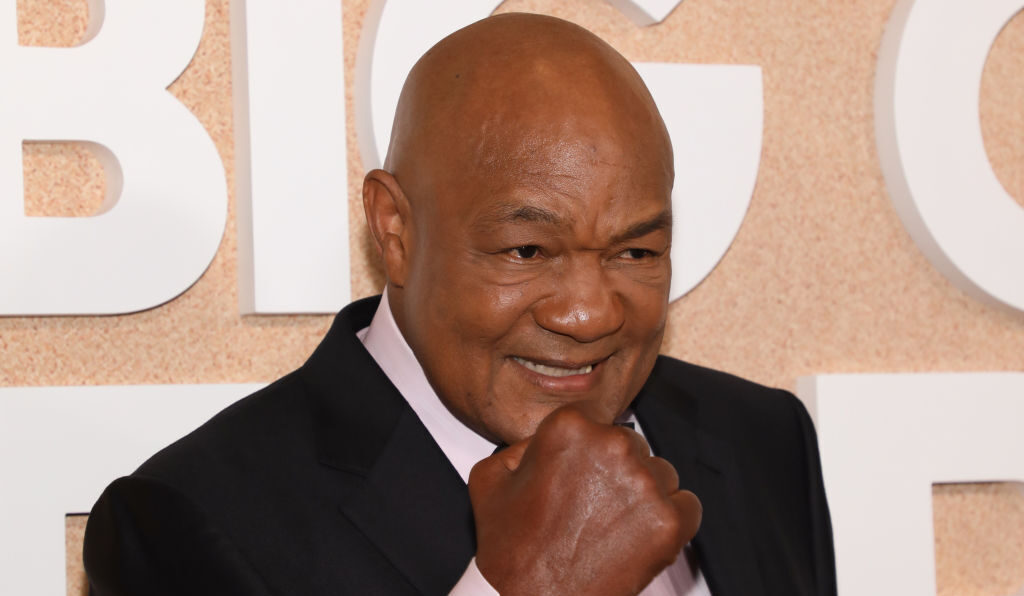

When George Foreman stepped into the boardroom of Salton Inc. in the early 1990s, he wasn’t just another celebrity looking for an endorsement deal. The former heavyweight champion was about to make a decision that would revolutionize the celebrity business model and generate hundreds of millions in revenue.

Doing The Deal

In a resurfaced video from a 2023 episode of “I Am Athlete,” he broke down why he decided to invest in this own brand, versus lending his celebrity to others.

“I’d become the darling of Madison Avenue,” Foreman revealed in the “I Am Athlete” interview, reflecting on his journey from ring icon to retail mogul.

His portfolio already boasted blue-chip clients like Doritos, Pepsi, and McDonald’s. But it was a conversation with a trusted adviser that sparked a paradigm shift in his business strategy.

Instead of accepting another standard endorsement contract, Foreman negotiated for significant equity in what would become the George Foreman Grill after a friend encouraged him to step out on his own.

The person pulled his coat and allegedly said to him, “George you’re making all these other people rich. why don’t you get your own product.”

He took the challenge on bravely.

“I wasn’t afraid to take on a joint venture where I’m the partner. I’d have to sell, I’d have to bear the expense,” he explained, outlining a risk-reward proposition that was virtually unheard of in celebrity endorsements at the time.

The initial product testing came from an unlikely source – his own kitchen. Despite early skepticism about what he called “this little ugly thing,” his wife’s enthusiastic feedback about the grill’s effectiveness proved pivotal.

He then said, “My wife uses it. She said, ‘It really works, George.’ I said, ‘Yeah, but take the grease out the food’s gonna be all dry.’ She said, ‘No, I tried it.’”

This grassroots validation from his fifth wife, Mary Joan Martelly, would foreshadow the product’s mass-market appeal.

The numbers tell the story: sales of the product that launched in 1994 soared to 120 million units, transforming a simple kitchen appliance into a global phenomenon.

But Foreman’s success wasn’t just luck – it was based on data-driven confidence from his previous endorsement track record and lessons learned when financial advisers stole from him, where he had consistently driven significant sales increases for major brands.

It paid off in a seven-figure royalty check in 1997.

“That was one of the happiest days of my business life,” Foreman said to CNBC.

He added, “I lost my last professional boxing match, I’d received a check for $1 million for the grill.”

The heavyweight champion turned entrepreneur draws an intriguing parallel to talent acquisition in sports, “People sign a 19-year-old boy, give them money because they see there’s future there for them to become wealthy.”

Oftentimes, young and successful athletes like Coach Deion “Prime” Sanders’ son, Shedeur Sanders, are pegged to endorse products through NIL deals but don’t get offered equity.

When Foreman’s company bought him out in 1999 for approximately $138 million, he reaped the benefits of betting on himself.

Over 30 years ago, the champ determined to follow a model where an athlete becomes the businessman and directly benefits from his image and likeness by owning the product or shares in the product, very similar to how Shaquille O’Neal has set up his business portfolio.

This insight crystallizes what might be called the Foreman Principle: If others can identify and bet on your potential, you should be capable of doing the same.

Foreman’s approach challenged conventional wisdom about market saturation.

“You may see Ford, Chevrolet— still room for someone else to do something equally as big. You just gotta work,” he notes, articulating a philosophy that resonates with modern startup culture.

The success of the George Foreman Grill, which would eventually contribute to Foreman’s estimated $200 million net worth, represents more than just a successful product launch. It marks a watershed moment in celebrity business ventures, proving that equity participation could yield returns far exceeding traditional endorsement fees.

Foreman message to aspiring business owners remains refreshingly direct: “There’s nothing frightening about starting your own.”

The George Foreman Grill case study continues to influence business strategy discussions, demonstrating how personal brand equity, when properly leveraged, can transform into substantial business value.

In an era of increasing celebrity entrepreneurship, Foreman’s pioneering move from pitchman to partner serves as a masterclass in strategic risk-taking and value creation.