Dividends—The Best Way to Fund Your Retirement?

What’s the Best Way to Fund Retirement?

Everyone’s situation is different, but traditional advice tends to have two key features:

- Spending plans that are unconnected to investment outcomes. The classic “4% Rule” is one such plan—at retirement, spending is set at 4% of savings and then grows by the rate of inflation regardless of investment performance. There are many variations of this rule, such as setting a higher percentage in early retirement years and then scaling back as age restricts leisure activities. The key characteristic is that spending is delinked from investment results.

- Investment plans that sacrifice returns for safety. Bonds are a lower returning asset class, but they are used in the classic 60% stocks/40%

bonds portfolio to reduce downside risk. Whether the ratio is 60/40 or 70/30 or 80/20, in every case, investors are trading off long-term returns for safety. Another related strategy is to combine a stock portfolio with 3, 5 or even 10 years of cash to cover spending in a stock market downturn. Historically, cash (or short-term bonds) has had inferior returns to equities, so like with 60/40 portfolios, holding years of cash is just another way to sacrifice investment returns for safety.

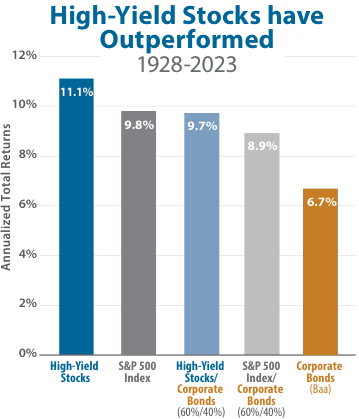

Dividend investing provides an alternative to these traditional retirement solutions. Highyield stocks (stocks in deciles 7, 8, & 9 as provided by Fama/French) have historically had a higher average total return than the S&P 500 Index (SP500, SPX) , so for those who believe that “time in the market beats timing the market,” high-yield stocks are an enticing investment option, unburdened by compromises for safety.

High-yield stocks also, as we will show, have generated income above the 4% Rule in most years. Dividend payments can fall in bad times, so unlike the 4% Rule and its variants, spending from dividends is linked to investment performance. Some retirees may view a link between spending and investment results as problematic while others may view it as realistic. We take a pragmatic approach, quantifying how frequently dividend spending would require retirees to tighten their belts and how often dividends generate spending budgets below the 4% Rule. As a broad overview of our historical simulations, we found that using dividends to set budgets never resulted in retirees running out of money and allowed for higher average spending than the 4% Rule.

| As of December 31, 2023. Sources: Morningstar Direct; Federal Reserve Bank of St. Louis (FRED); Fama/French; Damodaran Historical Returns US (NYU Stern School of Business); Miller/Howard Research & Analysis. See full list of definitions on last page. |

Forecasting a couple years out is hard enough, so anticipating what will happen over the course of your retirement is pretty much impossible. Will we finally see flying cars? At Miller/Howard, our view is that long-term forecasting is foolhardy—it’s better to choose a strategy that would perform well in a wide variety of investing environments. The past century has provided a remarkable laboratory to pressure test various investment and spending strategies. Our database goes back to 1928 (the earliest date across our sourced datasets), a period that includes the dismal stock market returns of the Great Depression, inflation spikes following World War II and again in the 1970s, and an assortment of both bull and bear markets. Using these historical returns, we simulated 67 30-year retirements from 1928-1957 (all ranges are inclusive), 1929-1958, and so on through 1994-2023.

In Miller/Howard’s 3Q 2024 Quarterly Report, Will Inflation Ruin Your Retirement?, we compared retirement outcomes across high-yield stocks, the S&P 500, bonds, and related 60/40 strategies, all assuming spending is 4% of their starting point adjusted for inflation. Using the 4% Rule, a 60/40 portfolio using high-yield stocks and bonds was the only strategy that never ran out of money in all 67 simulated 30-year retirements.

Yet, even for the most risk-averse retiree, choosing a 60/40 strategy is a compromise because the bond part of that portfolio historically has reduced investment performance, meaning less for retirees and less for their heirs. High-yield stocks generate enough income to allow for a completely different spending rule—suppose retirees set their spending budgets equal to dividend income. We will show that in our simulations, spending out of dividends is superior to the 4% Rule, both in terms of safety as well as enabling higher average retirement spending.

Why spending from dividends works

Looking at the 1928-2023 period, total returns for high-yield stocks exceeded dividend yield in twothirds of the calendar years. In those years, retirees could spend the dividend and still have a higher account balance at the end of the year. Relative to the fluctuations in total returns, dividend yields wiggle by modest amounts year-to-year. For almost all of our simulated 30-year retirements, high-yield stocks compound up over time, leading to higher dividend income as the relatively stable dividend yields are applied to higher and higher account balances.

|

As of December 31, 2023. Sources: Fama/French; Morningstar Direct; Miller/Howard Research & Analysis. High-Yield Stocks dividend yield was calculated as the 12-month sum of the monthly difference between the total return minus price return. The resulting sum was divided by the calendar year starting balance to calculate a yield. |

Higher Spending with Safety?

Let’s compare dividend spending versus the 4% Rule for investors in high-yield stocks from two perspectives:

Inflation-adjusted spending relative to the initial investment—higher is better. On average, retirees spending dividends in our simulations had budgets well above what would be afforded using the 4% Rule. On average, by the 30th year of retirement, dividend spending is three times greater than the 4% Rule would allow.

Dividend Spending in High-Yield Stocks Allows for a Larger Budget

Spending as a percent of the account balance at the end of the previous year—lower is safer. Running out of money always involves withdrawing sequentially higher and higher fractions of remaining savings. On average, both retirees spending dividends and those using the 4% Rule had downward-sloping withdrawal rates, withdrawing a smaller fraction of their savings each year as their retirement progressed.

| Sources: Morningstar Direct; Federal Reserve Bank of St. Louis (FRED); Fama/French; Damodaran Historical Returns US (NYU Stern School of Business); Miller/Howard Research & Analysis. High-Yield Stocks Dividend Rule, income is not reinvested at the end of each calendar year for the 30-year periods. Spending vs initial savings is income generated divided by $100,000 (inflation-adjusted). Dividend Rule Portfolios, Withdrawal Percent is annual income generated divided by calendar year ending balance. 4% Rule Portfolios, Withdrawal Percent is annual inflation-adjusted 4% withdrawal divided by calendar year ending balance. |

Dividend spending is safe yet allows retirees a larger budget, on average. But we all get just one retirement so good results “on average” is not enough. That’s why it’s important to examine how the dividend strategy works in all retirement periods, including those with challenging markets.

In 53 out of 67 simulated 30-year retirements, the dividend approach would allow for higher spending than the 4% Rule every year of retirement. The remaining 14 simulations, a combination of low dividend yields and poor total returns force retirees to spend less than the 4% Rule would afford for a portion of the 30-year period.

|

Sources: Morningstar Direct; Federal Reserve Bank of St. Louis (FRED); Fama/French; Damodaran Historical Returns US (NYU Stern School of Business); Miller/Howard Research & Analysis. Chart shows the percentage of calendar years when the income generated was greater than or less than 4% of inflation-adjusted $100,000 over a 30-year investment period. |

The Worst Retirement in History: 1929-1958

High-Yield Stocks with Different Spending Rules

| Sources: Morningstar Direct; Federal Reserve Bank of St. Louis (FRED); Fama/French; Damodaran Historical Returns US (NYU Stern School of Business); Miller/Howard Research & Analysis. For the 4% Rule, the 30-year period began with a 4% withdrawal. The withdrawal was then adjusted for inflation at the beginning of each calendar year. For the Dividend Rule, spending is limited to income generated by the portfolio. Dividend Spending represents the withdrawal as a percent of the account balance at the beginning of the year. For the 4% Rule, end-year of the displayed period is the last year before the required withdrawal exceeds the account balance. |

Many retirement advisors test investment and spending strategies versus computer-generated bad scenarios. Our view is that history provides a truly bad scenario, one that is unlikely to recur, but still allows us to answer the question, “Would your savings survive the historically worst-case scenario?” Beginning in 1929 through the end of 1931, high-yield stocks fell by a cumulative 76%, presenting a severe test for retirement strategies.

In our 3Q 2024 Quarterly Report, we showed that a simulated retirement beginning in 1929 (using a portfolio of high-yield stocks and the 4% Rule for spending) would run out of money after 15 years, short of our 30-year target. In contrast, spending based on dividend income protected savings, allowing retirement to continue a full 30 years.

We can see how this would play out in two different ways. First, looking at withdrawal rates as a percentage of the previous year’s account balance, spending using the 4% Rule overwhelms retirement savings. In the 1929-start scenario, the fatal feature of the 4% Rule is that spending is not throttled as the market plummets, leading to an empty retirement account by the beginning of 1944. In contrast, setting spending equal to dividends leads to a much better outcome. In the simulation, withdrawal rates as the percent of the previous year’s account balance drops as the market struggled and then gradually rebounded for the remaining years.

At Miller/Howard, we use the concept of “yield on original investment,” defined as dividend income divided by original investment amount. Dividend income tends to rise over time relative to the initial account value. But for a retirement beginning in 1929, this was not true. A dividend spending rule would acknowledge the reality of this dire situation, cutting spending to match income. In contrast, the 4% Rule sets spending independent of investment performance, leading to a disastrous outcome in this simulation.

Dividend Rule for High-Yield Stocks Never Ran Out of Money

|

Spending Rule: |

Dividend Spending |

Inflation-Adjusted 4% Annual Withdrawal |

||||

|

HighYield Stocks |

Corporate Bond (Baa) |

HighYield Stocks |

S&P 500 Index |

HighYield Stocks/ Corp Bond(60%/40%) |

S&P 500 Index/ Corp Bond(60%/40%) |

|

|

Failure |

0 |

30 |

1 |

5 |

0 |

1 |

|

Reduced Ending Estate |

2 |

16 |

2 |

6 |

3 |

16 |

|

Higher Ending Estate |

65 |

21 |

64 |

56 |

64 |

50 |

| As of December 31, 2023. Sources: Morningstar Direct; Federal Reserve Bank of St. Louis (FRED); Fama/French; Damodaran Historical Returns US (NYU Stern School of Business); Miller/Howard Research & Analysis. “Reduced Ending Estate” and “Higher Ending Estate” starting values are post-inflation-adjusted withdrawal versus initial retirement account. 60%/40% portfolios are rebalanced annually. “Dividend Spending: High-Yield Stocks” withdrawals are not inflation adjusted; withdrawals are income generated by the portfolios during each calendar year of the 30-year periods. |

Win-Win…Win?

In our 3Q 2024 Quarterly Report, we compared a variety of investment strategies paired with the 4% Rule for spending. Defining failure as running out of money before 30 years have passed, only a 60/40 high-yield stock/corporate bond portfolio avoided failure across all 67 simulations.

We have shown that using high-yield stocks with spending equal to dividends is a better strategy:

- No failed retirement in our simulations.

- On average, high-yield stocks allowed higher spending in every year of retirement.

But what about the ending estate?

It turns out that investing in high-yield stocks and spending out of dividends leaves a larger estate (on an inflation-adjusted basis) in 65 of the 67 simulated retirements. On average, the remaining estate is over three times the initial account value, including accounting for inflation. Even the two most challenging retirement periods, 1928-57 and 1929-58, still left estates with 80-90% of the inflation-adjusted starting points.

| Sources: Federal Reserve Bank of St. Louis (FRED); Fama/French; Miller/Howard Research & Analysis. Estate Ratio is the end balance divided by the inflation-adjusted $100,000 at the 30-year period end. |

Dividend Spending When Yields Are Low

Does Dividend Spending Work When Yields Are Low?

Dividend yields have been lower in recent decades, both for high-yield stocks and the broader market. At the outset of retirement, lower dividend yields clearly will lead to a lower spending budget. The flip side is that lower spending in the early years allows for more compounded returns, enabling higher dividend dollars in later years.

Let’s look at our latest full 30-year retirement, 1994-2023. In 1994, high-yield stocks had a dividend yield of 3.6%. Comparing dividend income to savings at the outset of retirement, spending would indeed be lower than 4% in the early years. That condition does not hold for long, because investment returns compound the account value upwards, coming to dominate a lower starting yield.

For the 1994-2023 retirement, the dividend yield on original investment, adjusted for inflation, was over 4% by the third year and was 13% by the 30th year. This 13% yield on initial investment is higher than the 12% average across our 67 retirement simulations, even though the starting dividend yield (3.6% in 1994) was well below the average starting dividend yield of 5.6% for 1928-1994.

A retirement starting in 2014 had an even lower initial dividend yield: 2.9%. Over the first 10 years of this retirement simulation, the yield on original investment has gradually sloped upwards, passing 4% in the 7th year. The point is that spending in both retirement simulations starts low but gets progressively better, even after adjusting for inflation.

Dividend Spending Approach in High-Yield Stocks vs S&P 500 Index

| Sources: Morningstar Direct; Federal Reserve Bank of St. Louis (FRED); Fama/French; Damodaran Historical Returns US (NYU Stern School of Business); Miller/Howard Research & Analysis. Income is based on dividends received and is not reinvested at the end of each calendar year for the 30-year periods. Spending vs initial savings is income generated divided by $100,000 (inflation-adjusted). Withdrawal Percent is annual income generated divided by calendar year ending balance. |

Comparing High-Yield Stocks to the S&P 500 Using Dividend Spending

Up to this point, we have only examined dividend spending combined with investments in highyield dividend stocks. But the S&P 500 Index also pays a dividend and has had total returns well above bonds over the long term. Let’s compare retirements using the S&P 500 versus high-yield stocks as investments with both simulations using dividends to set spending levels.

Both strategies never failed, meaning that retirees never ran out of money across all 67 simulated 30-year periods when spending dividends generated by either high-yield stocks or the S&P 500. In our 3Q 2024 Quarterly Report, we showed that using the 4% Rule led to one failure for high-yield stocks and five failures for the S&P 500 in our simulations. By changing spending from the 4% Rule to dividends, failures have been eliminated for both investment strategies.

Which investment strategy generates higher spending budgets? Since high-yield stocks have superior dividend yields, clearly high-yield stocks will tend to generate more dividends in the early years of retirement. Dividend dollars in later years are not so obvious, being a combination of total return, yield, and the accumulative negative impact of withdrawals for spending. It turns out that, on average, high-yield dividend stocks generate more income than the S&P 500 throughout a 30-year retirement.

On average, over the 67 retirement simulations, income from high-yield stocks averaged 5.8% in the first year of retirement, growing over 30 years to a 12% yield on original investment, after inflation. In contrast, income from the S&P 500 averaged 4.4% in the first year, growing to just a 7.1% yield on original investment, inflation-adjusted, after 30 years. Looking at the individual calendar years in our simulations, highyield stocks generated higher income in 98% of years. We conclude that high-yield stocks are better for income—but are they better for heirs?

Dividend Spending Rule— High-Yield Stocks Left Larger Estates vs S&P 500 Index

| Sources: Federal Reserve Bank of St. Louis (FRED); Fama/French; Damodaran Historical Returns US (NYU Stern School of Business); Miller/Howard Research & Analysis. Estate Ratio is the end balance divided by the inflation-adjusted $100,000 at the 30-year period end. |

High spending can depress the estate left after retirement. As we have seen, a high-yield stock portfolio generated more income than the S&P 500 in the majority of retirement years. You might think that this leads to high-yield stocks leaving smaller estates, but on average, that has not been true. High-yield stocks have had higher total returns during our 1928-2023 period, and the compounding advantage of this better performance more than offset the higher spending. The estate for highyield stocks in our simulations was 3.2 times the original account value, adjusted for inflation. In contrast, a retirement using the S&P 500 with dividend spending left an estate of 2.8 times the inflation-adjusted original account value.

What Does It All Mean?

Retirement planning can be very daunting once complexities such as taxes, estate planning, and non-liquid assets are taken into consideration. The simulations presented here are not intended to compete with detailed, personal financial planning, but they do reveal some important principles:

- Spending must be linked to investment performance. We have shown that a dividend spending approach allows for higher spending than the 4% Rule, yet has no failures in our historical simulations. The retiree spending dividends is sensible, knowing to pivot if dividends are cut broadly in the market. In contrast, the 4% Rule and its variants require overly conservative spending for most retirement scenarios, and yet is rigid enough to fail in the worst of times.

- The power of compounding is truly remarkable. In our scenarios, retirees spend at a healthy rate and still, on average, leave an estate that is multiple times the initial account value, even after inflation. What doesn’t compound? Cash. In our view, too many retirees have too much cash set aside for various contingencies. Too much cash can be a significant missed opportunity.

- High-yield stocks have a long history of superior income and better returns. Relative to the broad market, high-yield stocks provide an attractive solution for retirement spending needs.

Revisiting our original question: What’s the best way to fund your retirement? We believe retirees should consider spending the dividend income generated by high-yield stocks.

|

The investment portfolios described herein are those of Miller/Howard Investments. These materials are being provided for illustrative and informational purposes only. The information contained herein is obtained from multiple sources that are believed to be reliable. However, such information has not been verified, and may be different from the information included in documents and materials created by the sponsor firm in whose investment program a client participates. Some sponsor firms may require that these Miller/Howard Investments materials are preceded or accompanied by investment profiles or other documents or materials prepared by such sponsor firms, which will be provided upon a client’s request. For additional information, documents and/or materials, please speak to your Financial Advisor. |

|

INVESTMENT PRODUC TS: ARE NOT FDIC INSURED • MAY LOSE VALUE • ARE NOT BANK GUARANTEED |

Read the full article here