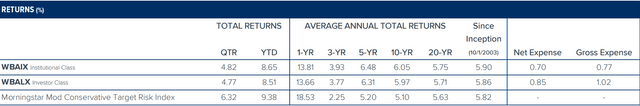

The Conservative Allocation Fund’s Institutional Class returned +4.82% for the third quarter compared to +6.32% for the Morningstar Moderately Conservative Target Risk Index. The Fund’s stock holdings drove the bulk of the positive quarterly return, with equity results that outpaced the Russell 1000 Index. The Fund’s bond holdings also posted positive contributions for the quarter from coupon income and price appreciation, across all fixed income sectors.

An Anticipated Move from the Fed and an AI Breather

The Fed began its long-awaited campaign to lower the Fed Funds rate, starting with an assertive 50 basis point (0.5%) cut in September in response to modestly softer employment conditions. Long interest rates and credit spreads had rallied well before the Fed acted, so the “returns cake” for bonds was pretty much baked before the meeting even took place.

Our conservative fixed income positioning dampened the Fund’s relative results, as bonds with longer maturities and more credit risk delivered the highest returns. We don’t expect the Fund to stand out when fixed income markets perform well, so this short-term outcome was not a surprise.

Stock gains were broad-based during the quarter as AI fever took a breather. Small- and medium-sized companies led the way, and value fare outpaced higher flying growth stocks. Thirteen of the Fund’s equity positions delivered double-digit quarterly returns, including “newer vintage” holdings such as Veralto, Old Dominion Freight Lines, and Bio Techne. Stocks are not cheap, and more assets of all stripes appear priced for smooth sailing. And while we haven’t battened down the hatches, it seems appropriate for investors to temper expectations.

Notable 3Q Contributors

Aon PLC, Accenture PLC, Berkshire Hathaway, Oracle and Danaher were the Fund’s leading quarterly contributors with Thermo Fisher Scientific a notable contributor as well. These are very good businesses run by capable managers. The companies have methodically grown business value per share over long time frames, both organically and via astute capital deployment. Think of them as representing some of the lean proteins and vegetables within the portfolio. Technology-related stocks were the most notable pocket of weakness during the quarter, in an abrupt reversal from prior months. Microchip Technologies, Alphabet, Microsoft, Honeywell International and Roper Technologies were the Fund’s leading quarterly detractors, and Martin Marietta Materials as a notable detractor as well.

We added new equity positions in Old Dominion Freight Line, Inc. (ODFL) and Bio Techne Corp. (TECH) during the quarter. Both are excellent businesses, with stocks that are usually well-loved and aspirational. Both stocks traded well off their highs, for understandable but largely short-term reasons. We were able to buy them at moderate, rather than juicy, discounts to our value estimates.

3Q Trading Activity

Our trading activity during the quarter was largely incremental. We added to the Fund’s equity positions in Bio Techne and IDEX Corp. at moderate discounts to our value estimates. We trimmed the Fund’s holdings of S&P Global, FIS, and Alphabet as the stocks generated healthy year-to-date returns. In bonds, we continued to layer in small individual positions in asset-backed and mortgage-backed debt, with a heavy focus on sponsor quality, structural protection, and straightforward collateral.

The Fund’s overall portfolio continues to evolve with market conditions. We own common equity stakes in 28 companies totaling 44.4% of net assets. The fixed income portfolio includes securitized debt (15.7%), investment-grade corporate bonds (0.2%), Treasury securities (32.5%), and cash equivalents/other (7.2%). We have ample resources to invest heavily in new opportunities as our team uncovers them.

We think the investing landscape for allocation investors is well-balanced. In our view, the Fund’s securities offer adequate long-term capital appreciation potential. High-quality bonds yielding more than 4% have enhanced the current income outlook. And sizeable holdings of short-maturity Treasury securities and cash provide healthy ballast with respectable yields. As always, we encourage investors to evaluate the strategy on a total-return basis over longer time horizons.

|

TOP CONTRIBUTORS(%) |

||||

|

Return |

Average Weight |

Contribution |

% of Net Assets |

|

|

Aon plc (AON) |

18.09 |

2.30 |

0.39 |

2.4 |

|

Accenture plc (ACN) |

16.96 |

1.97 |

0.32 |

2.1 |

|

Berkshire Hathaway, Inc. (BRK.A)(BRK.B) |

13.14 |

2.51 |

0.32 |

2.6 |

|

Oracle Corp. (ORCL) |

21.03 |

1.40 |

0.29 |

1.6 |

|

Danaher Corp. (DHR) |

11.37 |

2.34 |

0.26 |

2.4 |

|

TOP DETRACTORS(%) |

||||

|

Return |

Average Weight |

Contribution |

% of Net Assets |

|

|

Microchip Technology, Inc. (MCHP) |

-11.73 |

1.05 |

-0.14 |

1.0 |

|

Alphabet, Inc. (GOOG) |

-8.83 |

1.14 |

-0.12 |

1.0 |

|

Microsoft Corp. (MSFT) |

-3.56 |

1.67 |

-0.06 |

1.7 |

|

Honeywell International, Inc. (HON) |

-2.67 |

0.83 |

-0.03 |

0.8 |

|

Roper Technologies, Inc. (ROP) |

-1.15 |

1.28 |

-0.02 |

1.3 |

|

Data is for the quarter ending 9/30/2024. Holdings are subject to change and may not be representative of the Fund’s current or future investments. Contributions to performance are based on actual daily holdings. Returns shown are the actual returns for the specified period of the security. Additional securities referenced herein as a percent of the Fund’s net assets as of 9/30/2024: Thermo Fisher Scientific, Inc., 2.3%; Bio Techne Corp., 1.3%; Veralto, 1.5%; Martin Marietta Materials, 1.7%; IDEX Corp, 1.4%; S&P Global, Inc., 1.3%; Fidelity National Information Services, Inc., 1.2%; and Old Dominion Freight Line, Inc., 1.4%. |

The opinions expressed are those of Weitz Investment Management and are not meant as investment advice or to predict or project the future performance of any investment product. The opinions are current through 10/9/2024, are subject to change at any time based on market and other current conditions, and no forecasts can be guaranteed. This commentary is being provided as a general source of information and is not intended as a recommendation to purchase, sell, or hold any specific security or to engage in any investment strategy. Investment decisions should always be made based on an investor’s specific objectives, financial needs, risk tolerance and time horizon. Data quoted is past performance and current performance may be lower or higher. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, and shares, when redeemed, may be worth more or less than their original cost. Please visit weitzinvestments.com for the most recent month-end performance. Investment results reflect applicable fees and expenses and assume all distributions are reinvested but do not reflect the deduction of taxes an investor would pay on distributions or share redemptions. Net and Gross Expense Ratios are as of the Fund’s most recent prospectus. Certain Funds have entered into fee waiver and/or expense reimbursement arrangements with the Investment Advisor. In these cases, the Advisor has contractually agreed to waive a portion of the Advisor’s fee and reimburse certain expenses (excluding taxes, interest, brokerage costs, acquired fund fees and expenses and extraordinary expenses) to limit the total annual fund operating expenses of the Class’s average daily net assets through 07/31/2025. The Gross Expense Ratio reflects the total annual operating expenses of the fund before any fee waivers or reimbursements. The Net Expense Ratio reflects the total annual operating expenses of the Fund after taking into account any such fee waiver and/or expense reimbursement, if any; total returns would have been lower had there been no waivers or reimbursements. Performance quoted for Institutional Class shares before their inception of 03/29/2019 is derived from the historical performance of the Investor Class shares and has not been adjusted for the expenses of the Institutional Class shares, had they, returns would have been different. Index performance is hypothetical and is shown for illustrative purposes only. You cannot invest directly in an index. The Morningstar Moderately Conservative Target Risk Index is an asset allocation index comprised of constituent Morningstar indices and reflects global equity market exposure of 40% based on an asset allocation methodology derived by Ibbotson Associates, a Morningstar company. The Fund has also selected a broad-based index for regulatory requirements, the Bloomberg U.S. Aggregate Bond Index. This index is a broad-based index that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. See the Fund’s Prospectus for additional information. Credit ratings are assigned to underlying securities utilizing ratings from a Nationally Recognized Statistical Rating Organization (NRSRO) such as Moody’s and Fitch, or other rating agencies and applying the following hierarchy: security is determined to be Investment Grade if it has been rated at least BBB- by one credit rating agency; once determined to be Investment Grade (BBB- and above) or Non-Investment Grade (BB+ and below) where multiple ratings are available, the lowest rating is assigned. Mortgage-related securities issued and guaranteed by government-sponsored agencies such as Fannie Mae and Freddie Mac are generally not rated by rating agencies. Securities that are not rated do not necessarily indicate low quality. Ratings are shown in the Fitch scale (e.g., AAA). Ratings and portfolio credit quality may change over time. The Fund itself has not been rated by a credit rating agency. Consider these risks before investing: All investments involve risks, including possible loss of principal. These risks include market risks, such as political, regulatory, economic, social and health risks (including the risks presented by the spread of infectious diseases). In addition, because the Fund may have a more concentrated portfolio than certain other mutual funds, the performance of each holding in the Fund has a greater impact upon the overall portfolio, which increases risk. See the Fund’s prospectus for a further discussion of risks related to the Fund. Investors should consider carefully the investment objectives, risks, and charges and expenses of a fund before investing. This and other important information is contained in the prospectus and summary prospectus, which may be obtained at Weitz Investment Management – Home Page or from a financial advisor. Please read the prospectus carefully before investing. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here