Donald Trump’s win and a surge in interest in US digital asset funds and derivatives contracts have caused the crypto market’s attention to revert to the US in anticipation of easing regulations in 2025.

The success of US Bitcoin exchange-traded funds (ETFs) at the onset of 2024 ignited a rush in activity, while Trump’s commitment to position America as the epicentre of the crypto sector further intensified the momentum.

The ETFs clearly indicate a broader adoption of cryptos by long-term investors.

Still, With a long list of campaign pledges to keep, the president-elect’s pledge to retain all remaining Bitcoin “made in the USA” could be tricky, according to some naysayers.

Following a June meeting with leaders from cryptocurrency mining companies at Mar-a-Lago, Trump made the commitment in a post on his Truth Social account.

Miners are enterprises utilising extensive, sophisticated data centres to facilitate blockchain transactions in exchange for a fee in Bitcoin or other cryptocurrencies.

Trump transitioned from a cryptocurrency sceptic to a fervent sector advocate during this meeting.

Some observers say that due to the decentralised nature of blockchains, no single entity governs them, and any individual can be excluded from participation; hence, although it is sometimes regarded as a symbolic commitment, it is practically unfeasible.

The industry earns billions of dollars in revenue each year, and as large enterprises emerge worldwide, competition intensifies in the sector.

Examples of emerging competitors include Chinese traders in Africa, royal families in Dubai, and Russian oligarchs.

Their access to substantial power and considerable capital incentivises their involvement in the energy-intensive yet profitable process.

Although the stringent manufacturing cap will not be attained for another century, nearly all 21 million Bitcoins that will ever exist have already been extracted.

As Bitcoin’s value has skyrocketed in the past few years, the mining industry in the United States has grown into a multi-billion dollar industry.

Experts in the field have determined that domestic companies cannot sustainably power the entire network because the amount of computing power generated by miners in the US is far below 50%.

Despite the lack of official statistics, prominent crypto-mining service providers like Luxor usually have a good idea of the mix of the processing power coming from different parts of the world.

Their software aggregates computing resources and offers extensive information on mining locations to increase the possibility of miners getting Bitcoin rewards.

US mining companies like CleanSpark and Riot Platforms were among the first to back Trump in the hopes that the former president would relax regulations regarding the high-energy use process’s environmental impact, limit foreign competition, and reverse what they see as restrictive policies enacted by the Biden administration.

At $135 million, the cryptocurrency industry gave more to Trump’s campaign than any other sector in the previous election cycle.

Following the government’s comprehensive prohibition on Bitcoin mining operations in 2021, large sales in Asia suggest that Bitcoin mining activities in China are on the rise.

Kulyk claims that the cryptocurrency industry is experiencing a renaissance in Russia due to the country’s softening attitude toward the sector.

Due to US economic sanctions and severe inflation in certain developing nations, international miners have increased their operations despite the fast growth in the US and the most recent bull run in the cryptocurrency market.

Still, the US Bitcoin ETFs overtaking the Canadian market – the first country to approve crypto ETFs – shows the growing influence of the US as a crypto epicentre.

Thus, the United States has become an increasingly important hub for the liquidity and benchmark pricing of digital assets, even if Asia seemed to have reaped the most benefits from the crypto crackdown enacted by the Biden administration, which Trump is now rolling back.

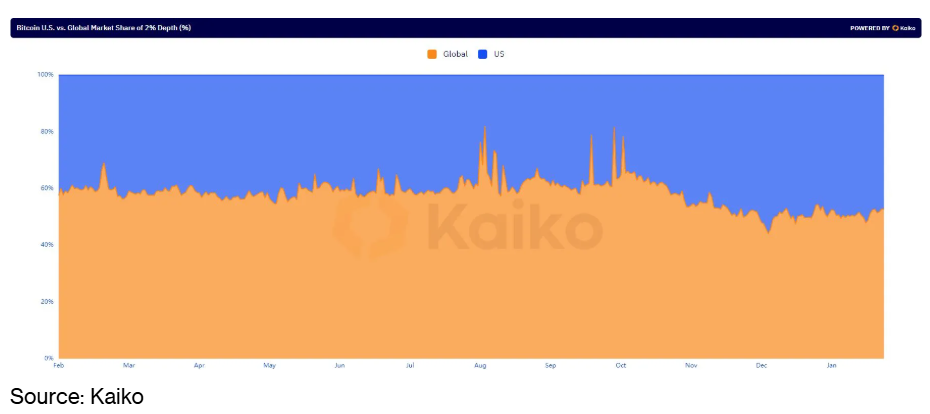

There is a clear trading shift, with Bitcoin-dollar trades becoming more concentrated during the US hours.

Compared to 2021, when data from Kaiko shows that 40% of daily Bitcoin trading in dollars during US hours, the share during US hours now is approximately 53%.

The growing interest in crypto funds is dominating the headlines, with liquidity in this sector and its dominance as a leading asset class expected to surge next year.

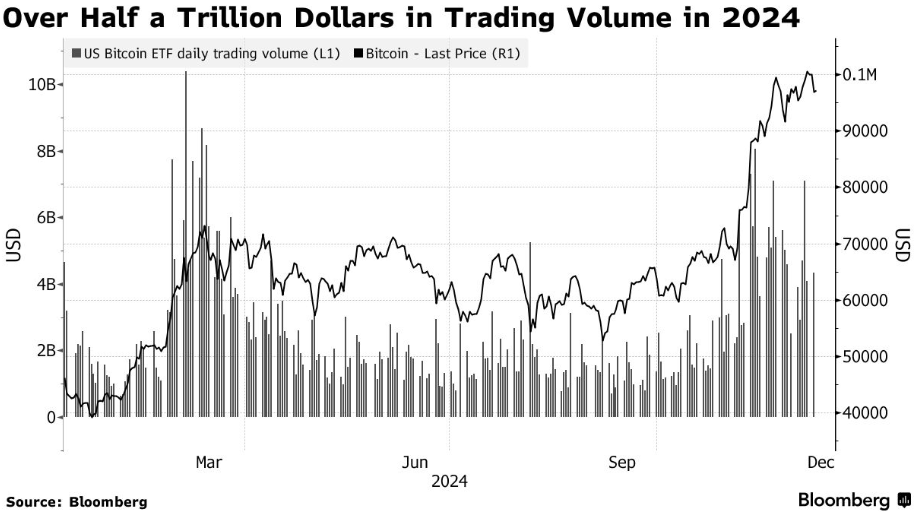

Since its inception in January, US Bitcoin ETFs have had net inflows of over $36 billion and a total daily trading volume above $500 billion.

The iShares Bitcoin Trust, provided by BlackRock, ranks among history’s most successful fund launches.

US cryptocurrency ETF offerings are limited to Bitcoin and Ether; however, this is anticipated to evolve under Trump’s administration.

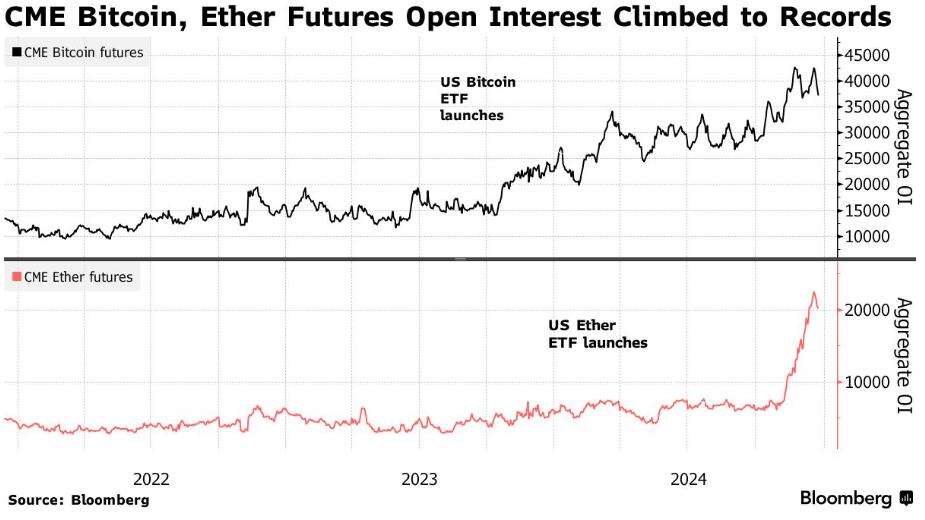

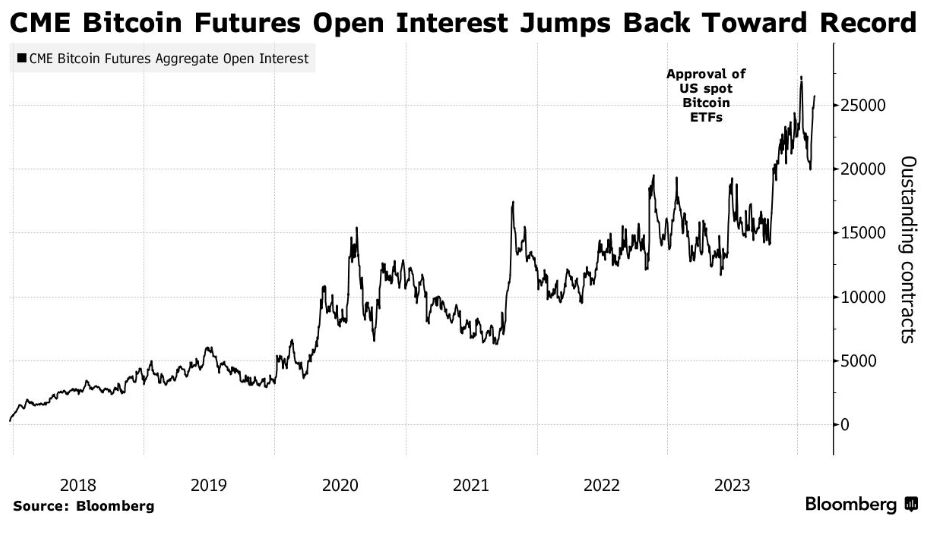

Earlier this year, the Chicago-based CME Group reached record highs for open interest, also known as outstanding contracts, for Bitcoin and Ether futures.

After being overtaken by the offshore platform Binance Holdings, the CME is now the leader in Bitcoin futures open interest.

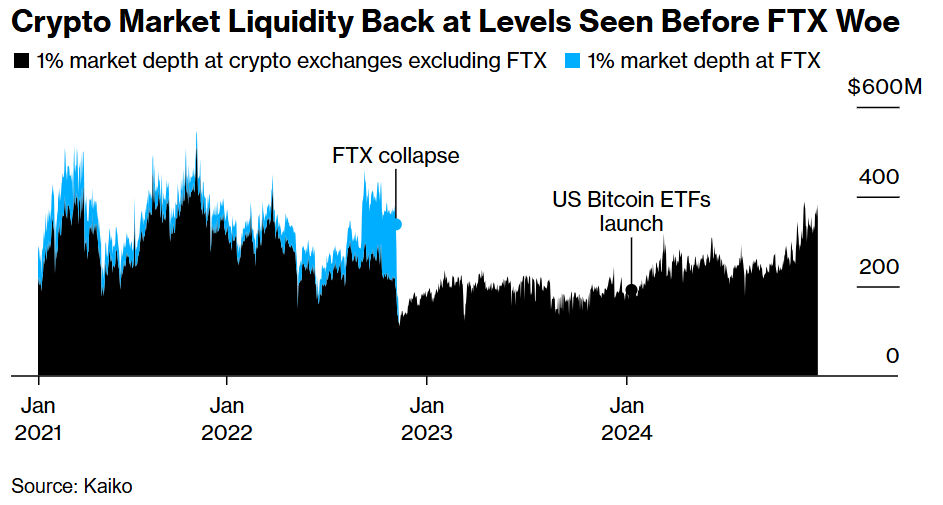

The liquidity situation was severely impacted in 2022 when the FTX exchange and sister hedge fund Alameda Research went bankrupt.

US ETFs and the optimism stoked by Trump have contributed to the turnaround.

According to Kaiko data, the crypto market depth has returned to levels recorded before the FTX crisis, effectively closing the so-called Alameda gap.

This means the market can handle reasonably big orders without excessively affecting prices.

A shift in liquidity is due to the nation’s ETFs for the largest digital asset, facilitating the trading of Bitcoin on US crypto exchanges relative to international platforms.

Research firm Kaiko discovered that, on average, over 50% of all bids and offers within 2% of Bitcoin’s mid-price this year—coinciding with the launch of US spot ETFs—occurred on US trading platforms.

In 2023, the predominant portion of Bitcoin market depth originated from platforms located outside the United States.

An increase in bids and asks within 2% of the mid-price is necessary to enhance liquidity and facilitate order execution without significantly disturbing prices.

Certain analysts perceive spot Bitcoin ETFs as a pivotal moment, contending they will enhance cryptocurrency usage.

Optimists anticipate a resurgence in digital-asset trading volumes following the diminished levels resulting from the collapse of the FTX exchange and its affiliated hedge fund, Alameda Research, during the bad market of 2022.

It is already clear that the ETFs have an impact.

According to Dessislava Aubert, a senior analyst at Kaiko, 57% of Bitcoin trades versus the US dollar happens during US market hours now, up from 48% a year ago.

Blockcast

In this episode, host Takatoshi Shibayama speaks to Kain Warwick, founder of Infinex, and a renowned figure in the DeFi space, known for his work on the Synthetix protocol.

Warwick argues that the current crypto landscape, dominated by centralized exchanges, is unsustainable and hinders innovation. He outlines Infinex’s vision to create a decentralized platform that rivals the convenience and accessibility of centralized exchanges while offering superior functionality and empowering users with true self-custody.

Blockcast 51 | The Next Wave of DeFi with Infinex’s Kain Warwick

Kain Warwick, Infinex’s founder and core working group lead, and founder of Synthetix protocol discusses the incoming “post-CEX” era in the industry.

Previous episodes of Blockcast can be found on Podpage, with guests like Peter Hui (Moongate), Luca Prosperi (M^0), Charles Hoskinson (Cardano), Aneirin Flynn (Failsafe), and Yat Siu (Animoca Brands) on our most recent shows.

Events

Consensus (Hong Kong, 18-20 February)

Consensus is heading to Hong Kong, bringing together the industry’s most important voices from East and West for pivotal conversations and deal-making opportunities.

Consensus Hong Kong convenes global leaders in tech and finance to debate pressing issues, announce key developments and deals, and share their visions for the future.

Use promo code BLOCKDESK20 at checkout for a 20% discount on tickets here.

It’s All Happening on LinkedIn

Did you know you can now receive Blockhead’s juicy daily newsletters directly to your LinkedIn? Subscribe to our LinkedIn newsletters for the latest news and insights in the world of Web3. There also might be the occasional discount code for the industry’s hottest events, exclusively for subscribers!

Subscribe on LinkedIn