Living in a Concentrated World

Global equity markets have grown more concentrated, led by the U.S. and a few dominant stocks. Declining concentration could favor value stocks and active investment strategies over time.

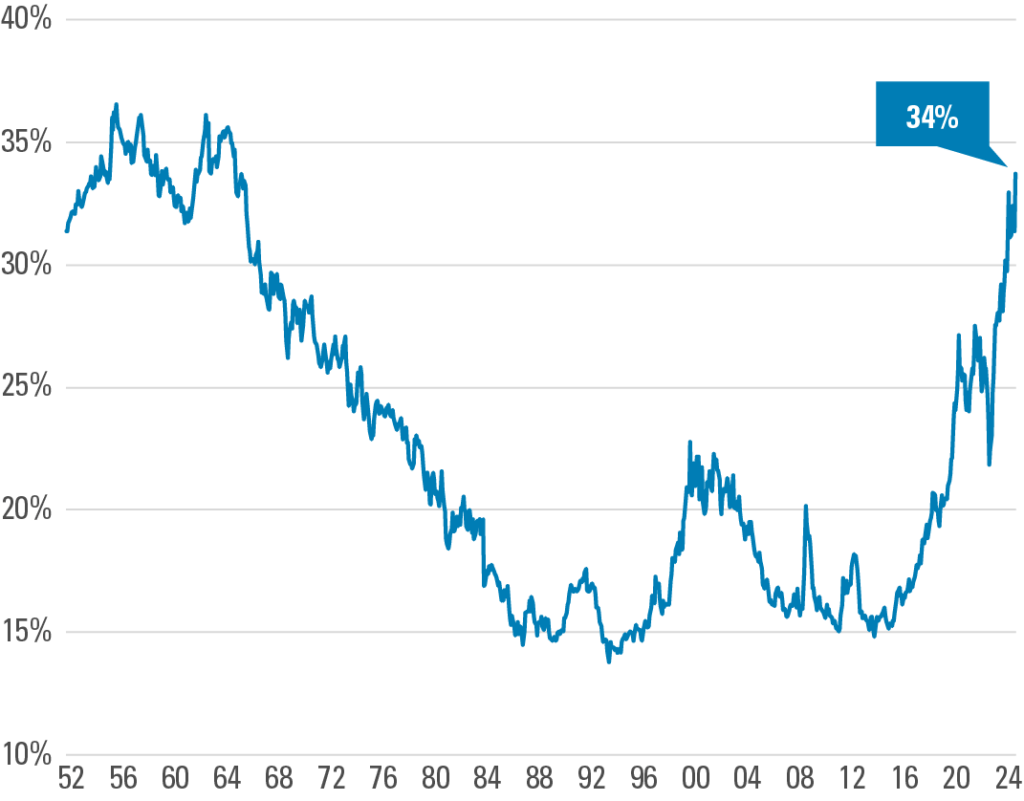

Over the past decade, global equity markets have become increasingly concentrated, with the United States playing a central role in this trend. The share of the U.S. in global market capitalization has surged significantly, primarily driven by a handful of dominant companies. This concentration has become even more pronounced since the release of ChatGPT in November 2022; a small group of stocks accounted for a significant portion of U.S. market performance over the last couple of years, pushing market concentration levels to a 60-year high.

In this essay, we discuss

- The impact increasing concentration has had on investment styles and strategies

- Historical performance when market breadth widens (or expands)

- Why concentrated markets eventually broaden

- Forecasted earnings convergence in the U.S. market

INCREASING CONCENTRATION

U.S. market concentrations are at historic levels, with highs not seen for 60 years (Exhibit 1). Over the past two years, a mere 10 stocks have accounted for 62% of overall U.S. market performance. The level of concentration has become magnified since the release of ChatGPT in November 2022 and throughout the rise of investment in generative AI. Global equity markets have also become increasingly concentrated, with the U.S. acting as a major driver, as its share of the global market cap has grown to 66% from 44% since the Global Financial Crisis.

Exhibit 1: Market Concentration Has Been IncreasingUS Large-Cap Stocks Share of Total Market Capitalizationin the Top-Ten Stocks | 1952 – 2024

| Source: Empirical Research Partners, Pzena analysisUniverse is the 1,000 largest US stocks ranked by market capitalization. Data from January 31, 1952 – December 31, 2024. |

IMPLICATIONS OF CONCENTRATED PERFORMANCE

Since November 2022, the Russell 1000 Growth Index has outperformed the Russell 1000 Value Index by 54 percentage points, and the environment has been difficult for active investors1, which is directionally in line with history (Exhibit 2). The historical performance is hardly surprising; as the largest, most expensive stocks perform well, market performance concentrates, thereby leading to value underperformance and poor alpha opportunity for active investors

Exhibit 2: Performance In Concentrating MarketsAverage 5-Year Annualized Alpha by Market Concentration

| Source: Empirical Research Partners, Sanford C. Bernstein & Co., Pzena analysisRising/Falling concentration = change in concentration percentage of the top 10 largest stocks in the universe versus five years ago.Value = stocks within the cheapest quintile based on price/book of the 1000 largest US stocks (ranked by market cap).Value Light = 2nd cheapest quintile.Expensive = most expensive quintile. The quintiles are measured on an equally weighted basis.Equal Weight = 1000 largest US stocks on an equally weighted basis. Alpha for Value, Value Light, Expensive, and Equal Weighted are calculated versus the cap-weighted market (1000 largest US stocks).Monthly rolling five-year data in US dollars January 1, 1960 – December 31, 2024.Does not represent any specific Pzena product or service. Past performance is not indicative of future returns. |

However, periods of declining concentration have historically lasted twice as long as rising concentration. Once market performance broadens and concentration levels fall, the previous effects are more than offset; value stocks significantly outperform expensive stocks, and the environment becomes more favorable for active investors. Interestingly, value-light stocks underperform value stocks in markets with both rising and falling concentration levels.

CONCENTRATION LEVELS TURN

While we cannot predict when market concentration will turn or what may drive it, history offers some guidance. The last five years have seen markets concentrate at a greater pace than during any other five-year period. The only other five-year period during which the market concentrated at levels similar to today was during the dot-com bubble of the late 1990s. The subsequent five-year periods saw a dramatic swing, as value stocks outperformed expensive stocks by nearly 1,500 basis points per year.

Market concentration can reverse for a variety of reasons. The culmination of a bubble period, as seen in the post-dot-com bubble at the turn of the twentieth century, could cause such a reversal. A general broadening of performance could also cause a reversal, as seen in the post-Nifty Fifty period in the early 1970s. Most importantly, it is extraordinarily difficult for market leaders to maintain their dominance indefinitely due to the power of capitalism and competitive markets. An analysis of the decade-by-decade top 10 global market cap leaders shows how challenging it is to remain a market leader2. Underperformance is a likely result of this rotation of the largest companies3. A nearly 60-year study found that sector leaders subsequently underperformed relative to the rest of the sector by 3–4% per year. The impact was even more powerful for the overall market cap leader, which trailed the market by 5–6% per year (Exhibit 3). That level of underperformance would have turned $100, reinvested annually into the biggest stock in the market since 1950, into just $4 today4. Such has been the plight of the largest stocks in the index.

Exhibit 3: Too Big to SucceedAverage Forward Relative Return | 1952 – 2009

| 1Y | 5Y | 10Y | |

| Overall Market Leader¹ | -6.6% | -6.1% | -4.9% |

| Sector Leaders² | -3.5% | -3.9% | -3.3% |

| Source: Research Affiliates: Too Big to Succeedhttps://www.researchaffiliates.com/content/dam/ra/publications/pdf/F_2010_ June_Too_Big_to_Succeed.pdfUniverse is the 1,000 largest US stocks ranked by market capitalization.1. The largest market cap stock in the universe versus the universe return.2. The average alpha for all 12 sector leaders (the largest market cap stock in each sector versus the average return of the sector).Does not represent any specific Pzena product or service. Past performance is not indicative of future returns. |

While market leaders face fierce competition from existing companies, the biggest threat may come from companies that are not viewed as competition or ones that have not even been formed yet. On average, the so-called Magnificent Seven largest stocks have only been publicly traded for 26 years. Compare them to the top 10 stocks at the turn of the century (Exhibit 4). Only one remains among the top 10 today, and half of the current list went public after 1996. Nobody would have predicted at the time that all but Microsoft (MSFT) would be surpassed by the rest of the Magnificent Seven.

Exhibit 4: Top 10 U.S. Market Caps In 2000

| 1. Microsoft (MSFT) |

| 2. General Electric (GE) |

| 3. Cisco Systems (CSCO) |

| 4. Wal-Mart Stores (WMT) |

| 5. Exxon Mobil (XOM) |

| 6. Intel (INTC) |

| 7. Lucent Technologies |

| 8. IBM |

| 9. Citigroup (C) |

| 10. AOL |

| Soucre: Morningstar |

The Nvidia-Intel rivalry is a great example of the brutal competitiveness of capitalism. At the turn of the century, Intel’s market cap was $251bn, and it had a seemingly impenetrable competitive edge over Nvidia, whose market cap was less than $1bn. Today, Nvidia’s $3.2tn market cap dwarfs that of Intel’s at $86bn.

EARNINGS CONVERGENCE

The outsized recent performance of the Magnificent Seven stocks has been driven, at least in part, by incredible earnings growth. These companies have grown earnings by 37% per year in 2023 and 2024, which is approximately three times faster than the earnings of the rest of the market. The law of large numbers is catching up, however. Over the next few years, the earnings growth of these businesses is expected to decelerate and is only projected to grow a few percentage points more than the rest of the market (Exhibit 5), while trading at almost twice the valuation.

Exhibit 5: Earnings ConvergenceMagnificent Seven Earnings Growth Is Moderating

| Source: FactSet, Pzena Analysis. Magnificent Seven = Apple, Nvidia, Microsoft, Amazon.com, Meta Platforms, Tesla, and Alphabet.Earnings data per FactSet as of December 31, 2024. |

CONCENTRATION ONLY NEEDS TO ABATE, NOT REVERSE

As the law of large numbers looms, analysts are forecasting earnings growth of the Magnificent Seven to converge with the rest of the market, which may stem the tide of increasing market concentration. Historically, that’s all that really needs to happen for style rotation to occur. The weight of the largest stocks does not need to reverse—it merely needs to stop going up. Once market concentration growth is relatively flat, value has historically outperformed the market by 460 basis points, beaten value-light strategies by 240 basis points, and outpaced expensive stocks by 370 basis points. Finally, as market concentration stops rising, equal weight (a proxy for active investing) has historically outperformed cap weight (a proxy for passive investing) by 150 basis points per year, even before market weights began to significantly diversify.5

CONCLUSION

The rise of concentrated performance has had significant implications. Expensive stocks have consistently outperformed cheaper stocks over this period, creating a challenging environment for active managers. As the earnings growth of these dominant stocks begins to converge with the broader market, the tide may turn, which should benefit value stocks and create a more favorable environment for active investing strategies.

|

Footnotes 1 We found a high correlation (.76 R-squared) between the alpha of active management and the relative performance of an equally weighted index relative to a cap-weighted index. 2 https://www.visualcapitalist.com/how-the-top-sp-500-companies-have-changed-over-time/ 3 Q2 2023 Newsletter 4 Mauboussin: Stock Market Concentration—How Much Is Too Much? 5 https://www.morganstanley.com/im/publication/insights/articles/article_stockmarketconcentration.pdf 6 Pzena analysis. See definitions in Exhibit 2. Further InformationThese materials are intended solely for informational purposes. The views expressed reflect the current views of Pzena Investment Management (“PIM”) as of the date hereof and are subject to change. PIM is a registered investment adviser registered with the United States Securities and Exchange Commission. PIM does not undertake to advise you of any changes in the views expressed herein. There is no guarantee that any projection, forecast, or opinion in this material will be realized. Past performance is not indicative of future results. All investments involve risk, including loss of principal. Investments may be in a variety of currencies and therefore changes in rates of exchange between currencies may cause the value of investments to decrease or increase. The price of equity securities may rise or fall because of economic or political changes or changes in a company’s financial condition, sometimes rapidly or unpredictably. Investments in foreign securities involve political, economic and currency risks, greater volatility and differences in accounting methods. These risks are greater for investments in Emerging Markets. Investments in small-cap or mid-cap companies involve additional risks such as limited liquidity and greater volatility than larger companies. PIM’s strategies emphasize a “value” style of investing, which targets undervalued companies with characteristics for improved valuations. This style of investing is subject to the risk that the valuations never improve or that returns on “value” securities may not move in tandem with the returns on other styles of investing or the stock market in general. This document does not constitute a current or past recommendation, an offer, or solicitation of an offer to purchase any securities or provide investment advisory services and should not be construed as such. The information contained herein is general in nature and does not constitute legal, tax, or investment advice. PIM does not make any warranty, express or implied, as to the information’s accuracy or completeness. Prospective investors are encouraged to consult their own professional advisers as to the implications of making an investment in any securities or investment advisory services. London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). ©LSE Group 2025. FTSE Russell is a trading name of certain of the LSE Group companies. Russell® is a trademark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. For U.K. Investors Only: This marketing communication is issued by Pzena Investment Management, Ltd. (“PIM UK”). PIM UK is a limited company registered in England and Wales with registered number 09380422, and its registered office is at 34-37 Liverpool Street, London EC2M 7PP, United Kingdom. PIM UK is an appointed representative of Vittoria & Partners LLP (FRN 709710), which is authorised and regulated by the Financial Conduct Authority (“FCA”). The Pzena documents have been approved by Vittoria & Partners LLP and, in the UK, are only made available to professional clients and eligible counterparties as defined by the FCA. For EU Investors Only: This marketing communication is issued by Pzena Investment Management Europe Limited (“PIM Europe”). PIM Europe (No. C457984) is authorised and regulated by the Central Bank of Ireland as a UCITS management company (pursuant to the European Communities (Undertakings for Collective Investment in Transferable Securities) Regulations, 2011, as amended). PIM Europe is registered in Ireland with the Companies Registration Office (No. 699811), with its registered office at Riverside One, Sir John Rogerson’s Quay, Dublin, 2, Ireland. Past performance is not indicative of future results. The value of your investment may go down as well as up, and you may not receive upon redemption the full amount of your original investment. The views and statements contained herein are those of Pzena Investment Management and are based on internal research. For Australia and New Zealand Investors Only: This document has been prepared and issued by Pzena Investment Management, LLC (ARBN 108 743 415), a limited liability company (“Pzena”). Pzena is regulated by the Securities and Exchange Commission (SEC) under U.S. laws, which differ from Australian laws. Pzena is exempt from the requirement to hold an Australian financial services license in Australia in accordance with ASIC Class Order CO 03/1100 and the transitional relief under ASIC Corporations (Repeal and Transitional) Instrument 2016/396, extended through 31 March 2026 by ASIC Corporations (Amendment) Instrument 2024/497. Pzena offers financial services in Australia to ‘wholesale clients’ only pursuant to that exemption. This document is not intended to be distributed or passed on, directly or indirectly, to any other class of persons in Australia. In New Zealand, any offer is limited to ‘wholesale investors’ within the meaning of clause 3(2) of Schedule 1 of the Financial Markets Conduct Act 2013 (‘FMCA’). This document is not to be treated as an offer, and is not capable of acceptance by, any person in New Zealand who is not a Wholesale Investor. For Jersey Investors Only: Consent under the Control of Borrowing (Jersey) Order 1958 (the “COBO” Order) has not been obtained for the circulation of this document. Accordingly, the offer that is the subject of this document may only be made in Jersey where the offer is valid in the United Kingdom or Guernsey and is circulated in Jersey only to persons similar to those to whom, and in a manner similar to that in which, it is for the time being circulated in the United Kingdom, or Guernsey, as the case may be. The directors may, but are not obliged to, apply for such consent in the future. The services and/or products discussed herein are only suitable for sophisticated investors who understand the risks involved. Neither Pzena Investment Management, Ltd. nor Pzena Investment Management, LLC nor the activities of any functionary with regard to either Pzena Investment Management, Ltd. or Pzena Investment Management, LLC are subject to the provisions of the Financial Services (Jersey) Law 1998. For South African Investors Only: Pzena Investment Management, LLC is an authorised financial services provider licensed by the South African Financial Sector Conduct Authority (licence nr: 49029). © Pzena Investment Management, LLC, 2025. All rights reserved. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here