COVID 19 profoundly changed the apartment industry. Free to work from anywhere, Americans uprooted and migrated to cities with lower cost real estate, more space, lower income taxes, and better weather. That translated to a mass exodus to Sunbelt places like Phoenix, Dallas, Tampa, Nashville, Atlanta, and Las Vegas. Multifamily landlords were quick to understand that they could raise Austin apartment rents by 20% and a worker transplanted from San Francisco would still be saving money. Soon all the apartment REITs had invested in the Nation’s hottest housing markets and so had everyone else. By 2023, developers with access to cheap capital had started delivery of the largest new apartment supply in almost 50 years.

The huge new supply began to outpace still strong demand; occupancy dropped, rents stopped rising and, in some markets, actually reversed. Fortunately, economies eventually find equilibrium; rapidly rising interest rates shut off the spigot to cheap capital and effectively made new development uneconomic. After a rough 2023, the mantra on multifamily earnings calls became “Survive until `25”.

In this Sector Spotlight, we will examine where we are now in the realm of multifamily REIT investment. We compare market valuations relative to AFFO/share, Net Asset Value (NAV), and 3Q24 Same-Store Net Operating Income (SSNOI).

2024 Returns

Spectacular rent growth early in the pandemic generated unbridled investor optimism and pushed apartment REIT earnings multiples up in the range of 25 to 30x. When rent growth stalled, multifamily share prices fell back to earth. 2024 was a wait-and-see period and, with multifamily outperforming the broader REIT market, optimism may be returning.

Multifamily REITs – 2024 Returns

S&P Capital IQ

Source: S&P Capital IQ as of 01/02/2025

Market Valuations

Various metrics can be applied to understand a company’s intrinsic value relative to its market valuation. At Portfolio Income Solutions, we put significant trust in Adjusted Funds from Operations (AFFO/share) measures because they level the earnings playing field in a peer set. At year-end, the AFFO/share multiples of the Multifamily REIT sector look like this.

2MCAC with data derived from S&P Capital IQ

Source: 2MCAC with data compiled from S&P Capital IQ

With P/AFFO multiples ranging from ~14x to almost 23x and an average P/AFFO multiple of 18.3x, the sector is much more modestly valued than it was at the apartment investment frenzy peak of 25x to 30x of 2021. Still, a mean 19.3x is a meaningful premium to the 16.4x average multiple of the whole equity REIT universe.

2MCAC with data derived from S&P Capital IQ

Source: 2MCAC with data compiled from S&P Global Market Intelligence

With sustaining strength in the US jobs market, apartment demand and household formation are expected to remain high. With new supply diminishing, investors may be pricing shares in anticipation of landlords reassuming the upper hand in rental rate negotiations.

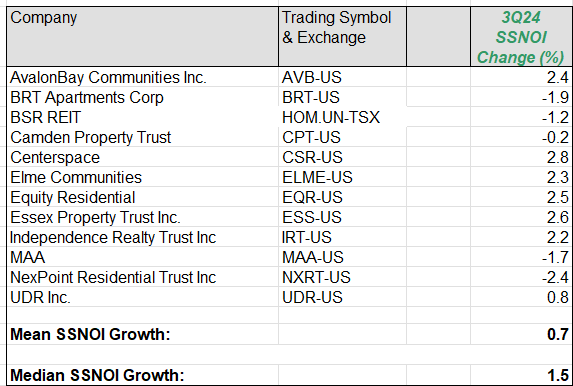

Same-Store Net Operating Income

Third quarter reporting indicated that while the multifamily sector still saw strong demand, waves of competing new supply have suppressed both rent growth and occupancy. The result is a trend of more tepid SSNOI growth for those sectors. On average, the apartment REIT sector saw same-store cash NOI grow 0.7% compared to 3Q23. With strong share price performance in 2024, it seems possible that investors believe that earnings may have troughed, and the future looks brighter.

2MCAC with data compiled from company filings

Source: 2MCAC with data compiled from company filings

Net Asset Value

NAV is broadly considered a useful metric for comparison of value relative to market share price and to peers. Twelve months ago, equity REITs traded at a high teens discount to Net Asset Value. Today they trade at close to NAV valuations, and that approximates pricing for the multifamily sector as well. In prior years, investor enthusiasm or pessimism pushed share prices to significant premiums or discounts, respectively. Today, the average multifamily REIT share is priced at about a 10% discount to consensus NAV.

2MCAC with data compiled from S&P Capital IQ

Source: 2MCAC with data compiled from S&P Capital IQ

When considering NAVs, it is important to understand that the value is derived from using an assumed capitalization rate. As the table above describes, the applied Cap Rates here vary in a tight band from 4.9% up to 6.0%; the lower the cap rate applied, the higher the NAV derived. Operationally, these companies are extremely diverse, so this valuation metric is only a starting point and much more analysis is required.

Takeaways

Our economy is delivering mixed blessings. Employment remains very strong and that bolsters high demand for the entire housing sector. Employment is one of the factors in the Federal Reserve’s dual mandate, so vigorous job and wage growth will dampen the pace of further rate cuts.

Relatively high borrowing costs will continue to suppress new apartment development and that is favorable for reducing new competition for apartment landlords. However, many REITs are levered so higher costs on refinancing will pressure Net Operating income and lower rates would be welcome relief.

The collection of multifamily REITs we have examined here are diverse in their capital structure, their market geographies and demographics, and, maybe most importantly, their management team’s skill sets and objectives. This Sector Spotlight is intended as an overview starting point. More thorough, granular analysis on an individual company basis is warranted.

Happy investing.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here