Introduction

In our previous article, we suggested that investors in Marathon Holdings (NASDAQ:MARA) should bet on its three characteristics: growing reserves, financially sustainable operations, and the ability to raise capital at good valuations to acquire underperforming competitors.

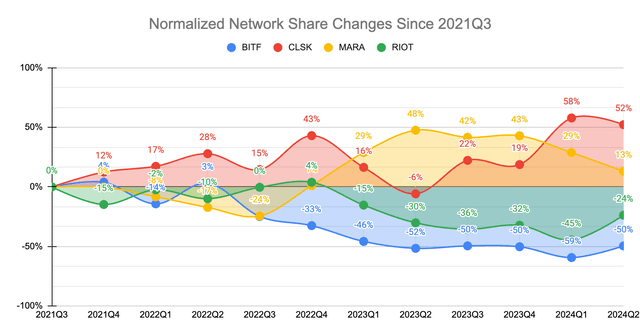

Over the past 2 quarters, we think that MARA has performed well in 2 out of the 3 fronts. We saw MARA grow its reserves by 64%, from 15,741 Bitcoins in January to 25,945 in August. It also raised capital at reasonable valuations to make acquisitions (although its acquisitions of Bitcoin and not Bitcoin miners, like Riot Platform’s (RIOT) acquisition of Bitfarms (BITF)). The only front MARA did not perform is on its operating cost efficiencies, resulting from its declining network share, an issue we pointed out in our previous article.

Considering its performance, we think there’s a market error we can exploit through MARA, potentially giving us asymmetric returns relative to other miners if it regains PBR superiority. Hence, in this article, we’ll update our thesis accordingly and also discuss why shareholder dilution may not matter in this case.

A Market Error

Opportunity in the Ongoing Mean Reversion

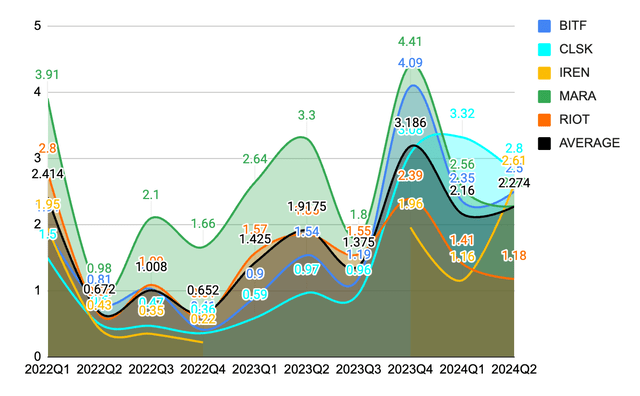

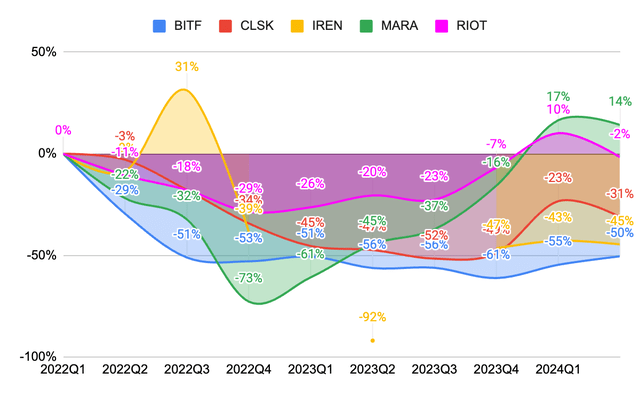

Currently, we are observing an ongoing mean reversion on Bitcoin miner valuations. By referring to Fig 1, we can see that MARA, which is usually trading above the sector average PBR, has now reverted back to the mean. We saw CleanSpark (CLSK), which diverted away from the mean to see significance outperformance, revert back to the mean. We also saw Iris Energy (IREN), which usually trades below the sector average PBR due to the lack of Bitcoin reserves, revert back to the mean.

Fig 1. Price-to-book value ratio of major Bitcoin mining companies (Author)

When the market reverts to the mean, the valuation dynamic changes. This creates an opportunity to scoop up certain stocks that were previously overvalued and are now potentially undervalued, hence the market error.

In a podcast 3 years ago, Howard Marks mentioned that the best asset allocation strategy to be “cautiously long” is to allocate within the asset class. He explained that within every asset class, there’ll be assets that perform better in good times and worse in bad times, and vice versa. This is the strategy we unknowingly followed when we tilted our portfolio between Bitcoin and Bitcoin miners in the past. This is also the strategy we’re currently undertaking in preparation for a potential upcoming bull run. Hence, our ongoing series of analyses of Bitcoin miners aims to identify the best Bitcoin miners to tilt into.

This thesis represents how we might find MARA fitting in our portfolio.

Is A Price-to-book value ratio (‘PBR’) >1 Justifiable for Unprofitable Bitcoin Miners?

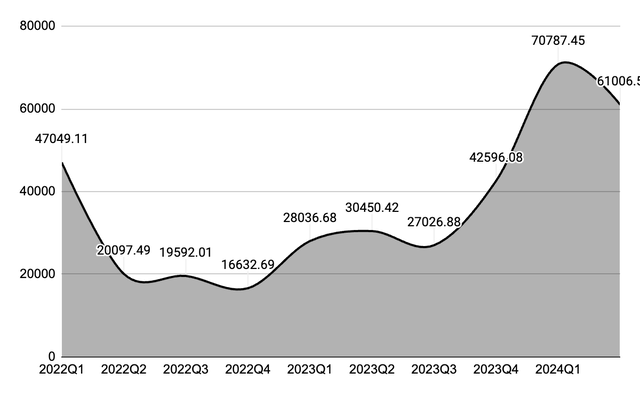

Let’s turn our attention back to Fig 1. Aside from the mean reversion that is taking place, we can also see that the sector average PBR fluctuates over time. This fluctuation can be explained by Bitcoin optimism and pessimism. When the Bitcoin price trended up/down (Fig 2), we can see that the market average PBR also trended accordingly.

Fig 2. Bitcoin Historical Price (Author)

The first problem we have to address is whether unprofitable Bitcoin mining companies trading above PBR=1 is justifiable. If no, we shouldn’t be looking at it further.

Based on our experience, PBR>1 is usually a side effect of a high Price-to-earnings ratio: The market anticipates higher earnings, appreciates the share price, and causes PBR to increase alongside PER as book value remains the same.

Now, consider an entity that does not generate any income, its value would simply be worth its assets (assuming no depreciation), hence PBR = 1. An unprofitable business without a profitability prospect would trade PBR<1 because losses will eat into its assets (Refer to Fig 1 between 2022Q2 and 2022Q4).

So, is Unprofitable Bitcoin companies trading at PBR>1 justifiable?

Yes, unprofitable Bitcoin miners can justify a PBR>1 because their quarterly reported profits are not realized profits unless the Bitcoins mined are sold.

Profitability is realized in cash. In traditional businesses that operate with cash transactions, if a deal is unprofitable, it remains unprofitable – there’s no changing that. In contrast, a Bitcoin mining company can HOLD until Bitcoin appreciates above its costs basis to realize profits.

So, Bitcoin optimism will lead investors to expect the sale of Bitcoin at higher prices to cover the previous costs. Hence, unprofitable Bitcoin miners can indeed justify a PBR>1 on Bitcoin optimism.

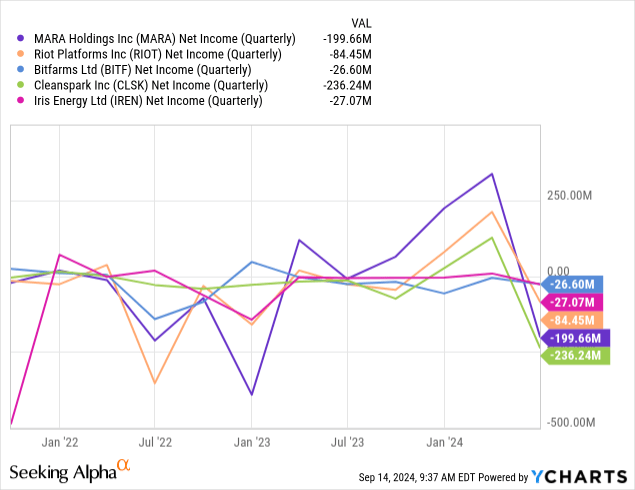

This problem has to be addressed, all major Bitcoin miners are now unprofitable (and are often unprofitable).

The Thesis

With the justification of PBR>1 out of the way, we can now look at our investment thesis for MARA.

Given our expectation of a potential bull run, we should also expect the sector average PBR to increase. This would essentially benefit all Bitcoin miners. Recall that there are assets that will perform better during good times. We think that there are fundamental reasons why MARA can be the best performing Bitcoin miner.

PBR favors companies with appreciable (or at least depreciation-resistant) assets but does not account for shareholder dilution. It is after considering shareholder dilution, only then we can measure how much value we, as (potential) shareholders, can extract. So we have to look at both aspects.

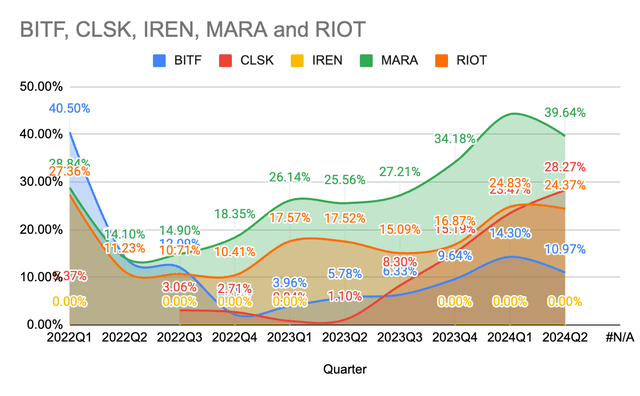

In terms of Book Value, a Bitcoin bull run favors a Bitcoin mining with a higher proportion of Bitcoin on its balance sheet. It’s not about the amount of Bitcoins but the proportion. It’s like allocating 1% of a portfolio to Bitcoin, even if Bitcoins double, it would only contribute a 1% portfolio return. So, it’s the proportion that matters.

Regarding Bitcoin proportion on the balance sheet, MARA ranks No. 1 by a margin (Fig 3). Hence, MARA’s book value is fundamentally able to extract more value from a Bitcoin bull run than other miners.

Fig 3. Proportion (%) of Bitcoin over Total Asset (Author)

Based on the prospect of book value appreciation combined with a higher average sector PBR driven by Bitcoin optimism, we expect MARA to benefit disproportionately compared to other Bitcoin miners.

In terms of shareholder dilution, MARA is also the best performer. Not only did MARA’s shareholder equity (per share) not decrease, but it increased (Fig 4). This means that MARA’s shareholders did not lose any equity despite almost tripling outstanding shares since 2022Q1.

Table 1. MARA’s Historical Shares Outstanding

Fig 4. Normalized Book Value Per Share (Author)

Combining MARA’s strong book value prospects with minimal shareholder dilution, it is reasonable to conclude that the market has mispriced MARA at the sector’s average PBR. Among the strategies available to trade this mean reversion, we find that MARA offers the best return-risk profile. Another available mean reversion play is RIOT, though we perceived it to be significantly riskier. (The article on RIOT is undergoing editorial process and will be available soon)

The Risk

There’s risk to every thesis, including this one. The risk to this thesis is the same as its opportunity, in addition to the lack of an alternative proposition.

Remember that some assets within the same asset class might do poorly during bad times? MARA could be one of them in the sector. During a Bitcoin drawdown, MARA’s book value will suffer the most because of the larger proportion of Bitcoin.

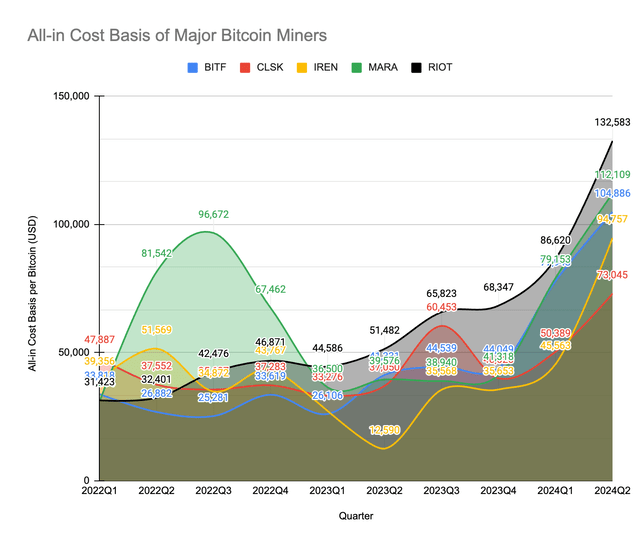

In addition, MARA lacks alternative proposition such as high operating cost efficiency, growing network share, or other profitability proposition. MARA’s cost basis is higher than the sector average (Fig 5) while losing network share (declining Bitcoin production (Fig 6)). This could also imply that MARA might not be able to maintain its performance in the shareholder dilution aspect. Just look at what happened to MARA’s PBR in 2022Q4 in Fig 1.

Fig 5. All-in cost basis per Bitcoin for major Bitcoin mining companies (Author) Fig 6. Normalized Network Share of major Bitcoin miners (Author)

Therefore, since MARA’s thesis is centered around its book value, we must be cautious about exposing ourselves only to situations that benefit high-book-value companies. That’s why it is crucial for us to wait for the 2 confirmations before holding a Bitcoin bullish bias. If a Bitcoin bull run does not take place, then MARA could perform worse than the sector.

Verdict

We often receive comments here on Seeking Alpha about “Bitcoin is a scam” or “Bitcoin is going to 0”. While that may still be true, we always have to ask “when?” and “why?”. The same applies to stocks. You can read on our doomsday scenario where Bitcoin could go to $0 here.

For now, we think that MARA’s valuation at 2 PBR is an opportunity we can exploit. While we can’t rate it as a “buy” right now, we can see how MARA might fit into our portfolio alongside CLSK. For now, we’ll wait for the 2 confirmations before further actions.

Read the full article here