This is a Business Insider headline from Feb. 3, 2022, which I remember well enough, because I wrote the headline: “Democratic Rep. Jamie Raskin failed to properly report a massive stock holding and payout for his wife — a Biden banking regulator nominee”

This is another Business Insider headline from June 14, 2022, and I wrote this headline, too: “Two prominent Democratic lawmakers violated a federal conflicts-of-interest law. Again.”

Sen. John Hickenlooper of Colorado and Rep. Jamie Raskin are those Democrats.

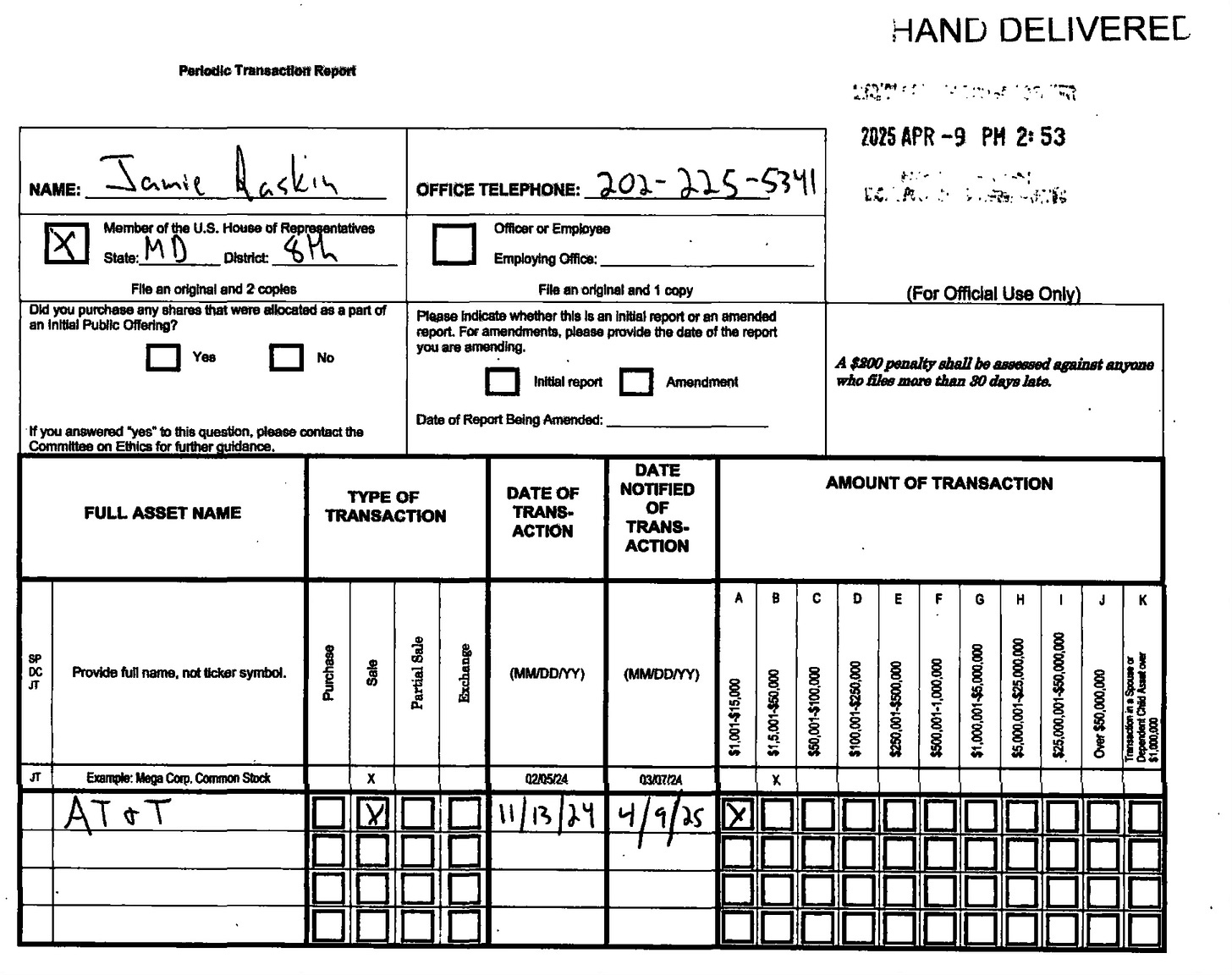

On Wednesday, Raskin filed a personal stock trade disclosure with the U.S. House of Representatives that indicates he sold between $1,001 and $15,000 worth of stock in AT&T. The disclosure does not specific whether Raskin himself, or his wife, Sarah Bloom Raskin, individually or jointly owned the stock.

In and of itself, this revelation of a relatively small amount of blue-chip stock is hardly noteworthy.

What is noteworthy: The hand-written and hand-delivered document discloses a stock trade Raskin made on November 13. This very much matters because the Stop Trading on Congressional Knowledge Act of 2012 — passed by Congress to defend against congressional conflicts of interest and insider trading — requires members of Congress to disclose stock trades made individually, by a spouse or on behalf of dependent child no more than 45 days after its made.

And it means that Raskin is about three-and-a-half months late — in violation of the STOCK Act for a third time in three years.

Raskin, mind you, is not a lawmaker who is ignorant of the law.

This congressional session, he serves as the ranking Democrat on the House Committee on the Judiciary.

Last congressional session, he was the ranking Democrat on the House Committee on Oversight and Accountability.

In 2021, then-House Speaker Nancy Pelosi appointed Raskin as the lead impeachment manager in Donald Trump’s impeachment proceeding following the Jan. 6 attack on the U.S. Capitol.

Raskin is a leading voice among lawmakers calling for Supreme Court ethics reforms.

Raskin is also a graduate of Harvard Law School and is a former editor of the Harvard Law Review.

Meanwhile, when it comes to ethics reforms in government, Raskin has long been a prominent voice.

And if Raskin was in need of a STOCK Act requirement refresher, the House Committee on Ethics provides ample resources, including annual “financial disclosure clinics and trainings.”

After Raskin’s stock disclosure document appeared in a congressional database Friday, I sent his congressional office a list of questions about Raskin’s apparent STOCK Act violation.

Here is what I wrote to Raskin’s office — and how they responded:

:max_bytes(150000):strip_icc()/Cheeses-you-didnt-know-are-made-in-America-FT-BLOG0425-01-c032b69569c2444fbd63df389595b57b.jpg)