Standardized performance (%) as of September 30, 2024

|

Quarter |

YTD |

1 Year |

3 Years |

5 Years |

10 Years |

Since inception |

||

|

Class A (MUTF:GTDDX) shares inception: 01/11/94 |

NAV |

10.33 |

7.68 |

13.06 |

-2.32 |

2.96 |

2.85 |

4.90 |

|

Max. Load 5.5% |

4.27 |

1.76 |

6.83 |

-4.15 |

1.80 |

2.27 |

4.71 |

|

|

Class R6 shares inception: 09/24/12 |

NAV |

10.44 |

7.97 |

13.50 |

-1.95 |

3.35 |

3.26 |

3.11 |

|

Class Y shares inception: 10/03/08 |

NAV |

10.42 |

7.87 |

13.35 |

-2.07 |

3.21 |

3.10 |

5.89 |

|

MSCI Emerging Markets Index |

8.72 |

16.86 |

26.05 |

0.40 |

5.75 |

4.02 |

– |

|

|

Total return ranking vs. Morningstar Diversified Emerging Mkts category (Class A shares at NAV) |

– |

– |

94% (757 of 795) |

72% (444 of 711) |

86% (529 of 639) |

76% (306 of 427) |

– |

Calendar year total returns (%)

|

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

|

|

Class A shares at NAV |

-3.26 |

-18.69 |

19.75 |

30.34 |

-18.75 |

29.97 |

17.14 |

-6.98 |

-17.70 |

8.81 |

|

Class R6 shares at NAV |

-2.83 |

-18.34 |

20.22 |

30.86 |

-18.40 |

30.52 |

17.58 |

-6.61 |

-17.41 |

9.23 |

|

Class Y shares at NAV |

-3.03 |

-18.50 |

20.05 |

30.65 |

-18.53 |

30.32 |

17.41 |

-6.75 |

-17.47 |

9.07 |

|

MSCI Emerging Markets Index |

-2.19 |

-14.92 |

11.19 |

37.28 |

-14.57 |

18.42 |

18.31 |

-2.54 |

-20.09 |

9.83 |

|

Expense ratios per the current prospectus: Class A: Net: 1.34%, Total: 1.35%; Class R6: Net: 0.97%, Total: 0.98%; Class Y: Net: 1.09%, Total: 1.10%. Performance quoted is past performance and cannot guarantee comparable future results; current performance may be lower or higher. Visit Country Splash for the most recent month-end performance. Performance figures reflect reinvested distributions and changes in net asset value (NAV). Investment return and principal value will vary so that you may have a gain or a loss when you sell shares. Returns less than one year are cumulative; all others are annualized. On Oct. 31, 1997, the fund reorganized from a closed-end fund to an open-end fund. Returns through that date are the closed-end fund’s historical performance. Returns since that date are those of the open-end fund. Fees and expenses of the open-end fund differ from those of the closed-end fund. Index source: RIMES Technologies Corp. Had fees not been waived and/or expenses reimbursed in the past, returns would have been lower. Performance shown at NAV does not include the applicable front-end sales charge, which would have reduced the performance. Class Y and R6 shares have no sales charge; therefore performance is at NAV. Class Y shares are available only to certain investors. Class R6 shares are closed to most investors. Please see the prospectus for more details. For more information, including prospectus and factsheet, please visit Invesco.com/GTDDX Not a Deposit Not FDIC Insured Not Guaranteed by the Bank May Lose Value Not Insured by any Federal Government Agency |

Manager perspective and outlook

Despite some volatility during the quarter, global equities ended the period with positive returns. As inflation has cooled, several central banks cut rates, including the much- anticipated US Federal Reserve rate cut.

Emerging market equities performed well, boosted by a quarter-end rally in Chinese stocks, which benefited from the government’s new economic stimulus measures. In contrast, Mexican, South Korean and Turkish equities declined for the quarter. Despite an interest rate cut, Mexican stocks declined amid apparent uncertainty related to recent judicial reforms. The rotation away from technology stocks negatively affected South Korean stocks, while Turkish stocks were weak due to depreciation of its currency.

Interest rate sensitive small-cap stocks performed well due to recent rate cuts, while the energy sector declined along with falling oil prices. As global equities have continued to rise in some regions, we believe it is important to acknowledge potential risks for the remainder of the year, including ongoing geopolitical tensions and elections, which may create market headwinds and may increase volatility. In this environment, we believe equity investors may focus on the type of high quality and traditional investment fundamentals that are central to the fund’s balanced EQV investment philosophy.

Portfolio positioning

|

Top issuers (% of total net assets) |

Fund |

Index |

|

Taiwan Semiconductor Manufacturing Co Ltd (TSM) |

7.63 |

9.02 |

|

Tencent Holdings Ltd (OTCPK:TCEHY) |

3.90 |

4.54 |

|

Richter Gedeon Nyrt (OTCPK:RGEDF) |

3.87 |

0.05 |

|

HDFC Bank Ltd (HDB) |

3.76 |

1.07 |

|

Samsung Electronics Co Ltd (OTCPK:SSNLF) |

3.24 |

3.11 |

|

SBI Life Insurance Co Ltd |

3.24 |

0.12 |

|

Bank Central Asia Tbk PT (OTCPK:PBCRF) |

3.15 |

0.46 |

|

Tongcheng Travel Holdings Ltd (OTCPK:TNGCF) |

3.13 |

0.04 |

|

BDO Unibank Inc (OTCPK:BDOUF) |

3.05 |

0.08 |

|

Bollore SE (OTCPK:BOIVF) |

2.98 |

0.00 |

|

As of 09/30/24. Holdings are subject to change and are not buy/sell recommendations. |

||

During the quarter, we initiated the following positions:

Trip.com (TCOM) is a Chinese online travel agent with brand recognition and a comprehensive product portfolio (hotel, air and entertainment ticketing). The company has benefited from China’s rising travel demand and a structural shift to online booking. Trip’s non-domestic business has also emerged as a key growth driver.

Prio (OTCPK:PTRRY) is a Brazil-based independent oil and gas company known for strong execution and effective mergers and acquisitions. Prio’s main strategy is to acquire mature oil and gas fields (thus avoiding costly exploration risks) and improve operations through cost rationalization and development in order to increase field production and oil recovery rates. An environmental workers’ strike extended the timeframe for obtaining environmental licenses, which delayed Prio’s plan to ramp up production. This delay has led to a stock price decline that in our view created a good entry point for us.

Cyient is an India-based global engineering research and development outsourcing company with specialized expertise in aerospace, communications, utilities and many other industries. The stock has been trading at a discount relative to peers in India, and we believe its valuation is attractive considering its long-term growth prospects and improving margin trend.

Sunresin New Materials is a China-based one-stop shop for resin-based absorption and separation materials and equipment solutions. The stock has been trading at a discount relative to its historical level and compared to peers due to apparent concerns about China’s weak economy, lithium extraction equipment sales and the risk of US/China friction. We think these are short-term headwinds and believe the stock may rise as sentiment improves over time, as earnings have shown resilience.

We sold Kimberly-Clark de Mexico (OTCPK:KCDMY), a paper-based products manufacturer, due to concerns about peaking profit margins, modest long-term growth and the situation in Mexico.

We trimmed MakeMyTrip (MMYT), a dominant, India-based online travel booking services company. India’s travel industry is still in the nascent stage of development with potential multi-decade growth opportunities ahead, and we believe MakeMyTrip will be one of the main beneficiaries. We still like the long-term fundamentals and trimmed the position purely due to valuation.

Performance highlights

|

Top contributors (%) |

||

|

Issuer |

Return |

Contrib. to return |

|

BDO Unibank, Inc. (OTCPK:BDOUF) |

29.64 |

0.98 |

|

Chemical Works of Gedeon Richter Plc (OTCPK:RGEDF) |

18.78 |

0.77 |

|

Tongcheng Travel Holdings Limited. (OTCPK:TNGCF) |

28.96 |

0.73 |

|

Tencent Holdings Limited (OTCPK:TCEHY) |

20.00 |

0.71 |

|

Bangkok Dusit Medical Services Public Company Limited (OTCPK:BDUUF) |

29.30 |

0.69 |

|

Top detractors (%) |

||

|

Issuer |

Return |

Contrib. to return |

|

Samsung Electronics Co., Ltd. (OTCPK:SSNLF) |

-20.15 |

-0.91 |

|

MediaTek Inc. (OTCPK:MDTTF) |

-12.05 |

-0.42 |

|

Wal-Mart de Mexico, S.A.B. de C.V. (OTCQX:WMMVY) |

-11.36 |

-0.22 |

|

Airtac International Group |

-3.39 |

-0.13 |

|

LEENO Industrial Inc |

-15.34 |

-0.13 |

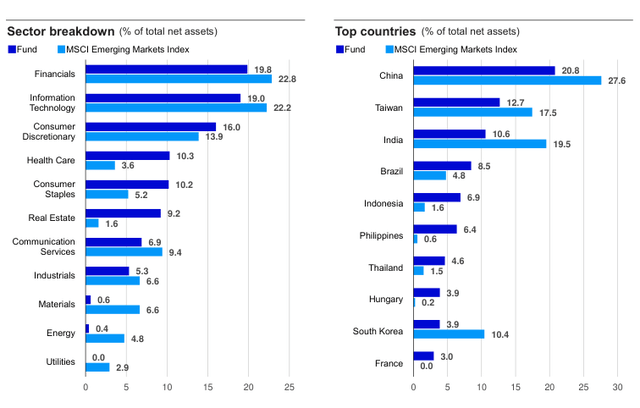

The fund’s health care holdings outperformed those of the benchmark index, adding to relative return. An overweight in the sector also added to relative results. Stock selection in financials and real estate added to relative performance, as did an overweight in real estate. Geographically, fund holdings in the Philippines, Thailand and Hungary outperformed those of the benchmark index, adding to relative return. Overweights in the Philippines and Thailand were beneficial as well.

Conversely, stock selection in consumer discretionary and information technology had the largest negative effect on relative results. Geographically, an underweight in China detracted from relative performance, as did stock selection and an overweight in Mexico. Given the rising equity market, the fund’s cash position (which averaged 3.8%) hampered relative results.

Contributors to performance

Below are the largest contributors to absolute return for the quarter:

BDO Unibank (BDO) is a large Philippine bank. BDO reported robust results driven by accelerating loan growth, stable asset quality and fee growth. We trimmed the fund’s position due to valuation and to control position size.

Gedeon Richter is a Hungary-based pharmaceutical company that has done well due to the success of Vraylar, an atypical anti-psychotic. Sold by AbbVie in the US, Vraylar provides Richter with US dollar- denominated, high margin royalty revenue. Richter’s first half results showed double-digit revenue growth across its important biopharma and women’s health care divisions, which, in our view, demonstrates that Richter has multiple growth businesses to stand on.

Tongcheng Travel is an online travel agency in China that focuses on domestic and lower tier cities.

Detractors from performance

Below are the largest detractors from absolute return for the quarter:

Samsung Electronics is a global leader in memory semiconductors, smartphones, electronic displays and other products. The market appeared to react negatively to product entry delays for Samsung’s high bandwidth memory chips (HBM3E) that prevented delivery to a major potential customer, allowing a key competitor to gain share. Additionally, the price outlook for memory semiconductors in PC and smartphones has weakened.

MediaTek is a Taiwan-based fabless semiconductor company that designs and manufactures a range of semiconductor products, providing chips for wireless communications and various products.

Walmart de Mexico is a leading retailer with stores spanning Mexico and Central America. The stock was affected by the decline of Mexican equities during the quarter.

Read the full article here