Dear partners,

The Fund had an exceptional performance last year – helped in no small part by benign global markets.

Let us be mindful that the stock market behavior is not synchronous with the underlying companies financial results: the operating progress of most of our portfolio came probably shy of the increase in their share prices. Their Annual Results are expected to be released in March, when more details will be provided.

While we are certainly pleased with 2024’s results, such years come far and between. It may be a while until it is repeated, so temper your expectations.

|

Annual |

ACWI |

SPY |

|

|

2020 (Dec) |

3.7% |

3.4% |

3.3% |

|

2021 |

23.2% |

16.6% |

27.0% |

|

2022 |

-17.1% |

-19.8% |

-19.5% |

|

2023 |

8.6% |

19.9% |

24.3% |

|

2024 |

35.8% |

15.5% |

23.3% |

|

Accumulated |

56.2% |

34.5% |

61.9% |

|

Annualized |

11.5% |

7.5% |

12.5% |

|

ACWI and SPY are ETFs that track the performance of the MSCI All-Country World and the S&P 500 indexes, respectively. As a reminder, the ETFs shown in the table above are not benchmarks. The Fund at the moment has no position in any of their constituents. Its NAV (Net Asset Value) is calculated after all fees and expenses. |

Throughout the year, most of the Fund’s assets were concentrated in our core positions: Tianjin Development (OTCPK:TJSCF), First Pacific (OTCPK:FPAFY), Sanjiang Chemicals (OTCPK:CNSJF), Halyk Bank and Compagnie de l’Odet (OTCPK:FCODF). There is no point in discussing their recent financial developments right now; it makes much more sense to wait a couple of months in order to have updated information. In any case, we can be confident that Sanjiang Chemicals, First Pacific and Halyk Bank had from good to excellent years.

Therefore, similarly to the First Letter of 2024, this is a fairly short Letter. Its purpose is to inform that:

- Last year was good;

- Prospects remain as good as ever;

- There is nothing really new to report in terms of positions.

A brief note on Compagnie de l’Odet

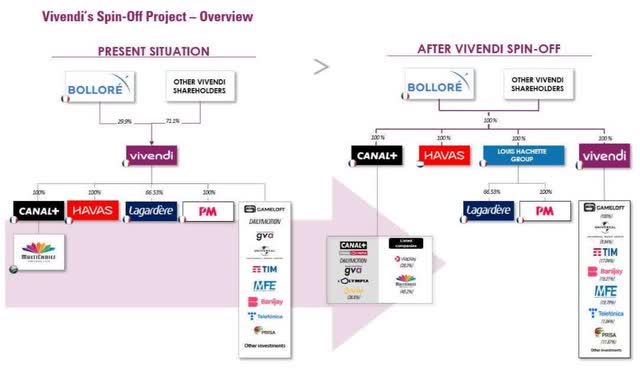

During the Fund’s Annual Event in December, I mentioned en passant that Vivendi (VVVNF, a company controlled by Bolloré SE (OTCPK:BOIVF), which in its turn is controlled by Compagnie de l’Odet, one of our positions) was in the process of splitting into four independent listed entities. It was successfully completed by the end of 2024.

Now, in addition to a huge pile of cash (result of the sale of its logistics assets), Bolloré has significant stakes in five listed companies:

- Universal Music Group (OTCPK:UMGNF, which dwarfs the remaining ones);

- Canal+ (which in its turn controls Multichoice in South Africa);

- Havas (OTC:HAVSF);

- Louis Hachette Group (which in its turn controls Lagardère);

- the remaining Vivendi (whose main asset is a 10% stake in UMG, among a myriad of smaller participations).

Some market participants expected a re-rating as a consequence of the split – Vivendi had for a long time traded at a significant discount to the sum-of-its-parts – but at least until now, it did not happen. In fact, the totality of the newly listed companies are trading at a lower level than before the spin-offs.

In the past five years, Vincent Bolloré has 1) sold 30% of UMG to Tencent and Pershing Square; 2) IPOed UMG; 3) sold Bolloré Africa Logistics; 4) sold the remaining Bolloré Logistics assets; 4) acquired control of Multichoice: 5) acquired control of Lagardère; 6) split Vivendi in 4 listed assets. All multi billion euro deals.

It seems reasonable to expect that the extremely high liquidity of Bolloré Group – more than € 6 billion in net cash – will be put into good use, either taking advantage of mispriced assets the Group already controls, or into new ventures.

We do know that buybacks at the Bolloré SE level happen almost every week. To be seen.

Best regards,

Diego B. Milano

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here