Dear Fellow Investors,

I ended our Q3 letter saying, “[w]ith a concentrated portfolio of idiosyncratic companies, our returns have and will continue to come in chunks. As we ‘wait,’ progress is being made. I think we hold multiple multi-baggers and believe that the table is set for another ‘chunk’ of returns.” In Q4, we were indeed rewarded for our waiting with another chunk.

The Fund1 returned approximately 13%2 during the quarter and ended up more than 27%2 for the full year. Please refer to your individual statements for exact performance as returns will vary by fund, class, and timing of investment.

Greenhaven Road’s last two letters have focused on the adage that “the big money is in the waiting,” and it is nice to see some of the appreciation in the portfolio that we have been waiting for.

WHAT WE DON’T OWN

Most of this letter will be devoted to our largest holdings and recent purchases, but it’s worth noting what we don’t own: the S&P 500 (SP500, SPX). In fact, only one of our holdings, KKR, is in the index, representing about 0.20% of it. Your Greenhaven Road portfolio currently has virtually no overlap with the S&P 500.

The past decade has favored size – large companies have outperformed small ones. By year-end 2024, the “Magnificent 7” constituted almost 40% of the S&P 500’s total value and drove most of the index’s 24%+ return for the year. Without these seven, the remaining 493 returned just 4.1%.3

The “Magnificent 7” are powerful companies with direct ties to AI, which will undoubtedly change the world. AI should also be beneficial to our portfolio. For example, I believe that specialty insurer Hagerty (HGTY) will integrate AI-based tools over time to significantly reduce the cost of servicing claims. Similarly, Cellebrite (CLBT) will use AI tools to dramatically increase the efficiency of its users and their investigations, and should be able to capture some of that value.

If you have not experimented with Google Gemini, especially the Advanced 1.5 Pro with Deep Research, I encourage you to do so. Recently, I was trying to understand the scale and scope of the damages likely impacting a particular property insurer due to the tragic Los Angeles wildfires. In a matter of minutes, Google Gemini created a research plan, scanned 57 websites, and generated a 5-page report with calculations that were all sourced and footnoted. There were some errors, but the quality of the report was stunning. The technology is still flawed, but the trajectory is clear.

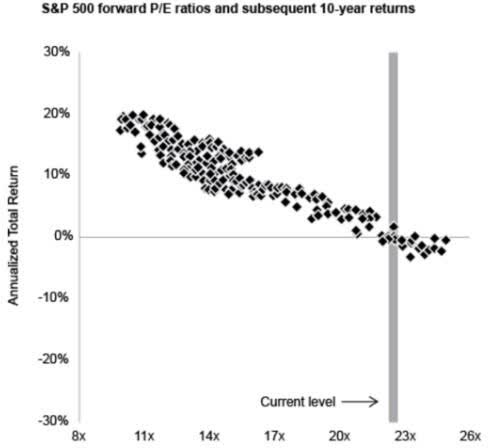

Maybe this time is different and the Mag 7 are so magnificent that they will continue to drive the S&P 500 ever higher, but I am skeptical. I would point to two data points. The first is a chart compiled by J.P. Morgan Asset Management that shows historical forward returns for the S&P 500 at different forward P/E levels (see left).

Given the 2024 year-end forward P/E ratio was just under 23X, the 10-year forward returns from this level are historically negative.

The other data point I would refer to is company-specific. On any given day, Apple (AAPL) is the largest or second-largest component of the S&P 500, comprising more than 7% of the total value. In 2024, AAPL’s total shareholder return was more than 30%. That 30% return is wonderful and is, in fact, better than Greenhaven Road’s net return last year. That said, given the rapid appreciation in share price, it might surprise you that for the latest fiscal year (ends September), Apple’s revenue increased by less than 3% year-over-year and its per-share earnings actually declined.

After the rise in share price, AAPL ended the year at $250.42 with a trailing P/E in excess of 41X last fiscal year’s earnings of $6.08 per share. That type of valuation typically implies that a pretty rosy future is in store for the business. However, Apple’s AI products have been lackluster, the Vision Pro is rumored to have been discontinued, and the slow rate of innovation in their phones is notable. The largest component of the index may be running out of steam.

For the last several years, not owning the S&P 500 as a whole, or its largest components individually, has been a headwind, relatively speaking. I am not calling the top or for an immediate reversal of that trend, but multiple expansion has driven much of the outperformance, and I am happy hunting outside of the S&P 500 right now.

GETTING THERE

One of the great pleasures of my work life has been my relationship with Chuck Royce. Last year, the Museum of American Finance inducted Chuck into their Hall of Fame (true story, I was there) and honored him with their Financial Innovation Award. To me and to many others, Chuck is the godfather of small cap investing. When he speaks, I listen. (Full disclosure, the Royce family is a seed investor in Greenhaven Road).

A company that is small and illiquid will often trade at a discount to its larger and more liquid peers. Years and years ago, when I was first getting to know Chuck, I was looking at investing in a very small, very illiquid company and was struggling with its “illiquidity discount.” Was the share price discounted enough given the lack of liquidity?

If anybody could offer sound insight, it was the Godfather, so I asked Chuck to sit down with me to discuss the company. I walked him through the products, management, and valuation, and ended with my question about the appropriate illiquidity discount. Like many conversations with wise people, I did not get my actual question answered. Instead, he politely told me that I was worried about the wrong thing. The real question he proffered was, “Will the company get there?” to which I responded, “Get where?”

Chuck went on to explain that businesses face all sorts of challenges, but if they can execute consistently, over time the small and illiquid company will become larger and more liquid. With growth and execution, the illiquidity issue solves itself, so the more important questions are: Will their balance sheet derail them? How will competition respond? Will margins erode? How long is the runway? Will products become obsolete? Can management scale the business? Is there keyman risk?

Chuck’s point was simple: While pricing matters, a business’s ability to survive and prosper over time matters more. Businesses typically fail. This is true even for public companies. As long-term investors, understanding a business’s ability to survive and prosper for a long period of time is more important than calculating the exact discount that should be embedded within today’s purchase price. Can the company stay in the game? Can they avoid getting knocked out? Can they “get there?” For smaller companies, this is the critical question.

TOP 5 POSITIONS

Below, I will discuss our largest holdings through the lens of “getting there.”

PAR Technology (PAR)– PAR’s underlying point of sale (POS) business has an annual churn of less than 5%. This is a fantastic, stable base upon which to build a business that will “get there.” Their continued growth and their successful price increases further aid their ability to “get there.” Through a combination of organic growth and acquisitions, PAR ended the year as a much larger and stronger company, growing annual recurring revenue (‘ARR’) from $137M at the end of Q4 2023 to more than $270M at year-end 2024.

The company has several paths for continued organic growth, including the rollout of Burger King (U.S.), which has already contracted with PAR. As another positive sign for PAR’s cross-selling initiatives, Burger King just bought PAR’s back- office solution for their U.S. corporate stores. Other paths for organic growth include increasing penetration in convenience stores with their loyalty and payments products (just launched), offering PAR’s existing customer base POS solutions for their international operations (thanks to the TASK acquisition), continued cross-selling (payments, back office, loyalty, online ordering), and continued new logo wins (I expect another Tier 1 customer this year). I believe PAR will also continue to fuel growth via acquisitions. For example, PAR recently bought an analytics platform that is immediately accretive and can be sold across the company’s customer base for years to come.

Looking forward, the competitive landscape remains favorable, the pipeline strong, and the value proposition compelling. The multiple may contract, but I believe that, even without any new acquisitions, in 2 years this company will be more than 50% larger on a recurring revenue basis, substantially profitable, and able to handle its debt, which does not come due until 2030. Even if PAR is not “there” quite yet, they still had a transformative year in 2024 and are well-positioned for profitable growth going forward. I believe that they can become a Rule of 40 company next year.

Lifecore (LFCR)– Of our top holdings, Lifecore faces the most uncertainty in “getting there.” But the path exists: They can triple production with no additional capital investment. Their largest customer, Alcon, is through its destocking phase. Alcon also has contractual minimum volume step-ups that will kick in for 2027. The terms of the contracted volume step- ups have not been disclosed, but I estimate them to be on the order of $25M in the medium term and more than $50M in the long term.

At recent conferences and on investor calls, there has been a noticeable increase in management’s references to the potential for new contracts for existing drugs (tech transfers) as well as the potential for a large contract with a multinational company.

Thus, in addition to the contractual step-ups that should help drive revenue, multiple other levers are being pulled. The combination of cost containment and revenue growth/operating scale make the path to improved margins quite plausible.

The new CEO, Paul Josephs, brings substantial business development experience from Mylan. Because of investments already made, Lifecore can nearly triple production with no additional capital required. With increased volumes and better expense management, management presentations have indicated that EBITDA margins should increase from 15% to 25%+ in the medium term. The final ingredient for being a multi-bagger would be multiple expansion. For context, two other CDMO businesses, Catalent and Avid Biosciences, were recently purchased for more than 22X EBITDA and 6.3X sales, respectively.

Simple math shows the potential: At $300M revenue and 25% EBITDA margins, you get $75M EBITDA. Apply a 15X multiple and assume 50M shares after debt conversion, and you reach $20 per share versus today’s sub-$7 price. There is also the potential for higher multiples and higher EBITDA margins. We are not playing to make 5% or 10% here. Interestingly, the CEO made his first open market purchase of shares this year and took a contract heavily tied to share price.

KKR (KKR) – KKR has been in business for 48 years and ended the third quarter with $624 billion in assets under management (AUM), up 18% year-over-year. At the firm’s last investor day, they highlighted that 80% of their strategies are not yet scaled and they are just scratching the surface with individuals. In fact, they laid out an $11 trillion growth opportunity in the alternatives industry. Given their brand name and historical track record, they are incredibly well- positioned to monetize that wave. KKR has not only “gotten there”, but they are also very, very likely to stay“there.”

Cellebrite (CLBT)– Cellebrite has a decade-long history of growing quickly and profitably and is a Rule of 50 company (growth rate + EBITDA margin), growing their recurring revenue by 26% while maintaining EBITDA margins of 24%. I believe this trend should continue as they are in the beginning of an upgrade cycle: management expects 15% of the customer base to have upgraded in 2024, leaving a long runway for 2025 and 2026. The company should accelerate its federal opportunity by obtaining FedRamp certification in 2025, which will make it easier for Federal customers to purchase Cellebrite products. Even without FedRamp, the U.S. Federal government represents more than 30% of revenue.

As discussed in previous letters, I believe Cellebrite will be a large beneficiary of AI as they are integrating it into their products, and I believe they are well-positioned to dramatically increase customer productivity. They have distribution, data, and guardrails to make sure only the proper data is analyzed. Since agencies are constrained on hiring talent, software is the most viable path to reducing case backlogs and increasing closure rates (the KPIs of Cellebrite’s customers). Cellebrite should be able to capture some of the incremental value they will deliver.

While I have little doubt that Cellebrite will “get there,” I do wonder who the CEO will be and if it will remain an independent public company. After 20 years at the helm, Yossi Carmil stepped down from the CEO role at the end of 2024, announcing the plan after reporting Q3 revenues exceeding $100 million. Good for him! Cellebrite’s Executive Chairman of the Board, Tom Hogan, has stepped into the interim CEO role. Tom has a long history in software and was an operating partner at Vista Equity, which has a great playbook for optimizing software companies. I speculate that Tom will become the permanent CEO and may, in the medium term, try to sell the company to Axon Enterprise (AXON), which is a 5% shareholder.

Burford (BUR) – Burford isn’t just “getting there” – they’re already the leader in litigation finance with a 27% historical gross IRR and losses on only 13% of cases, according to their disclosures. I have gone out of my way in past letters to highlight just how good the company has been historically at financing litigation. They rarely lose money on cases, in part because the vast majority (76%) settle. They do, however, occasionally have “monster winners” that return 10X, 50X or even 100X their initial investment.

Burford’s leadership team personally owns stock totaling 9% (>$200M) of the company and has been a net buyer of the shares. With aligned insider ownership, historically low loss rates, and tangible book value making up more than 80% of their share price, Burford is a well-capitalized and sustainable business.

In 2024, Burford was worse than “dead money” as it posted a share price decline. It is rarely easy to isolate the cause of a share price decline, but apparently investors had some consternation over the slowing pace of investments in new cases. While I have tried to focus our attention on Burford’s current and future business, I think it is time to look deeper at the YPF case.

The general facts of the YPF case are not disputed. YPF is an oil company operating in Argentina that was publicly traded. In 2012, Argentina nationalized the company and gave no compensation to existing shareholders. Burford has been financing the case of the shareholders against Argentina. YPF still exists, and the Argentinian government has benefited for more than a decade from the shares they stole/nationalized without compensation.

This litigation against Argentina has gone on for years, including appeals by Argentina disputing if Burford even has the right to collect and if the U.S. courts have jurisdiction. The plaintiffs Burford financed were ultimately awarded $16B, which is earning $1B per year in interest. In round numbers, a full payout would likely be worth more than $6B for Burford, or $25+ per share. To put this in perspective, this is double where the shares ended the year for a single case in Burford’s portfolio. We can debate the magnitude and timing of the ultimate payout, but I believe the expected value is not $0.

Clearly the market is not pricing in a full settlement with Argentina. The Argentinian government has used every delay tactic legally available to them. Argentina also does not have the money to pay Burford or other YPF claimants. However, things are improving in Argentina. Under President Javier Milei, who came into office in December 2023, there already has been broad regulatory reform, and are working towards getting the country’s fiscal house in order. Milei has shrunk the size of government and just reported its first budget surplus in 14 years!

Milei wants to be welcome in international circles. He goes to the “global conference” in Davos, Switzerland, and has named his dog Milton Friedman. To realize his ambitions, he will need to work with the IMF and global capital markets, which would be easier with a successful resolution of the YPF case where a previous regime unambiguously stole from foreign shareholders who have not yet received any restitution. I believe there is a deal to be had.

To date, there have been better proxies for Argentinian reform and progress than Burford shares. The S&P’s Argentina index (Merval) surged 172.52% in 2024 vs. a decline for Burford. With so many parties involved, including the Argentinian government and various U.S. courts, the range of outcomes for any Burford/YPF settlement is very wide. That said, I think there is a greater than 50% chance that we get a settlement worth at least the entire 2024 year-end share price of Burford in the next 2 years (to be paid out over years). Milei did not create this problem, but I increasingly think he will solve it. Meanwhile, Burford has an outstanding litigation finance business that keeps chugging away by funding lawsuits with high expected value returns. I don’t think BUR stays dead money, and a decent Argentina settlement could double the value of the shares overnight. We could “get there” with a step function increase in share price.

ONE MORE TO WATCH – IWG

While not in our top 5 largest positions, I wanted to revisit International Workplace Group (OTCPK:IWGFF). I wrote extensively about the company in the Q4 2023 letter. IWG was also temporarily “dead money” in 2024 with its share price declining. As a reminder, IWG is the largest operator of flexible/shared office spaces. The company is increasingly shifting to an asset-light model where they partner with landlords that have vacant space. In the new partnership model, IWG puts up no capital for the renovations and does not incur the liabilities of a multi-year lease. Instead, they bring their systems, tools, and experience to manage the sites. I believe there is almost no downside to a partnership for IWG, but there is upside via management fees and a share of the revenues for the partnership facilities. Because the whole process of signing up a partner, managing the site renovation, and finally recruiting tenants takes almost 3 years to reach maturity, the economics of the partnership model are not fully evident in IWG’s historical financials.

IWG trades for approximately 7X my estimate of this year’s operating cash flow, a valuation typically reserved for a business in decline. But IWG is growing and making progress on several dimensions that should improve its value over time. Over the course of 2025, I think IWG should pay down debt and initiate a stock buyback. The company should complete its transition to GAAP financials, which will allow for a transition from a London listing to a U.S. listing, a process that tends to result in higher valuation multiples. More importantly, IWG will continue to sign and open partnerships. Over time, the partnership business should have enough scale to be listed separately. There are many similarities to the IWG partnership business and hotel management companies such as Hilton and Hyatt, but valuation is not currently one of them as Hilton trades at >30X free cash flow and Hyatt at more than 20X free cash flow.

Below is a simple model showing the growth of just partnership signings, open locations, and contribution from Partnerships. The part of the business that I am most excited about most likely lost money in 2024, but as the signed locations come online, the profitability should come quickly. There should be operating leverage in the model.

We will have to wait, but the partnership model should “get there” and become an increasingly meaningful portion of the profits of the business. The Partnerships portion of the business, which should attract the highest multiple as evidenced by Hilton/Hyatt, is growing the fastest. Last year’s losses should turn to contribution as the number of open sites continues to grow. Higher contribution + higher multiple should lead to higher share price.

RECENT SALE

We sold almost all our MarketWise (MKTW) holdings during the quarter, nearly concluding our worst investment since the founding of the Partnership. In retrospect, I underestimated just how large of a beneficiary the company, a multi-brand content and technology platform for self-directed investors, was from Covid. I take some solace in that, during the entire IPO and subsequent 3+ years, insiders were net buyers of shares and the largest holders and board members never sold a share. I had high hopes for Porter Stansberry as CEO. He led the company for the 20 years before their IPO. His numbers were a thing of beauty. Profitable growth year after year after year. He left the company shortly before the IPO but returned in 2023. People matter and when he left the CEO role, I began to think about the exits. MarketWise built an incredible business with only $50K of invested capital, and they may in fact be able to rebuild the growth algorithm, but we are unlikely to be shareholders for that journey.

SHORTS

We ended the year short 2 companies facing significant litigation with the potential for treble damages (i.e., 3X the actual amount) for their actions and potential liabilities far in excess of their market capitalizations. We are also short 3 major indices and held some deep out of the money puts on a major index.

RECENT PURCHASES

Recently, we purchased shares in two companies that are listed outside of the U.S., are undergoing transitions, and are experiencing deep market skepticism about their ability to “get there.” These positions are discussed in the appendix.

OUTLOOK

Let me be direct about market conditions: stocks aren’t cheap. With higher interest rates typically leading to lower multiples and a potential reversion to historical valuations, I expect overall market multiples to decline. This creates headwinds for our portfolio’s share prices.

But multiple compression can be offset by growth. If multiples merely hold steady, our companies should continue strengthening. Remember – we don’t own the market. We own a small collection of companies with strong management teams and compelling products. We may have to endure the ups and downs of multiple compression and expansion, but, collectively and over time, I believe that our companies will “get there.” I believe that progress is being made during the waits and there are chunky returns to be had.

Sincerely,

Scott

APPENDIX – NEW PURCHASES IN Q4

Delivery Hero (OTCPK:DLVHF, DHER) – New Purchase

A simple thesis underlies this complex business: The market is giving us large, profitable pieces of Delivery Hero for free. Delivery Hero is the “world’s leading local delivery platform operating marketplace, own-delivery and dark store businesses.” Delivery Hero has the #1 food delivery app in over 50 countries and >90% of their gross merchandise value (GMV) is from countries where they are #1. The delivery app industry tends to coalesce around one or two winners in each market as consumers want selection, low cost, and fast delivery, which the largest players are best positioned to provide. Similarly, restaurants want to reach a broad audience and will gravitate towards the platforms driving the most business.

As food delivery apps have evolved, two trends have emerged that are worth highlighting. The first is that the platforms that control their own delivery have tended to “win,” as they are able to better satisfy customers who ultimately want food delivered quickly and hot when it arrives at their door. The second trend is the addition of “quick commerce” where the apps allow you to order more than just food, typically providing access to a large number of vendors such as grocery stores, pharmacies, beauty products, etc. The addition of quick commerce orders increases utilization of the delivery networks, provides an additional revenue stream, and drives higher frequency of purchases from users. The need to control delivery and offer more than food from restaurants dramatically increases the complexity of these businesses. This is not as simple as throwing up a website and accepting credit cards. Operations are complex, scale matters, and density matters.

Analyzing Delivery Hero is difficult as they operate in 72 countries across multiple business lines. The company is suppressing profits by investing to grow the business. In addition to different markets being in different phases of growth, the company also operates in different competitive landscapes. In some countries Delivery Hero is dominant, in others it is engaged in expensive dog fights to capture market share. For a long time, Delivery Hero fell into the “too hard” pile.

In the second half of 2024, Delivery Hero began to reveal the economics of some of their markets. More importantly, the company recently listed its Talabat division, which serves the Middle East region including the UAE, Kuwait, Qatar, Bahrain, Egypt, Jordan, Oman, and Iraq. As a result of listing Talabat, Delivery Hero raised just under $2B and cut its debt in half, effectively taking any short-term debt issues off the table. The listing also highlighted just how good of a business Talabat is and how good a scaled food delivery business can become.

In round numbers, Delivery Hero has a market capitalization of €8.7B, plus another €2B in debt for an enterprise value of €10.7B. Against that enterprise value, Delivery Hero retained just under €8B of Talabat stock. Talabat is a small piece of the overall business, representing approximately 15% of revenue/GMV. This dynamic of getting most of Delivery Hero for “free” raises 3 possible scenarios. The first scenario is that Talabat stock is wildly overvalued, making any sum of the parts valuation inaccurate. The second scenario is that the remaining 85%, non-Talabat business is being accurately reflected in the current combined valuation. The third scenario is that the €10.7B enterprise value above reflects a mispriced security and we could make real money over time by owning Delivery Hero.

Scenario 1 – Talabat is wildly overvalued: This does not appear to be the case. Talabat generated over $400M in operating cash flow in 2024 while growing revenues and GMV in excess of 20%. Talabat is expected to grow both cash flow and revenues at a similar rate in 2025. I would argue that, for a fast-growing business with operating leverage, trading at 20X trailing operating cash flow is not wildly mispriced. In fact, I think there is a very reasonable case to be made that it is undervalued.

Scenario 2 – The remaining 85% of the company is overvalued at under €3B: I would point out that Uber offered $950M – just under 1/3 of this €3B stub value – for Delivery Hero’s Taiwan business. The Taiwan business is less than 5% of DHER’s remaining non-Talabat GMV. The Uber deal was scuttled for regulatory reasons, but its existence would imply that the market is ascribing just ~€2B in value to Delivery Hero’s remaining business, excluding Talabat and Taiwan. This implied valuation encompasses subsidiaries that hold the #1 market share in countries such as South Korea, Italy, Greece, Argentina, and Turkey. South Korea alone generated approximately $500M of adjusted EBITDA in 2024. Assembling a mosaic of these facts, I don’t think the remaining 85% is worth just under €3B or the remaining 80% (excluding Talabat and Taiwan) is really worth less than €2B.

Scenario 3 – We Make Real Money: Delivery Hero certainly has challenges, including stiff competition from Coupang in South Korea and Meituan in Saudi Arabia. The company is also navigating labor law issues in the EU and the failed sale of the Taiwan business, but I believe this is a business headed in the right direction. In the last letter we discussed companies engaging in “self-help” and the successful listing of Talabat and the attempted sale of its Taiwan business demonstrate that Delivery Hero falls into this bucket. In addition, the company has dramatically reduced losses over the past four years and has guided to being free cash flow positive for 2024.

Delivery Hero is trading at less than 10X 2025 EBITDA, a figure that is growing 50%+. We have the opportunity for all 3 engines of share price returns to fire here – revenues can grow double digits, margins are improving much faster, and we can get multiple expansion on both the listed Talabat shares and the remaining Delivery Hero business. I believe we have the opportunity to make multiples of our money as the business grows and if multiples expand.

Vistry (OTCPK:BVHMF, VTY) – New Purchase

Sometimes the market overreacts to short-term issues in a declining business while missing the value in the growing one. That’s Vistry. As three profit warnings drove shares down 50%, we bought into this UK homebuilder that’s transitioning from traditional homebuilding to a capital-light partnership model focused on affordable housing.

The traditional homebuilding business – which they’re exiting – requires substantial upfront capital and faces cyclical risks. The partnership business, their future focus, typically requires less capital for shorter periods while working with government and non-profit partners.

Management has been very clear. As they transition away from the traditional Homebuilding business, there will be excess cash on the order of $1B as excess inventory and land is sold off. Vistry has been paying down debt and buying back stock. To date, the buyback has been relatively modest at £300K per day but should be more aggressive once the debt is paid off.

The shares ended the year trading below tangible book value, which I believe is effectively below liquidation value such that you could theoretically sell the land, finished houses, and works in progress and not lose money. The shares were also valued at 7X forward earnings, which may be depressed and may be understated, as I suspect that 2025 has been “kitchen sinked” with certain costs lumped in and certain sales delayed. Even with the earnings warnings and cost overruns in Homebuilding, the company will make more than £300M in 2025 delivering 17K+ units. Their medium-term guidance, which may get pushed out or revised, was for £800M in operating earnings on 22K home units at 12% margin. Vistry is trading at just over 3X their medium-term guidance. Average UK homebuilders trade at more than 10X operating earnings.

Management has to execute, but the setup is in place for both earnings growth and multiple expansion while a large share buyback is happening. It is easy to pencil out a 4X or more IF management really has their arms around the costs which we and others will be watching closely. It was the allure of 4X+ upside for something which is going asset-light and trading below liquidation value that had us buy our first homebuilder. I am admittedly not fluent in the UK housing market or the vagaries that drive the partners’ (councils, etc.) behavior, so this is a smaller position. If the company does not “get there” the fact that they are trading below liquidation value should provide some protection.

|

Footnotes 1 Greenhaven Road Capital Fund 1, LP, Greenhaven Road Capital Fund 1 Offshore, Ltd., and Greenhaven Road Capital Fund 2, LP are referred to collectively herein as the “Fund” or the “Partnership.” 2 See end notes for a description of this net performance. 3 J.P. Morgan Asset Management: Guide to the Markets, Q1 2025 DISCLAIMERS AND DISCLOSURES NOT AN OFFER OR RECOMMENDATION. This document does not constitute an offer to sell, or the solicitation of any offer to buy, any interest in any Fund managed by Greenhaven Road Investment Management LP and/or its affiliates, MVM Funds LLC and Greenhaven Road Capital Partners Fund GP LLC (all together “Greenhaven Road”). Such offer may only be made (i) at the time a qualified offeree receives a confidential private placement memorandum describing the offering and related subscription agreement and (ii) in such jurisdictions where permitted by law. The discussion in this document is not intended to indicate overall performance that may be expected to be achieved by any Fund managed by Greenhaven Road and should not be considered a recommendation to purchase, sell, or otherwise invest in any particular security. Portfolio holdings change over time. Securities referred to in these materials do not represent all of the securities held, purchased, or sold by Greenhaven Road. Any references to largest or otherwise notable positions are not based on the past or expected future performance of such positions. An investment in a Fund is speculative and is subject to a risk of loss, including a risk of loss of principal. There is no secondary market for interests in the Funds and none is expected to develop. No assurance can be given that a Fund will achieve its investment objectives or that an investor will receive a return of all or part of its investment. By accepting receipt of this communication, the recipient will be deemed to represent that they possess, either individually or through their advisers, sufficient investment expertise to understand the risks involved in any purchase or sale of any financial instruments discussed herein. FORWARD LOOKING STATEMENTS. Certain information contained herein constitutes “forward-looking statements”, which can be identified by the use of forward-looking terminology such as “may,” “will,”‘ “should,” “expect,” “anticipate,” “target,” “goal,” “project,” “consider,” “estimate,” “intend,” “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual performance of an individual investment, an asset class or any Fund managed by Greenhaven Road may differ materially from those reflected or contemplated in such forward-looking statements. Past performance is not indicative of future results. Greenhaven Road undertakes no obligation to revise or update any forward-looking statement for any reason, unless required by law. Any projections, market outlooks or estimates in this document are forward-looking statements and are based upon certain assumptions and should not be construed to be indicative of the actual events which will occur. Unless otherwise stated, all representations in this document are Greenhaven Road’s beliefs at the time of its initial distribution to recipients based on industry knowledge and/or research. The forward-looking statements contained in these materials are expressly qualified by this cautionary statement. INFORMATION COMPLETENESS AND RELIABILITY. While information used in these materials may have been obtained from various published and unpublished sources considered to be reliable, Greenhaven Road does not guarantees its accuracy or completeness, accepts no liability for any direct or consequential losses arising from its use, cannot accept responsibility for any errors, and assumes no obligation to update these materials. Hyperlinks contained herein are not endorsements, and Greenhaven Road is not responsible for the functionality of links or the content therein. USE OF INDICES. Indices, to the extent referenced in this document, are presented merely to show general trends in the markets for the period and are not intended to imply that a Fund’s portfolio is benchmarked to the indices either in composition or in level of risk. The indices are unmanaged, not investable, have no expenses and may reflect reinvestment of dividends and distributions. Index data is provided for comparative purposes only. It should not be assumed that any portfolio(s) managed by Greenhaven Road will consist of any specific securities that comprise the indices described herein. The S&P 500 is a stock market index that tracks the performance of 500 of the largest publicly traded companies in the U.S., representing a broad cross-section of industries. The Russell 2000 is a stock market index that measures the performance of the 2,000 smallest companies in the Russell 3000 index, providing a gauge of the performance of small-cap stocks in the U.S. Net Performance (i) is representative of a “Day 1“ investor in the U.S. limited partnership Greenhaven Road Capital Fund 1, LP, (ii) assumes the highest possible management fee of 1.25%, (iii) assumes a 25% annual incentive allocation subject to a loss carry forward, high water mark, and 6% annual (non-compounding) hurdle, and (iv) is presented net of all expenses. Fund returns are audited annually, though certain information contained herein may have been internally prepared to represent a fee class currently being offered to investors. Performance for an individual investor may vary from the performance stated herein as a result of, among other factors, the timing of their investment and the timing of any additional contributions or withdrawals. Greenhaven Road Investment Management LP is a registered investment adviser with the Securities and Exchange Commission (“SEC”). SEC registration does not imply a certain level of skill or training. The Fund(s)/Partnership(s) are not registered under the Investment Company Act of 1940, as amended, in reliance on exemption(s) thereunder. Interests in each Fund/Partnership have not been registered under the U.S. Securities Act of 1933, as amended, or the securities laws of any state, and are being offered and sold in reliance on exemptions from the registration requirements of said Act and laws. The enclosed material is confidential and not to be reproduced or redistributed in whole or in part without the prior written consent of MVM Funds LLC or Greenhaven Road Capital Partners Fund GP LLC, as applicable. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here