Dear Partners,

Atai Capital delivered a positive return of 6.5% in the third quarter net of all fees. This compares to a 5.9% total return for the S&P 500 (SP500, SPX) , a 9.3% total return for the Russell 2000, and an 8.3% total return for the Russell Microcap.

|

Atai Capital |

Russell Micro |

Russell 2000 |

S&P 500 |

|

|

Q3-2024 |

6.5% |

8.3% |

9.3% |

5.9% |

|

YTD |

4.4% |

7.4% |

11.2% |

22.1% |

|

Since Inception |

24.5% |

17.4% |

30.0% |

54.2% |

|

Annualized |

13.4% |

9.6% |

16.2% |

28.2% |

Portfolio Commentary

Early in the quarter, we initiated a new position in Haivision (OTCPK:HAIVF), which we’ll discuss in the next section of this letter. After the quarter, we made trims to our holdings in Bel Fuse (BELFB) and Turning Point Brands (TPB) but continue to hold both.

As of writing, ~50% of our portfolio consists of businesses with market caps smaller than $250M, and our top five positions make up ~54% of our portfolio.

Haivision Systems Inc. (“TSX: HAI”):

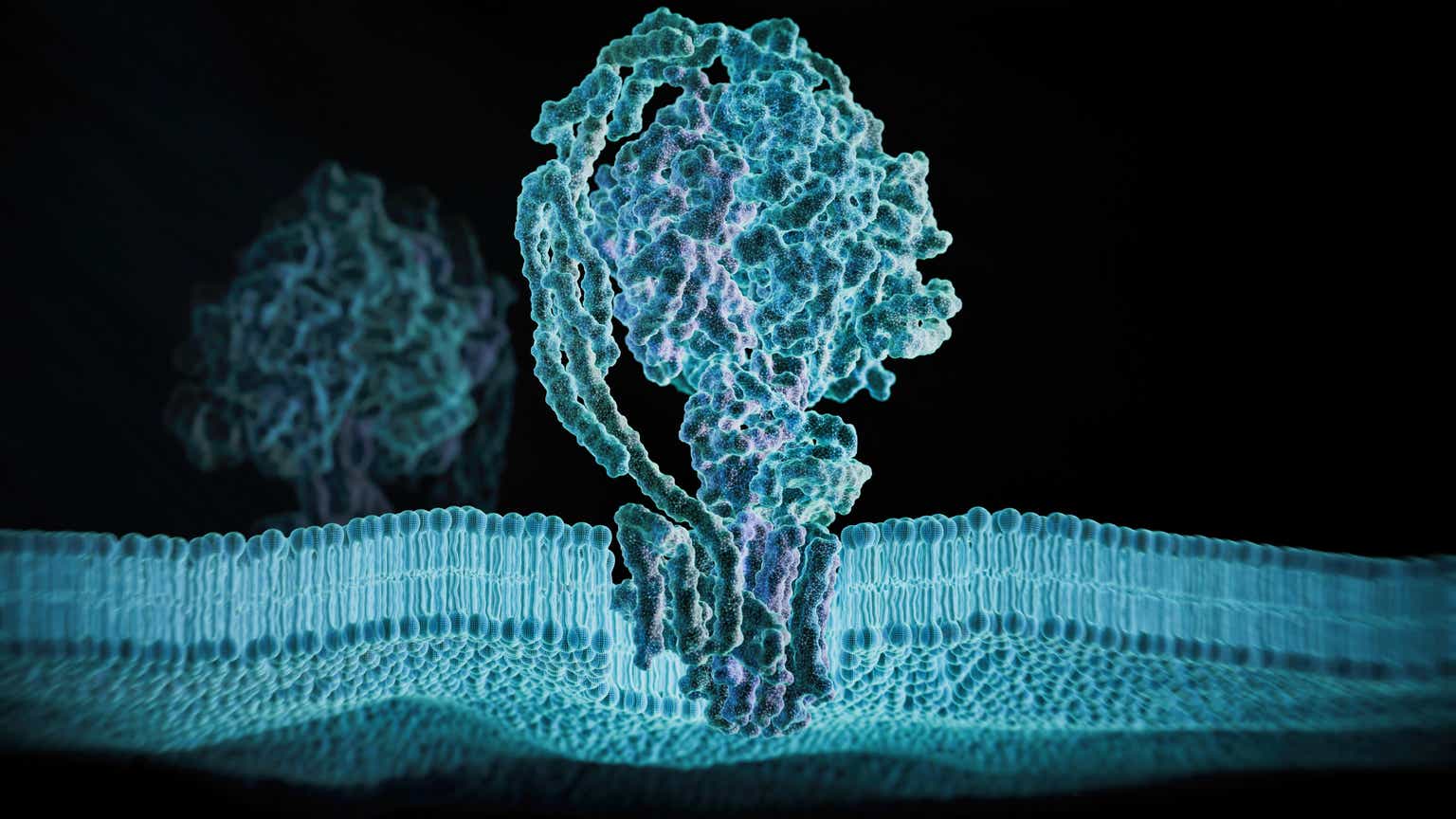

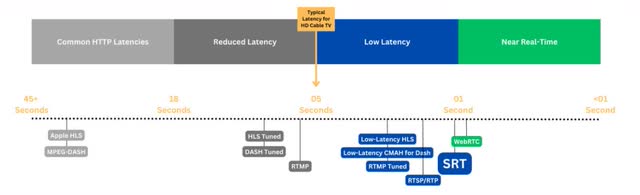

Haivision offers infrastructure solutions for the video networking and streaming market, serving broadcasters, enterprises, and governments worldwide. Most of their revenue is derived from hardware-based products like video encoders, decoders, transcoders, and transmitters (~80% of revenue). Put simply, these products compress and transmit video signals into readable digital outputs. The products do this through the SRT (Secure Reliable Transport) protocol, which Haivision invented in 2013 and later open-sourced in 2017. Since SRT’s open-sourcing, it has become one of the most widely adopted video transport protocols, continually taking share from the largest legacy protocol – RTMP (Invented in 2002 with its last official update in 2012).

Haivision invented SRT to transition their business toward video transmission over the Internet protocol (‘IP’) instead of satellite, cable, and purpose-built dedicated fiber networks. Around that same time (2013), and some time afterward, other protocols were also being invented and fighting for share. However, in 2017, Haivision decided to open-source their code, hoping to see increased adoption and faster development. That plan has proven very successful, with competitors now offering SRT in their own Encoders and several giants joining the SRT Alliance, a consortium of companies committed to the widespread adoption of the SRT protocol. Notable members of the SRT Alliance include YouTube, Microsoft (MSFT), and Sony (SONY), all of whom have recognized the value of SRT. Despite SRT now being open source, Haivision still benefits from being at the forefront of this technology, leading the SRT Alliance, being closer to the tech than anyone else, and having immediate access to newer builds.

While there are protocols that outperform SRT in some respects, they almost always lack in other vital areas. For example, while a protocol like WebRTC may be marginally faster, it falls short of the quality and reliability that SRT delivers. Moreover, the higher implementation costs of WebRTC limit its applicability to niche applications.

As mentioned, there is an ongoing transition from legacy protocols like RTMP to modern IP-based protocols like SRT, and Haivision is poised to capitalize on this shift. For example, when organizations such as local news stations or sports arenas upgrade their video equipment (cameras, encoders, etc.), they are increasingly opting for modern IP-based transmission protocols over outdated solutions. And with SRT frequently chosen as the protocol of choice, there is a growing need for SRT-compatible products. This transition away from legacy systems is expected to intensify over the next 3-5 years, offering growth opportunities for Haivision.

Our research shows that Haivision produces high-quality and reliable products, such as their Makito encoder, which is considered the industry standard. The brand has an incredibly strong reputation, with almost all video engineers and customers saying things like, “If you can afford Haivision, you go Haivision.” – I am paraphrasing, but we heard this point reiterated by several industry experts we spoke with, and a quick Google search will also show that this same viewpoint is shared on several forums and websites. Further supporting this idea are Haivision’s high gross margins of 70%+ (despite being primarily a hardware-based business). These high gross margins have persisted for over a decade, and Haivision was also able to pass on a ~10% price increase in 2022, offsetting inflation and supply-chain-related costs. They outsource the manufacturing of their products to select contract manufacturers in the U.S., Canada, and France, making the business incredibly capital-light (they have essentially zero capex).

Wait, did you say broadcasters? As In local news stations? As in terminal risk?

While any business with broadcasting exposure would generally be a cause for concern, in Haivision’s case, I am not worried. Broadcasting (They classify it as “Media & Entertainment”) makes up only a third of Haivision’s business and consists primarily of live sports, which is growing, not shrinking like legacy news stations.

It’s important to clarify that Haivision focuses specifically on “mission critical” live video streams where latency, quality, and reliability are of the utmost importance. Here is a link if you’d like to read about how the NFL used SRT alongside Haivision encoders, decoders, and gateways to enable the virtual 2020 NFL draft (which had 600+ simultaneous live streams). Additionally, we think it’s safe to say that live sports will use more cameras in the future, not less; thus, more Haivision products will also be needed.

Haivision has two other segments that account for roughly a third each of their business. The first is Government & Defense, which includes customers like NASA, the U.S. Department of Defense, the U.S. Navy, and the Japanese Maritime Self-Defense Force.

This segment is a focus area for Haivision, which was recently awarded a large defense contract with the U.S. Navy in September, amounting to CAD 82M over five years (Haivision’s enterprise value is CAD 137M today). This contract is expected to ramp up in the back half of FY-2025 with a steady run rate starting in FY-2026.

The last segment is Enterprise, which includes customers like META (Facebook), the New York Stock Exchange, and Microsoft. Here is a case study of Microsoft using SRT in conjunction with Haivision Makito encoders and Haivision’s media platform to stream their annual Inspire conference.

Haivision products are also used in control rooms, where Haivision provides Video Wall Solutions utilizing their Command 360 Software and related hardware (video processors, encoders, decoders, access points, etc.), which enable low-latency video feeds for critical operations. Here is a case study where Haivision helped the Cleveland Department of Public Safety upgrade their video wall solution for monitoring major public events (both planned and unplanned) like the Cleveland marathon and the 2022 NBA all-star game.

Control rooms present a significant growth opportunity for Haivision, and they are in the process of shifting their existing integrator business to a channel partner model. Previously, CineMassive (acquired in 2021) operated as a full-service solutions provider, managing tasks like planning, installation, and selling several lower-margin third-party products (chairs, monitors, etc.). The new strategy, however, has Haivision providing their software and hardware to channel partners instead, leaving the execution—planning, installation, and more—in their hands. This model will have higher margins, stronger returns on capital, and much faster scalability. However, the transition has temporarily impacted topline revenue as the company sheds the previously mentioned lower-margin revenue streams and prepares for a full roll-out in 2025.

Outside of selling hardware, the rest of their revenue comes from service/maintenance contracts and their software offerings (~20% of revenue, but a focus for the company as they want to increase high-margin recurring revenue streams). An example of their software offering would be their Haivision SRT Gateway-> Basically, the signal from a camera at a football game goes into an encoder, gets decoded at, say, ESPN’s HQ, and the software/server can then format the video, and change the protocol as needed for delivery. For instance, websites like Twitch still only accept RTMP, so while SRT is superior, you need to convert it to RTMP to stream on Twitch. As a side note, YouTube recently joined the SRT alliance and plans on adopting the protocol for their livestreaming platform, which only accepts RTMP, HLS, and DASH today. The latter two, while offering higher-quality video than RTMP, come at the cost of high latency; SRT, on the other hand, provides the same high-quality video without sacrificing latency.

Haivision was founded by CEO Mirko Wicha in 2004, and before their IPO, he grew revenues at a 22.7% CAGR for 16 years to $80M+ while being entirely self-funded off an initial investment of $8M. Prior to founding Haivision, Mirko worked at Silicon Graphics in a sales capacity, where he helped grow the business from $86M in revenue to $1B+ in five years. After Silicon Graphics, Mirko went to work for Alias Research and was tasked with turning around their unprofitable European business – the company would be sold two years later to his former employer, Silicon Graphics. Mirko was interviewed in 2013, covering his background, how Haivision was founded, and the importance of company culture.

Mirko owns 13.5% of the company, with insiders owning 31% in total; he bought an additional ~$200k worth in the open market earlier this year, and his ownership is worth CAD 20M, representing ~20x his cash comp and ~10x his total comp. From my conversations with him and review of his past he appears to say and do the right things. I believe he has made several wise decisions over the years, including the creation and open-sourcing of SRT, walking away from lower margin/ROIC business, and the two post-IPO acquisitions are likely to prove significantly accretive. During his tenure, he has also successfully integrated eight acquisitions, which should help limit the possibility of poor outcomes from further M&A.

Haivision has guided to $134-$136M in revenue for FY-2024 (ended in October) after two prior topline guidance cuts with EBITDA margins in the mid-teens. The top-line cuts are mostly related to a much faster-than-expected transition of their control room business to the channel partner model. They have a long-term 20% EBITDA margin target and expect to be “knocking on the door” of that target this year.

Based on their guidance, we can infer that FY-Q4 revenues will likely fall between $35M and $37M, with EBITDA margins of 16-19%. Operating expenses have fallen significantly over the past two years and have remained stable over the past four quarters. The sequential margin decline in the recent quarter is entirely attributable to operating deleverage, and we believe Haivision, once scaled, can have EBITDA margins north of 20%.

As of writing, at $5.00/share, Haivision has a market cap of $145M, $13.9M in cash, and $6.2M in debt, so an EV of $137M. Their 2024 guide implies ~$21M in EBITDA and ~$13.5M in fully loaded UFCF (after leases, SBC, and capex), translating to a 6.5x EBITDA multiple and 10x EV/UFCF.

Haivision expects to return to growth in 2025 and has guided to $140M+ in revenue. This growth will come from industry-wide growth, their pivot away from being an integrator to a solutions provider, their new long-term rental business (infancy stage, but grew 76% y/y), the continued growth of their 5G transmitter business, and the aforementioned CAD 82M U.S. Navy contract. Another exciting growth opportunity is a consortium with Airbus to help develop new technologies for rapid and secure communications (private 5G networks, etc.). All these initiatives set up FY2026 and beyond to see double-digit growth per the company’s guidance.

If they can grow at HSD in 2026 with 18% EBITDA margins, this would result in ~$27M of EBITDA and around ~$18M in fully loaded UFCF, implying the business is trading at less than 5x EBITDA and 7.5x EV/UFCF before any credit for cash generation. These multiples are far too low for a business that should grow at attractive rates for the foreseeable future, has gross margins of 70%+, and should have EBITDA margins north of 20% with scale.

Haivision has also been transitioning towards higher profitability over the past two years as they work to integrate their two post-IPO acquisitions further, wind down their low-margin house of worship business, and pivot their control room business to a channel partner model. These initiatives have led to permanent headcount reductions and a lower fixed-cost base. However, they have also obfuscated Haivision’s organic growth (which we estimate to be HSD) as they have shed non-significant amounts of lower-margin revenue. We believe that as Haivision scales and margins expand, the market will begin to notice this small but high-quality business.

Giving credit for cash generation (the company has been actively repurchasing shares since June) and applying a 10x EBITDA multiple (15x UFCF) on 2026 numbers gets me to $11.00/share, compared to just $5.00 today.

Conclusion

As in previous years, I’ll be attending the Three-Part Advisors Southwest Ideas Conference in Dallas to meet with some of our portfolio companies and explore additional opportunities.

Although portfolio adjustments over the past few months have increased our cash position more than I’d prefer, I’m actively researching new ideas and remain optimistic about our portfolio’s prospective returns.

As a reminder, we are open to new clients, and if you know someone who might be a good fit, please feel free to pass along my contact information.

As always, I am humbled by and grateful for the opportunity to invest your capital alongside my own, and I will continue to make every effort to compound that capital at attractive rates.

Cordially,

Brandon Daniel | Founder & Portfolio Manager Atai Capital Management, LLC | [email protected]

“If anyone can refute me, show me I’m making a mistake or looking at things from the wrong perspective, I’ll gladly change. It’s the truth I’m after, and the truth never harmed anyone. What harms us is to persist in self-deceit and ignorance” – Marcus Aurelius

|

Disclaimer: This letter expresses the views of the author as of the date cited, and such views are subject to change at any time without notice. The information contained in this letter should not be construed as investment advice, and Atai Capital Management, LLC (“Atai Capital”) has no duty or obligation to update the information contained herein. This letter may also contain information derived from independent third-party sources. Atai Capital believes that the sources from which such information is derived are reliable; however, Atai Capital does not and cannot guarantee the accuracy of such information. References to stocks, securities, or investments in this letter should not be considered investment recommendations or financial advice of any sort. Any return amounts that are reported within this letter are estimated by Atai Capital on an unaudited basis and are subject to revision. Atai Capital’s returns are calculated net of a 2.00% annual management fee and reflect a client’s performance who would have joined the firm on its inception date (01/03/2023). Actual Individual investor returns will vary based on the timing of their initial investment, the impacts of additions and withdrawals from their account, and their individually negotiated fee structure. Atai Capital believes showing returns net of a 2.00% management fee better reflects actual performance as of 11/19/2024 since no account that Atai Capital currently manages is charged a fee more than the stated 2.00% management fee. Past performance is no guarantee of future results. Index returns referenced in this letter include the S&P500, Russell Microcap, and Russell 2000. Atai Capital’s returns are likely to differ from those of any referenced index. These returns are calculated from the respective provider’s websites, Essential Intelligence for the S&P500 and ftserussell.com for the Russell Microcap and Russell 2000, and include the reinvestment of all dividends in both cases. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here