Most asset classes are expensive, but there are opportunities in fixed income – Esteemed NYU Stern School of Business Finance Professor Aswath Damodaran recently observed on X that the return of the S&P 500 (SP500, SPX) in 2024 was the 27th best one-year performance in the last 97 years and the two-year return in 2023-24 was the 10th best performance for any two consecutive years in the last century.16 Considering that the stock market was not coming off a bear market or crash, it should not be surprising, after this performance, that equities appear rich. In fact, Damodaran’s market valuation model calculates that the S&P 500 is about 12% above intrinsic value.17 Furthermore, the equity risk premium18 has fallen to 2 bp at year-end 2024, far below the 25-year average of 301 bp.19. Effectively, the market is providing no premium for taking on equity risk relative to owning 10-year Treasury bonds.

In Guggenheim Partner’s presentation, 10 Macro Themes for 2025,20 they state, “With inflation under greater control and central banks easing, we view yields as likely to stay in a range or trend modestly lower.” They go on to say that “Managers with expertise in fixed-income segments beyond the indexed universe can find stable excess returns, even in an environment where overall spreads are tight relative to history.”21 In general, fixed income appears to be rich on a spread basis although yields tell a slightly different story. It is important to note that, since 2000, U.S. Treasury rates have been low for extended periods, such that the recent rise in rates has caused yields for most of the segments to rise into the upper quartile for the 25-year period. We maintain that spreads matter as they reflect market pricing for credit risk above a “riskless” Treasury bond. Guggenheim concludes by saying, “All told, it’s a good time to be an active fixed-income investor.” We think that Guggenheim makes an excellent point. Even though credit spreads are historically tight, we are seeing more one-off credit opportunities to earn attractive total return than we saw a year ago.

Strategies for 2025

With a higher level of uncertainty in the market and many crosscurrents, success in 2025 will continue to depend on a diligent approach to credit analysis and constant monitoring of individual credits for any sign of deterioration. It will also depend on an opportunistic approach to themes that we are already seeing in the market and have been taking advantage of in 4Q24.

Term Loans may act like cushion bonds22 – The decline in high yield credit spreads and ongoing demand for floating rate loans, particularly from collateralized loan obligations (CLOs), has caused the spread over SOFR23 for new loan issuances to narrow. As most term loans provide the borrower the opportunity to “reprice” the loan at no additional cost six months after issuance, we have seen a very active repricing market. Mindful that loans may be repriced in a relatively short time frame, we have been purchasing loans in the secondary market and new issue loans, often at a discount, in expectation that we will earn the coupon and capture any purchase price discount to par if the loan is repriced and potentially more if SOFR rises or the issuer delays repricing or refinancing.

Magnite Inc. (MGNI) SOFR+375 bp First Lien Term Loan due 2/6/3124 – Magnite is the world’s largest independent sell-side advertising platform for connected TV, online video, display, and audio. It is a public company and, as of 9/30/24, cash on the balance sheet exceeded the outstanding amount of the First Lien Term Loan, making it a very solid credit. We initially participated in this loan when it was issued at SOFR+450 bp at a price of 99 in February 2024. We maintained our position when it was repriced in September 2024 at SOFR+375. It is interesting to note that, marking the position to par at the time of the repricing, we had achieved an 11.50% annualized rate of return25 through the holding period. In late October 2024, we added to our position at a price of 100.625. The 6.45% expected yield26 to the next repricing date, in March 2025, was attractive at 200 bp over the Treasury rate for that maturity. However, by way of example of the loan’s cushion bond-like characteristics, the yield would rise to 7.19%27 if the loan were called at par on 12/31/25 – providing a higher rate of return, like a cushion bond, if it remained outstanding longer.

Loans are still attractive relative to high yield bonds – Per a recent Barclays report,28 the curve-adjusted yield for loans exceeds the average yield-to-worst for bonds by 83 bp despite the decline in short term rates since September 2024. With nearly 70% of the loan market trading at a price of 99 or higher, there is limited incremental return to be achieved by a “pull to par”.29 However, in continuing to favor loans over bonds, investors are banking on capturing the higher current yield. It is notable though that the timing for expected future Fed moves to reduce rates has been pushed out, suggesting that loan investors, assuming their loans are not repriced, should keep their higher yields for longer. Meanwhile, with bonds issued in the low-rate environment of 2020-21 nearing maturity, their issuers will face significantly higher rates which will have some negative impact on interest coverage and overall credit quality.

Terra Millenium (TERMIL) SOFR+500 bp First Lien Term Loan due 11/1/3030 – Founded in 1906 and controlled by private equity sponsor H.I.G Capital, Terra Millenium is an industry-leading national provider of refractory, mechanical and specialized services to industrial companies. A significant portion of the company’s services are non-discretionary with approximately 75-80% of revenues and gross profit coming from recurring scheduled maintenance under long term contracts. The business is “asset lite” with 85-90% of the cost structure variable as there are no full-time field employees. The company has net leverage just over 4.0x EBITDA, but, given its low level of capital expenditures, high margins and the recurring nature of its business, has generated significant cash flow, after payment of interest and capital expenditures, in every year since 2017.31 In November 2024, we purchased a portion of the loan when it was issued at a price of 99 with a coupon of SOFR+500 bp and a 9.00% curve-adjusted32 yield-to-maturity (YTM).

The rate environment is encouraging companies to defease their bonds – Companies that issued fixed rate bonds in the low-rate environment in 2020-21 have been defeasing them as their maturity dates are on the horizon. In some cases, they have issued new debt and used the proceeds to purchase Treasury bonds which they deposit with the indenture trustee of the old bond in order to ensure that they will be repaid at a specific future date. In doing so, they are taking advantage of the elevated yields on Treasury bonds to partly cover the coupon of the old bond and are able to remove the old bond from their balance sheets while avoiding a prepayment premium that would be due if they immediately repaid the old bond. From our perspective, defeased bonds have yields to the expected repayment date similar to other short term high yield bonds but tend to remain outstanding longer and are backed by Treasury bonds on deposit with the indenture trustee, virtually eliminating any repayment risk. During 4Q24, purchases of defeased bonds by the RiverPark Short Term High Yield Fund had a weighted average expected time to call of 3.5 months and a weighted average yield-to-call (YTC) of 6.03%, or 154 bp over the Treasury rate.

Life Time Inc. (LTH) 5.75% First Lien Notes due 1/15/2633 and 8.00% Unsecured Notes due 4/15/2634 – Life Time, the national operator of fitness centers, issued a 6.00% First Lien Note due 11/15/31 in late October 2024 and a First Lien Term Loan due 11/5/31 in early November 2024 to refinance its 5.75% and 8.00% notes. As the old bonds were still in their non-call period and would have high repayment premiums if called before the call price fell to par in early 2025, the company used the proceeds of their debt issuances to defease the existing bonds, purchasing Treasury bonds that matured near the call dates and depositing them with the indenture trustee so that, when they matured, the cash and earned interest would be used to repay Life Time’s old notes. We began purchasing the old Life Time bonds in late October, when the new financing was announced, effectively investing at 100 bp over the 3-month Treasury rate with Treasury risk.

Mergers and acquisitions may be picking up – Under the Biden administration, Lina Khan, Commissioner of the US Federal Trade Commission was aggressive in challenging proposed mergers and acquisitions. The Trump administration is expected to take a more lenient view with respect to anti-trust concerns. An increase in M&A may lead the way for a new opportunity set in the leveraged finance market as a result of an increase in issuance of bonds and loans to finance acquisitions, upgrades in credit quality as investment grade companies acquire high yield issuers and required repayment of bonds and loans of issuers that are experiencing a change of control. If we identify a company with good credit quality, characteristics that suggest it might be an attractive acquisition target, and provisions that are likely to require repayment upon a change of control, we may buy its debt instruments if they offer an acceptable rate of return as well as optionality for a higher total return if the company is acquired.

Builder’s First Source (BLDR) 4.25% Senior Unsecured Notes due 2/1/3235 – Publicly-traded Builder’s First Source is a leading supplier of manufactured building materials, including lumber, windows and doors, metal, and concrete products. The company has had strong performance, benefiting from robust demand for new home construction. Operating in a fragmented market, the company has grown organically and via acquisition. At the end of 3Q24, gross leverage was 1.5x EBITDA and net leverage was 1.4x EBITDA with interest coverage over 10x, a very solid credit. During 4Q24, we purchased the 4.25% bonds in the low 90s at a yield-to-worst (YTW) of 5.79%, in line with other high yield bonds of similar credit quality and maturity. Given the company’s high cash flow and stable operations, the company may seek to refinance the debt stack early or may attract attention either as a strategic purchase or LBO candidate. The significant discount to par provides attractive optionality in the event of an early repayment, either as a result of a change of control, which might result in a significant capital gain if repayment were required at a price of 101, or, potentially, the company’s decision to call the bond early, most likely in February 2031 when the bond “goes current”,36 which would result in a 6.08% yield.37

Corporate events provide total return opportunities – It is not unusual to identify a loan or a bond that has special provisions that increase the probability of early repayment or improves the instrument’s priority in the issuer’s capital structure. An example might be an asset sale provision that requires the proceeds from the sale of significant assets be used to repay debt at par or even a premium to par. If the debt has been trading at a discount, the early repayment increases the total return. Another example is a “negative pledge,” a provision in an unsecured note indenture that would cause the bond to be given collateral if the company issued new secured debt. Upon being granted a security interest, the old note would likely experience price appreciation.

Liberty TripAdvisor Holdings (OTCQB:LTRPA) 0.50% Exchangeable Senior Debentures due 205138 – Liberty TripAdvisor is a holding company whose principal assets include a 21% economic and 57% voting interest in TripAdvisor, Inc. (TripAdvisor), one of the world’s largest publicly traded travel guidance platforms. As a result, the value of Liberty TripAdvisor is tied to the value of its equity stake in TripAdvisor, which we believe covers the $330 million Senior Debenture with sufficient margin of safety. TripAdvisor features strong credit fundamentals including a 2.4x gross leverage ratio, net cash on its balance sheet39, positive free cash flow, and growing non-core asset value. We began purchasing the bonds in early 2024 in the low 90s after identifying language in the bond indenture permitting holders to “put” their bonds to the company at par in March 2025, long before its 2051 maturity date, creating an event-driven opportunity to earn a rate of return greater than the yield to maturity. As Liberty TripAdvisor had minimal cash itself, we believed the owners would tap TripAdvisor to assist with repaying this debt and avoid forfeiting the controlling ownership position to creditors. A third-party review of the company’s credit documentation, corporate structure, and a campaign to identify and organize other bondholders supplemented our analysis. We continued our purchases in 4Q24 at an average yield-to-put (YTP) of 16.4%. In late December, Liberty TripAdvisor announced it would be acquired by TripAdvisor in a transaction providing for our bonds to be repaid with cash by the March put date. Subsequent to the announcement, we continued purchasing bonds for our short-term high yield strategies at an average YTP of 6.7%.

Commitment fees enhance returns – We are sometimes offered the opportunity to provide a backstop commitment to a new financing prior to it “officially” coming to market in order to provide the issuer with confidence that the capital will be available when needed, often to finance an acquisition. While we see these deals in the U.S., we are offered them more frequently in the Nordic market because it is a smaller capital market with fewer investors and we are known to be active investors able to make quick decisions. Typically, we receive a fee in exchange for a commitment to fund a significant portion of the transaction, would receive a “break up” fee if the issuer cancelled the transaction and would have “outs” permitting us to back out of the deal if the credit deteriorates or there is some other material adverse change prior to funding. Moreover, in these situations, the credit is usually strong enough that we would be perfectly happy to fund our full commitment at an agreed-upon above-market yield if the syndication was unsuccessful. Ultimately, if the financing is completed in the market, the commitment fee we receive effectively represents a discount to the issuance price, enhancing our expected yield.

MacGregor Pte (MOHDER) EURIBOR+525 bp Secured Notes due 12/11/2940 – We were one of six investors invited to backstop a EUR 175 mm secured note proposed to finance Triton Partners’ acquisition of MacGregor Pte, a Finnish manufacturer of marine cargo handling equipment such as cranes, winches, and ramps. MacGregor-branded equipment is installed on 50% of the global shipping fleet, with significant aftermarket service revenue that buffers the ups and downs of original equipment sales to ship builders. At the time of issuance, net leverage was 1.8x EBITDA with interest coverage of 5.9x. In exchange for our two-month commitment to fund the transaction, we received a 150 bp fee with a 75 bp breakup fee to be received if the transaction did not close. In addition, if we were required to fund our full commitment, the bond would be issued at EURIBOR+750 bp. With the transaction closing as expected, the bond was issued at EURIBOR+525 bp, but the commitment fee effectively increased our YTM from 8.11% to 8.48%.

Continued Investment in Overseas Opportunities – We continue to be active investors in offshore credit, particularly Nordic debt and event-driven European situations. The MacGregor bond (above) is a good example of a recent Nordic market purchase. Compared to similar credits in the U.S., the Nordic market, generally speaking, has offered debt that has less leverage, better investor protections (covenants), and is more transparent, all the while offering wider (more attractive) spreads. We launched the CrossingBridge Nordic High Income Bond Fund (NRDCX) on September 30, 2024 – the first ever dedicated Nordic bond fund in the U.S. –to provide investors with direct access to opportunities in this market.

Mutual Fund Selected Characteristics41

In keeping with several of the themes we have discussed, a comparison of the portfolios from YE23 to YE 24 shows that most have seen an increase in investment grade holdings and a decrease in high yield and floating rate exposure. Foreign exposure has also declined. Dry powder is up modestly for most portfolios, but up more significantly in CBUDX and CBLDX which, due to their low duration mandates, tend to hold a lot of securities we consider to be “dry powder.”

Licking our index finger and pointing it upward to see which the way the wind is blowing,

David K. Sherman and the CrossingBridge Team

|

Endnotes: 1 Bloomberg 2 The U.S. Treasury yield curve was inverted for 793 days. A yield curve is considered inverted when short-term bond yields are higher than yields for long-term bond. Most economists will compare the yield on the 10-year bond to the yield on the 2-year bond to determine whether the curve is inverted versus “normal” or upward sloping. 3 Thoughts from the Frontline – A Possible Storm, John Mauldin, 1/18/25 4 The Fed has repeatedly stated that its decisions with respect to future changes in interest rates will depend on new data, most importantly gross domestic product, the inflation rate, and the level of unemployment. 5 Federal Reserve and Bloomberg 6 Term premium is the excess return that an investor receives for taking on the risk that interest rates may change during the life of the bond. The term structure is not directly observable so it must be estimated from financial and macroeconomic variables. The ACM approach employs five components of yield in a three-step linear regression model. For more information, see Staff Report No. 340 from the Federal Reserve Bank of New York, Pricing the Term Structure with Linear Regression by Adrian, Crump and Moench, published August 2008 and revised April 2013. 7 Duration risk is the risk that an investment will decline in value as a result of a rise in interest rates. An instrument with higher duration has higher sensitivity to a change in rates. 8 Adrian Crump & Moench 10-Year Treasury Return Premium: averaged 0.8018 during 12/30/94-12/29/24; averaged 1.3803 during 12/30/94-12/31/07 (per Bloomberg). 9 Rolling down the curve is a term describing the rise in the price of a bond due to the reduction in the time to its maturity. A steeper yield curve results in faster price appreciation due to a more rapid decline in rates as the bond rolls down the curve (i.e. price and yield move in opposite directions so a faster decline in rates, due to a steeper curve, results in faster price appreciation). 10 FridsonVision Fair Value Model (1/31/97-12/31/24) 11 ICE BofA US High Yield Index as of 9/30/24 and 12/31/24 12 Best Ideas: Don’t think twice, it’s all right, Barclays, 1/17/25 13 Best Ideas: Don’t think twice, it’s all right, Barclays, 1/17/25 14 Known as the “dean of high yield debt,” Martin Fridson is the chief investment officer of Lehman, Livian, Fridson LLC, has authored many articles and books on the leveraged finance markets, and currently provides his insights through his bi-weekly report, FridsonVision High Yield Strategy. 15 10 Macro Themes for 2025, Guggenheim Partners – In constructing this graph, Guggenheim cited the following sources: Guggenheim Investments, Credit Suisse, Bloomberg, ICE BofA, JP Morgan, Palmer Square. Data as of 01/13/2025. History based on monthly data since January 2000. Index Legend: Treasury yield and MBS data based on Bloomberg data. AAA CLOs based on the Palmer Square CLO Index. Prior to 2012, historical CLO spreads were provided by Bank of America Research and yields are approximated by Guggenheim by adding spreads to 3m Libor. AA-BBB ABS is the ICE BofA ABS Master AA-BBB Index, B Loans based on the UBS S&P Leveraged Loan Index, high yield corporates is the Bloomberg U.S. High Yield Index and investment-grade corporates is the Bloomberg U.S. Corporate Index. 16 Aswath Damodaran (@AswathDamodaran) post on X on 1/17/25 17 Aswath Damodaran (@AswathDamodaran) post on X on 1/17/25 18 The Morgan Stanley Equity Risk Premium (<MSRPSPX> on Bloomberg) is the consensus earnings yield of the S&P 500 for the next twelve months minus the 10-year Treasury rate. 19 The Morgan Stanley Equity Risk Premium (<MSRPSPX> on Bloomberg) 20 10 Macro Themes for 2025, Guggenheim Partners 21 10 Macro Themes for 2025, Guggenheim Partners 22 Cushion bonds are bonds with call schedules that cause total return to increase as the bond remains outstanding longer. 23 SOFR stands for Secured Overnight Financing Rate, a broad measure of the cost of overnight borrowing collateralized by Treasury securities. Akin to the Treasury rate in the fixed rate bond market, it is the base rate for determination of coupon for floating rate debt instruments. 24 On 12/31/24, holdings in the Magnite Inc. (MGNI) SOFR+375 bp First Lien Term Loan due 2/6/31 represented 1.14% of the CrossingBridge Low Duration High Yield Fund, 1.65% of the CrossingBridge Responsible Credit Fund and 2.04% of the RiverPark Strategic Income Fund. 25 There was no change in SOFR from the date of issuance to the repricing date. 26 Based on the Fed Funds Futures Curve on the date of purchase. 27 Based on the Fed Funds Futures Curve on the date of purchase. 28 Best Ideas: Don’t think twice, it’s all right, Barclays, 1/17/25 29 Best Ideas: Don’t think twice, it’s all right, Barclays, 1/17/25 30 On 12/31/24, holdings in the Terra Millenium (TERMIL) SOFR+500 bp First Lien Term Loan due 11/1/30 represented 0.95% of the RiverPark Strategic Income Fund. 31 We do not have access to the company’s financial performance prior to 2017. 32 Based on the Fed Funds Futures Curve on the date of purchase. 33 On 12/31/24, holdings in the Life Time Inc. (LTH) 5.75% First Lien Notes due 1/15/26 represented 1.56% of the CrossingBridge Low Duration High Income Fund, 1.65% of the CrossingBridge Responsible Credit Fund, and 1.27% of the RiverPark Strategic Income Fund. 34 On 12/31/24, holdings in the Life Time Inc. (LTH) 8.00% Unsecured Notes due 4/15/26 represented 2.98% of the CrossingBridge Low Duration High Income Fund, 2.45% of the CrossingBridge Responsible Credit Fund, and 3.02% of the RiverPark Strategic Income Fund. 35 On 12/31/24, holdings in the Builder’s First Source (BLDR) 4.25% Senior Unsecured Notes due 2/1/32 represented 0.51% of the RiverPark Strategic Income Fund. 36 A bond “going current” means that it has one year left until maturity (i.e. it has become a current liability). Companies will often refinance bonds just before they go current in order to assure auditors and investors that they will be able to refinance their debt when due. 37 Prospective yields are calculated based on the price and date of purchase. 38 On 12/31/24, holdings in the Liberty TripAdvisor Holdings (OTCQB:LTRPA) 0.50% Exchangeable Senior Debentures due 2051 represented 2.05% of the CrossingBridge Low Duration High Income Fund, 1.76% of the CrossingBridge Responsible Credit Fund, and 2.17% of the RiverPark Strategic Income Fund. 39 Net cash means that cash and equivalents exceed total debt. 40 On 12/31/24, holdings in the MacGregor Pte (MOHDER) EURIBOR+525 bp Secured Notes due 12/11/29 represented 1.16% of the CrossingBridge Nordic High Income Bond Fund. 41 Dry powder is defined as the sum of cash, cash equivalents, pre-merger SPACs, and maturities of 90 days or less. THE PROSPECTUS FOR THE CROSSINGBRIDGE Low duration high Income FUND, CROSSINGBRIDGE Ultra-Short duration FUND, CrossingBridge Responsible Credit Fund and Strategic income Fund CAN BE FOUND BY CLICKING HERE. THE STATEMENT OF ADDITONAL INFORMATION (SAI) CAN BE FOUND BY CLICKING HERE. TO OBTAIN A HARDCOPY OF THE PROSPECTUS, CALL 855-552-5863. PLEASE READ AND CONSIDER THE PROSPECTUS CAREFULLY BEFORE INVESTING.THE PROSPECTUS FOR THE CROSSINGBRIDGE NOrdic High Income Bond Fund CAN BE FOUND BY CLICKING HERE. The Statement of additonal information (SAI) can be found by clicking here. TO OBTAIN A HARDCOPY OF THE PROSPECTUS, CALL 855-552-5863. PLEASE READ AND CONSIDER THE PROSPECTUS CAREFULLY BEFORE INVESTING.THE PROSPECTUS FOR THE CROSSINGBRIDGE Pre-Merger SPAC ETF CAN BE FOUND BY CLICKING HERE. The Statement of additonal information (SAI) can be found by clicking here. TO OBTAIN A HARDCOPY OF THE PROSPECTUS, CALL 855-552-5863. PLEASE READ AND CONSIDER THE PROSPECTUS CAREFULLY BEFORE INVESTING.THE FUNDs Are OFFERED ONLY TO UNITED STATES RESIDENTS, AND INFORMATION ON THIS SITE IS INTENDED ONLY FOR SUCH PERSONS. NOTHING ON THIS WEBSITE SHOULD BE CONSIDERED A SOLICITATION TO BUY OR AN OFFER TO SELL SHARES OF THE FUND IN ANY JURISDICTION WHERE THE OFFER OR SOLICITATION WOULD BE UNLAWFUL UNDER THE SECURITIES LAWS OF SUCH JURISDICTION.CrossingBridge Mutual Funds’ Disclosure: MUTUAL FUND INVESTING INVOLVES RISK. PRINCIPAL LOSS IS POSSIBLE. INVESTMENTS IN FOREIGN SECURITIES INVOLVE GREATER VOLATILITY AND POLITICAL, ECONOMIC AND CURRENCY RISKS AND DIFFERENCES IN ACCOUNTING METHODS. INVESTMENTS IN DEBT SECURITIES TYPICALLY DECREASE IN VALUE WHEN INTEREST RATES RISE. THIS RISK IS USUALLY GREATER FOR LONGER-TERM DEBT SECURITIES. INVESTMENT IN LOWER-RATED AND NON-RATED SECURITIES PRESENTS A GREATER RISK OF LOSS TO PRINCIPAL AND INTEREST THAN HIGHER-RATED SECURITIES. BECAUSE THE FUND MAY INVEST IN ETFS AND ETNS, THEY ARE SUBJECT TO ADDITIONAL RISKS THAT DO NOT APPLY TO CONVENTIONAL MUTUAL FUND, INCLUDING THE RISKS THAT THE MARKET PRICE OF AN ETF’S AND ETN’S SHARES MAY TRADE AT A DISCOUNT TO ITS NET ASSET VALUE (“NAV”), AN ACTIVE SECONDARY TRADING MARKET MAY NOT DEVELOP OR BE MAINTAINED, OR TRADING MAY BE HALTED BY THE EXCHANGE IN WHICH THEY TRADE, WHICH MAY IMPACT A FUND’S ABILITY TO SELL ITS SHARES. THE VALUE OF ETN’S MAY BE INFLUENCED BY THE LEVEL OF SUPPLY AND DEMAND FOR THE ETN, VOLATILITY AND LACK OF LIQUIDITY. THE FUND MAY INVEST IN DERIVATIVE SECURITIES, WHICH DERIVE THEIR PERFORMANCE FROM THE PERFORMANCE OF AN UNDERLYING ASSET, INDEX, INTEREST RATE OR CURRENCY EXCHANGE RATE. DERIVATIVES CAN BE VOLATILE AND INVOLVE VARIOUS TYPES AND DEGREES OF RISKS, AND, DEPENDING UPON THE CHARACTERISTICS OF A PARTICULAR DERIVATIVE, SUDDENLY CAN BECOME ILLIQUID. INVESTMENTS IN ASSET BACKED, MORTGAGE BACKED, AND COLLATERALIZED MORTGAGE BACKED SECURITIES INCLUDE ADDITIONAL RISKS THAT INVESTORS SHOULD BE AWARE OF SUCH AS CREDIT RISK, PREPAYMENT RISK, POSSIBLE ILLIQUIDITY AND DEFAULT, AS WELL AS INCREASED SUSCEPTIBILITY TO ADVERSE ECONOMIC DEVELOPMENTS. INVESTING IN COMMODITIES MAY SUBJECT THE FUND TO GREATER RISKS AND VOLATILITY AS COMMODITY PRICES MAY BE INFLUENCED BY A VARIETY OF FACTORS INCLUDING UNFAVORABLE WEATHER, ENVIRONMENTAL FACTORS, AND CHANGES IN GOVERNMENT REGULATIONS. SHARES OF CLOSED-END FUND FREQUENTLY TRADE AT A PRICE PER SHARE THAT IS LESS THAN THE NAV PER SHARE. THERE CAN BE NO ASSURANCE THAT THE MARKET DISCOUNT ON SHARES OF ANY CLOSED-END FUND PURCHASED BY THE FUND WILL EVER DECREASE OR THAT WHEN THE FUND SEEK TO SELL SHARES OF A CLOSED-END FUND IT CAN RECEIVE THE NAV OF THOSE SHARES. THERE ARE GREATER RISKS INVOLVED IN INVESTING IN SECURITIES WITH LIMITED MARKET LIQUIDITY.CrossingBridge Pre-Merger SPAC ETF Disclosure: Investing involves risk; Principal loss is possible. The Fund invests in equity securities and warrants of SPACs. Pre-combination SPACs have no operating history or ongoing business other than seeking Combinations, and the value of their securities is particularly dependent on the ability of the entity’s management to identify and complete a profitable Combination. There is no guarantee that the SPACs in which the Fund invests will complete a Combination or that any Combination that is completed will be profitable. Unless and until a Combination is completed, a SPAC generally invests its assets in U.S. government securities, money market securities, and cash. Public stockholders of SPACs may not be afforded a meaningful opportunity to vote on a proposed initial Combination because certain stockholders, including stockholders affiliated with the management of the SPAC, may have sufficient voting power, and a financial incentive, to approve such a transaction without support from public stockholders. As a result, a SPAC may complete a Combination even though a majority of its public stockholders do not support such a Combination. Some SPACs may pursue Combinations only within certain industries or regions, which may increase the volatility of their prices. The Fund may invest in SPACs domiciled or listed outside of the U.S., including, but not limited to, Canada, the Cayman Islands, Bermuda and the Virgin Islands. Investments in SPACs domiciled or listed outside of the U.S. may involve risks not generally associated with investments in the securities of U.S. SPACs, such as risks relating to political, social, and economic developments abroad and differences between U.S. and foreign regulatory requirements and market practices. Further, tax treatment may differ from U.S. SPACs and securities may be subject to foreign withholding taxes. Smaller capitalization SPACs will have a more limited pool of companies with which they can pursue a business combination relative to larger capitalization companies. That may make it more difficult for a small capitalization SPAC to consummate a business combination. Because the Fund is non-diversified it may invest a greater percentage of its assets in the securities of a single issuer or a smaller number of issuers than if it were a diversified fund. As a result, a decline in the value of an investment in a single issuer could cause the Fund’s overall value to decline to a greater degree than if the Fund held a more diversified portfolio.DEFINITIONS: THE S&P 500, OR SIMPLY THE S&P, IS A STOCK MARKET INDEX THAT MEASURES THE STOCK PERFORMANCE OF 500 LARGE COMPANIES LISTED ON STOCK EXCHANGES IN THE UNITED STATES. THE ICE BOFA INVESTMENT GRADE INDEX TRACKS THE PERFORMANCE OF US DOLLAR DENOMINATED INVESTMENT GRADE RATED CORPORATE DEBT PUBLICALLY ISSUED IN THE US DOMESTIC MARKET. THE ICE BOFA HIGH YIELD INDEX TRACKS THE PERFORMANCE OF US DOLLAR DENOMINATED BELOW INVESTMENT GRADE RATED CORPORATE DEBT PUBLICALLY ISSUED IN THE US DOMESTIC MARKET. EBITDA IS A COMPANY’S EARNINGS BEFORE INTEREST, TAXES, DEPRECIATION, AND AMORTIZATION IS AN ACCOUNTING MEASURE CALCULATED USING A COMPANY’S EARNINGS, BEFORE INTEREST EXPENSES, TAXES, DEPRECIATION, AND AMORTIZATION ARE SUBTRACTED, AS A PROXY FOR A COMPANY’S CURRENT OPERATING PROFITABILITY. A BASIS POINT (BP) IS 1/100 OF ONE PERCENT. PARI-PASSU IS A LATIN TERM THAT MEANS ‘ON EQUAL FOOTING’ OR ‘RANKING EQUALLY’. IT IS AN IMPORTANT CLAUSE FOR CREDITORS OF A COMPANY IN FINANCIAL DIFFICULTY WHICH MIGHT BECOME INSOLVENT. IF THE COMPANY’S DEBTS ARE PARI PASSU, THEY ARE ALL RANKED EQUALLY, SO THE COMPANY PAYS EACH CREDITOR THE SAME AMOUNT IN INSOLVENCY. LIBOR IS THE AVERAGE INTERBANK INTEREST RATE AT WHICH A SELECTION OF BANKS ON THE LONDON MONEY MARKET ARE PREPARED TO LEND TO ONE ANOTHER. YIELD TO MATURITY (YTM) IS THE TOTAL RETURN ANTICIPATED ON A BOND (ON AN ANNUALIZED BASIS) IF THE BOND IS HELD UNTIL IT MATURES. FREE CASH FLOW (FCF) IS THE CASH A COMPANY PRODUCES THROUGH ITS OPERATIONS, LESS THE COST OF EXPENDITURES ON ASSETS. IN OTHER WORDS, FREE CASH FLOW IS THE CASH LEFT OVER AFTER A COMPANY PAYS FOR ITS OPERATING EXPENSES AND CAPITAL EXPENDITURES. DURATION IS A MEASURE OF THE SENSITIVITY OF THE PRICE OF A BOND OR OTHER DEBT INSTRUMENT TO A CHANGE IN INTEREST RATES. DEBTOR-IN-POSSESSION (DIP) FINANCING IS IS A SPECIAL KIND OF FINANCING MEANT FOR COMPANIES THAT ARE IN BANKRUPTCY. ONLY COMPANIES THAT HAVE FILED FOR BANKRUPTCY PROTECTION UNDER CHAPTER 11 ARE ALLOWED TO ACCESS DIP FINANCING, WHICH USUALLY HAPPENS AT THE START OF A FILING. DIP FINANCING IS USED TO FACILITATE THE REORGANIZATION OF A DEBTOR-IN-POSSESSION (THE STATUS OF A COMPANY THAT HAS FILED FOR BANKRUPTCY) BY ALLOWING IT TO RAISE CAPITAL TO FUND ITS OPERATIONS AS ITS BANKRUPTCY CASE RUNS ITS COURSE. YIELD TO CALL (YTC) REFERS TO THE RETURN A BONDHOLDER RECEIVES IF THE BOND IS HELD UNTIL THE CALL DATE, WHICH OCCURS SOMETIME BEFORE IT REACHES MATURITY. The SEC yield is a standard yield calculation developed by the U.S. Securities and Exchange Commission (SEC) that allows for fairer comparisons of bond funds. It is based on the most recent 30-day period covered by the fund’s filings with the SEC. The yield figure reflects the dividends and interest earned during the period after the deduction of the fund’s expenses. It is also referred to as the “standardized yield.”ETF Definitions: The ICE BofA 0-3 Year U.S. Treasury Index tracks the performance of U.S. dollar denominated sovereign debt publicly issued by the US government in its domestic market with maturities less than three years. Gross Spread is The amount By which a SPAC is trading at a discount or premium to its pro rata share of the collateral trust value. For example, if a SPAC is trading at $9.70 and shareholders’ pro rata share of the trust account is $10.00/share, the SPAC has a Gross Spread of 3% (trading at a 3% discount). Yield to Liquidation: Similar to a bond’s Yield to Maturity, SPACs have a Yield to Liquidation/Redemption, which can be calculated using the Gross Spread and Time to Liquidation. Maturity: Similar to a bond’s maturity date, SPACs also have a maturity, which is the defined time period in which they have to complete a business combination. This is referred to as the Liquidation or Redemption Date. Price refers to the price at which the etf is currently trading. Weighted Average Life refers to the weighted average time until a portfolio of SPACs’ Liqudation or redemption dates. The SEC yield is a standard yield calculation developed by the U.S. Securities and Exchange Commission (SEC) that allows for fairer comparisons of bond funds. It is based on the most recent 30-day period covered by the fund’s filings with the SEC. The yield figure reflects the dividends and interest earned during the period after the deduction of the fund’s expenses. It is also referred to as the “standardized yield.”Fund holdings and sector allocations are subject to change and should not be considered recommendations to buy or sell any security. ANY DIRECT OR INDIRECT REFERENCE TO SPECIFIC SECURITIES, SECTORS, OR STRATEGIES ARE PROVIDED FOR ILLUSTRATIVE PURPOSES ONLY. When Pertaining to Commentaries posted by crossingbridge, it REPRESENTS THE PORTFOLIO MANAGER’S OPINION AND IS AN ASSESSMENT OF THE MARKET ENVIRONMENT AT A SPECIFIC TIME AND IS NOT INTENDED TO BE A FORECAST OF FUTURE EVENTS OR A GUARANTEE OF FUTURE RESULTS. THIS INFORMATION SHOULD NOT BE RELIED UPON BY THE READER AS RESEARCH OR INVESTMENT ADVICE REGARDING THE FUND OR ANY SECURITY IN PARTICULAR. SPECIFIC PERFORMANCE OF ANY security MENTIONED IS AVAILABLE UPON REQUEST. Any performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 914-741-1515. Please Find the Most Current standardized performance For Each Fund as of the most recent quarter-end By clicking the following links: CrossingBridge Low Duration High Yield Fund, CrossingBridge Ultra-Short Duration Fund, CrossingBridge Responsible Credit Fund, riverpark strategic income fund, CrossingBridge Pre-Merger SPAC ETF. All performance data greater than 1 year is annualized.DIVERSIFICATION DOES NOT ASSURE A PROFIT NOR PROTECT AGAINST LOSS IN A DECLINING MARKET.A STOCK IS A TYPE OF SECURITY THAT SIGNIFIES OWNERSHIP IN A CORPORATION AND REPRESENTS A CLAIM ON PART OF THE CORPORATION’S ASSETS AND EARNINGS. A BOND IS A DEBT INVESTMENT IN WHICH AN INVESTOR LOANS MONEY TO AN ENTITY THAT BORROWS THE FUND FOR A DEFINED PERIOD OF TIME AT A FIXED INTEREST RATE. A STOCK MAY TRADE WITH MORE OR LESS LIQUIDITY THAN A BOND DEPENDING ON THE NUMBER OF SHARES AND BONDS OUTSTANDING, THE SIZE OF THE COMPANY, AND THE DEMAND FOR THE SECURITIES. THE SECURITIES AND EXCHANGE COMMISSION (SEC) DOES NOT APPROVE, ENDORSE, NOR INDEMNIFY ANY SECURITY. Duration is a measure of the sensitivity of the price of a bond or other debt instrument to a change in interest rates.TAX FEATURES MAY VARY BASED ON PERSONAL CIRCUMSTANCES. CONSULT A TAX PROFESSIONAL FOR ADDITIONAL INFORMATION.Crossingbridge advisors, LLC is the Adviser to The CrossingBridge ultra-short duration fund, the crossingbridge low duration high yield fund, the crossingbridge Responsible credit fund and the riverpark strategic income fund which are distributed by QUASAR DISTRIBUTORS, LLC.CrossingBridge ADvisors, LLC is the ADviser to the crossingbridge Pre-merger Spac ETF, which is distributed by Foreside Fund Services, LLC. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here