By Evan Bauman, Aram Green & Amanda Leithe

Seeding the Portfolio for Future Growth

Market Overview

A market broadening in the fourth quarter sparked by Donald Trump’s election victory and a further interest rate cut from the Federal Reserve proved momentum-driven and short lived. While small cap, value and cyclical shares were bid up in the aftermath of Trump’s win, growth stocks reasserted control by quarter’s end. The Russell Midcap Growth Index jumped 8.14% for the quarter, topping the Russell Midcap Value Index by 989 basis points and the S&P 500 (SP500, SPX) by 573 bps, making it the best-performing area of the market. The benchmark finished up 22.10% for the year.

The ClearBridge Growth Strategy delivered positive absolute returns for the quarter but underperformed the benchmark Russell Mid Cap Growth Index due to stock-specific weakness among a handful of portfolio holdings and having less exposure to some of the higher-beta growth names in the index that outperformed. The team added a number of new positions in the quarter, as a part of our ongoing effort to increase the growth profile and improve the upside capture of the portfolio.

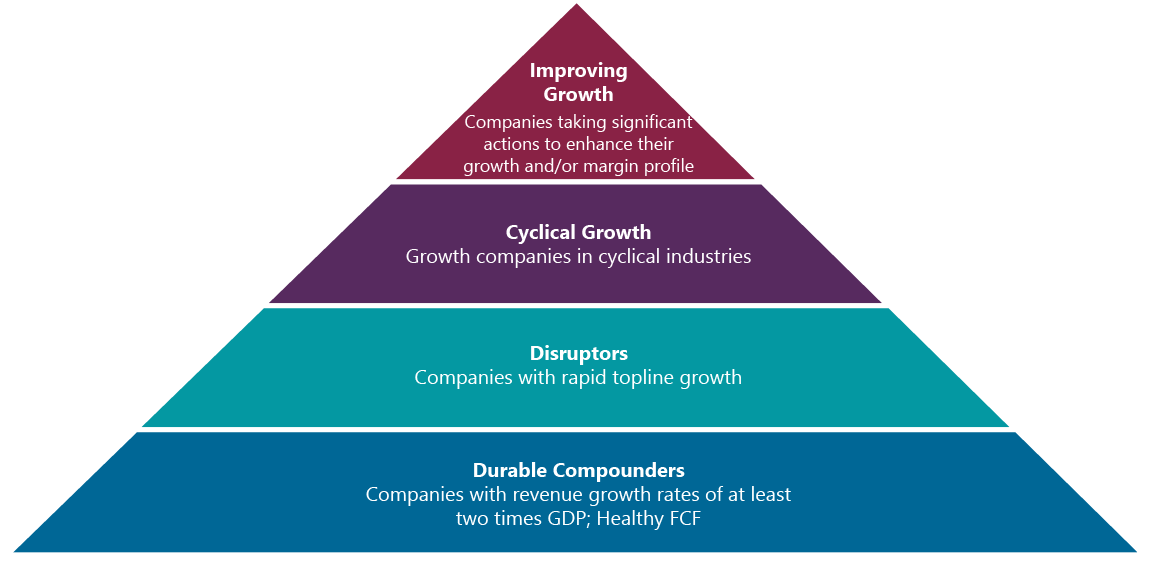

That said, we still believe in maintaining a balanced approach to growth, pairing faster-growing disruptors with more durable compounders generating high levels of free cash flow, cyclical growers and growth franchises undergoing a turnaround. We believe this will optimally position the Strategy for outperformance over time.

Exhibit 1: A Balanced Approach to Growth

Source: ClearBridge Investments.

For the quarter, health care was the largest drag on relative results as larger holdings Vertex Pharmaceuticals (VRTX) and UnitedHealth Group (UNH) suffered losses. Vertex, a biotechnology company known for its cystic fibrosis treatments, was hurt by a setback in clinical trials for its new therapeutic, suzetrigine, in the chronic pain setting. The company is continuing forward for this indication in the hopes that altering the future design of its trial will yield more promising results. Additionally, Vertex hopes to commercially launch the drug for acute pain in the first quarter and is still seeing growth and patent life extension in its cystic fibrosis franchise. The company also has additional pipeline assets, most notably to treat mediated kidney disease and Type 1 diabetes, which gives us confidence in the company’s ability to sustain profitable growth over the long term.

UnitedHealth declined due to a combination of negative investor sentiment and the increasing risk of regulatory scrutiny of its health insurance business following the surprising public reaction to the tragic murder of the company’s benefits group CEO in early December. We believe the company, a decades-long holding in the portfolio, is part of the solution to improving the outcomes and lowering the costs of the U.S. health care system, and that its business model will prove resilient.

Industrials were also a detractor from performance. L3Harris Technologies (LHX), a provider of avionics and electronic systems to the U.S. military, was pressured by concerns that defense spending will decline as part of the new administration’s focus on improving efficiency. A number of our other industrial holdings were also weak as cyclicals, which had a strong run since July, rolled over late in the quarter. Performance was supported in the quarter by AI-indexed semiconductor and software provider Broadcom (AVGO), along with a cohort of disruptors. Software makers CrowdStrike (CRWD), HubSpot (HUBS), ServiceNow (NOW), DocuSign (DOCU) and Snowflake (SNOW) all delivered double-digit returns, as did digital health care platform Doximity (DOCS) and cosmetics retailer e.l.f. Beauty (ELF).

Portfolio Positioning

To promote balance, manage risk and augment the portfolio’s growth characteristics, we continued to take profits in some of our more established, larger holdings to seed new purchases. We believe that the arms race and value unlock from AI will provide a multiyear tailwind to a number of companies in our coverage. To maintain exposure to this theme, we used some of our profit taking in Broadcom to initiate new positions in AI-levered names AppLovin (APP) and Palantir (PLTR).

AppLovin is the world’s leading mobile game and app advertising platform, providing software for marketing and monetization, powered by its proprietary AI targeting engine Axon. We see opportunity for AppLovin to continue to expand and grow its share of the market for mobile app marketing, at a time when mobile gaming ad spend is recovering from a higher-rate-driven trough. We also see the potential for the company to expand its addressable market to include e-commerce advertising, around which early checks have been encouraging. With strong incremental margins and management keeping expenses controlled, the company should be able to drive significant free cash flow growth as revenue continues to scale.

Palantir is a software-as-a-service provider with an AI-powered operating system that connects data to existing customer applications. Palantir’s platform acts as a hub to improve business outcomes across government and commercial end markets, allowing users to synthesize diverse data sources into actionable insights in real time. The company is highly profitable and growing rapidly at scale with 80%+ gross margins. Given the stock’s more elevated valuation we are being mindful of position size.

We also initiated a position in fast casual restaurant chain Chipotle Mexican Grill (CMG). The recent pullback in shares related to a moderation in industry-wide restaurant sales and CEO Brian Niccol’s August departure created an attractive entry point into a company with industry-leading unit economics in a still underpenetrated market. Chipotle plans to double its store footprint over time while executing initiatives to increase volume growth through technology enhancements, reduced mobile order friction and higher production during peak hours. Better throughput, technological integration and improved mix should help to drive continued margin expansion. Chipotle further diversifies the portfolio, adding to consumer discretionary where we have historically had less exposure.

Additionally, we purchased Robinhood Markets (HOOD), an established disruptor in retail brokerage with a brand that resonates across younger cohorts. The company ushered in the era of commission-free trading by leveraging payment for order flow from market makers and also generates revenue from cryptocurrency transactions. While currently maintaining only about 1% market share of self-directed assets, Robinhood is taking share in a large, secularly growing industry. Robinhood should significantly benefit from the upcoming change in administration with reduced regulatory risk around payment-for-order flow and the potential for policies supportive of cryptocurrency to create a runway for new growth opportunities.

We also exited several long-held positions that continue to generate healthy free cash flow but no longer possess the revenue and earnings growth to support the portfolio’s upside capture.

We exited Biogen (BIIB), a biotechnology company developing treatments for Alzheimer’s disease and other neurological disorders. While Biogen has delivered significant advancements for the biotech sector and has been held in the portfolio for several decades, the company’s growth trajectory is now more uncertain due to a slower-than-expected launch of Alzheimer’s treatment Leqembi, with no clear catalyst for an upward inflection, which leaves the drug’s peak sales potential questionable. Additionally, patent expirations and pricing pressures in key therapeutic areas such as multiple sclerosis have further weighed on earnings potential. Biogen may also need acquisitions to stimulate growth, potentially increasing execution risk and degrading its balance sheet.

We continue to consolidate our positions within media to those with more attractive growth prospects over the next several years. We sold media conglomerate Comcast (CMCSA) as it faces greater competition and weakening pricing in its core broadband business. The growth outlook for Comcast is more challenged as competition from new entrants and dampened pricing power has impacted its connectivity business. Industry-wide saturation in broadband, coupled with a secular decline in cable TV subscribers, has diminished growth potential in its core cable business. Comcast’s ability to offset these subscriber losses through price increases is also becoming increasingly constrained.

Outlook

While disappointed with the Strategy’s relative performance since the benchmark change, we have made significant progress in upgrading the quality and growth profile of the portfolio. The Strategy added over 10 new positions during the year and continues to enhance portfolio balance through greater exposure in sectors where it has traditionally been underweight such as consumer discretionary and financials. At the same time, we have been targeting disruptors leveraging generative AI and rapidly taking market shares in the some of the fastest-growing parts of the economy, closing the weighting gap with the benchmark to high-growth, momentum names such as AppLovin that have led recent performance.

We believe our holdings in the $10 billion to $100 billion market cap range are poised for improved results, both on a fundamental level and as macro conditions become more favorable for smaller companies. While the market broadening that began over the summer has experienced fits and starts, we believe this cycle of wider leadership beyond the Magnificent Seven is still in the early innings. The economic leadership in the Trump administration brings capital markets experience to policy making, which we believe will lead to lighter regulation and improve the environment for M&A activity, conditions particularly beneficial to companies down the market cap spectrum.

Rather than chasing concepts to keep up with the index, we are staying true to the Strategy’s long-time approach of seeking to own profitable, cash-flow-generative businesses. Our disruptors, for instance, are flexing their strong fundamentals to widen out their competitive moats by continuing to invest in innovation and roll out new products and services. Valuation and risk management also remain key factors in our portfolio construction process and we will continue to exercise patience in waiting for attractive entry points into new names and manage position sizes of higher-growth names appropriately.

Portfolio Highlights

The ClearBridge Growth Strategy underperformed its Russell Midcap Growth Index benchmark in the fourth quarter. On an absolute basis, the Strategy delivered gains across four of the eight sectors in which it was invested (out of 11 sectors total). The primary contributor to performance was the IT sector while health care was the main detractor.

Relative to the benchmark, overall sector allocation contributed to performance but was offset by negative stock selection effects. In particular, stock selection in the health care, IT, industrials and communication services sectors detracted while selection in consumer staples contributed to performance. From an allocation standpoint, overweights to the IT and communication services sectors and an underweight to the consumer discretionary sector proved beneficial while an overweight to health care hurt results.

On an individual stock basis, the leading absolute contributors to performance were Broadcom, CrowdStrike, HubSpot, Autodesk (ADSK) and ServiceNow. The primary detractors were Vertex Pharmaceuticals, Freeport-McMoRan (FCX), UnitedHealth Group, L3Harris Technologies and Builders FirstSource (BLDR).

Evan Bauman, Managing Director, Portfolio Manager

Aram Green, Managing Director, Portfolio Manager

Amanda Leithe, CFA, Director, Portfolio Manager

|

Past performance is no guarantee of future results. Copyright © 2024 ClearBridge Investments. All opinions and data included in this commentary are as of the publication date and are subject to change. The opinions and views expressed herein are of the author and may differ from other portfolio managers or the firm as a whole, and are not intended to be a forecast of future events, a guarantee of future results or investment advice. This information should not be used as the sole basis to make any investment decision. The statistics have been obtained from sources believed to be reliable, but the accuracy and completeness of this information cannot be guaranteed. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information. Performance source: Internal. Benchmark source: Russell Investments. Frank Russell Company (“Russell”) is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. Neither Russell nor its licensors accept any liability for any errors or omissions in the Russell Indexes and/or Russell ratings or underlying data and no party may rely on any Russell Indexes and/or Russell ratings and/or underlying data contained in this communication. No further distribution of Russell Data is permitted without Russell’s express written consent. Russell does not promote, sponsor or endorse the content of this communication. Performance source: Internal. Benchmark source: Standard & Poor’s. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here