A previously secret study revealing that Florida insurers claimed to be losing money because of major storms while transferring billions of dollars to affiliate and parent companies sheds light on the crisis that has enveloped the state over the past few years.

The 2022 study report, obtained and released by the Miami Herald and Tampa Bay Times last week, shows that insurance companies in the Sunshine State justified massive premium hikes for policyholders as necessary to cover losses at the same time that executives distributed $680 million in dividends to shareholders and diverted billions to affiliates.

“This is the most eye-opening ray of sunlight to pierce the shadowy world of Florida homeowners insurance in years,” Doug Quinn, executive director of the watchdog American Policyholder Association, told Newsweek.

“The impact of this scandal is huge. Florida policyholders have had money taken out of their pockets that they simply cannot afford.”

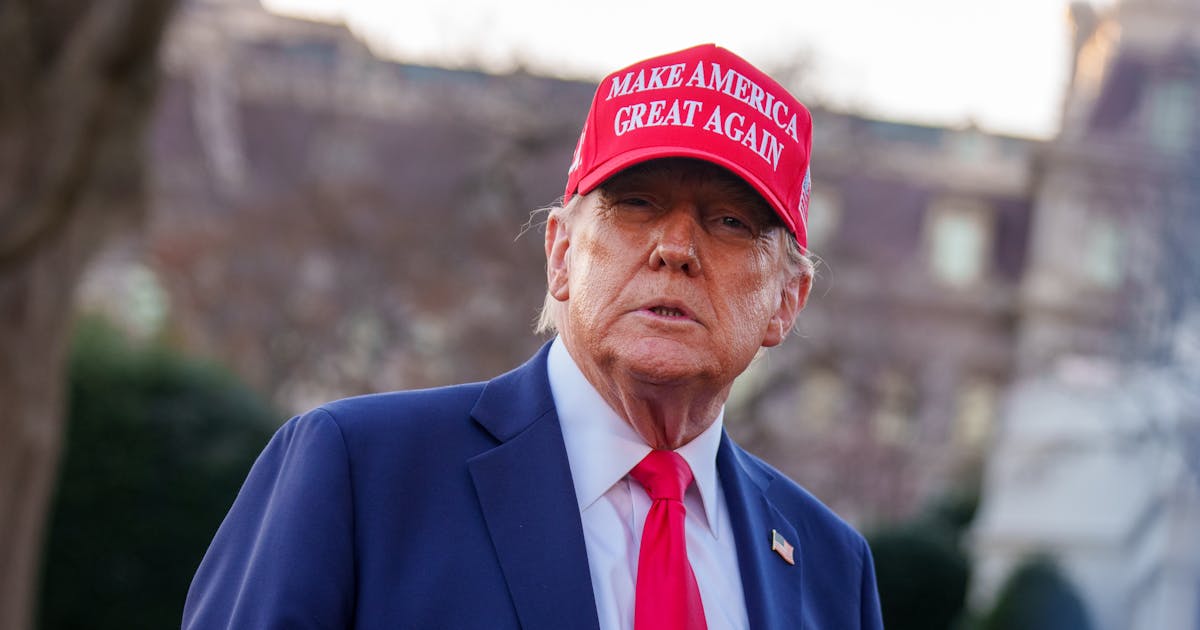

Joe Raedle/Getty Images

Crucially, the Florida Office of Insurance Regulation (FLOIR) has released only the executive summary of the report, not including the indexes, “even though they appear to have critical information,” Quinn said.

“The release of the entire report, not just the executive summary, is very important,” Birny Birnbaum, executive director of the Center for Economic Justice and a former chief economist at the Texas Department of Insurance, told Newsweek.

“My understanding is that the [Florida] Office of Insurance Regulation will charge some $1,500 for the report, indicating that OIR is not claiming the report is confidential, but effectively making it so with exorbitant costs. The full report is needed to evaluate some of the terms used in the executive summary and to assess the conclusions.”

What Does The Report Reveal?

While insurers’ profits are capped at about 4.5 percent by Florida regulators, the profits of affiliate and parent companies are not. Insurers are known to use these companies to reward their executives and investors in a way that’s open to be abused and has been linked to companies going insolvent before.

Money-shifting is not necessarily illegal for insurers, but the study’s report found that the huge amounts removed from companies by executives violated state regulations. Florida insurers were left so weakened by these transfers of money that they didn’t have the necessary funds to pay claims to policyholders, the study found.

Responding to a request for comment from Newsweek, a spokesperson for Florida state Senator and state Senate President Ben Albritton said they were not aware of the report. The Miami Herald confirmed that Florida lawmakers never saw the report, reportedly because it was not a formal examination report and was left in a “draft” status.

Newsweek contacted the author of the report and FLOIR for comment by email on Thursday. In a statement to the Miami Herald, FLOIR said that the report presents an incomplete picture of insurers’ money but highlights the need for reforms in the sector.

Unaware of these shadowy transfers of money, over the past few years Florida regulators said they tackled the state’s property insurance crisis as best they could, focusing on excessive litigation and widespread fraud in the state market.

For Quinn, this was a mistake.

“Florida legislators were duped into taking away their constituents’ rights to recover their legal fees if their insurer was found guilty in civil court of cheating them,” he said.

“The false narrative that the insurance companies were losing money was used to justify dramatic premium increases and explain away insolvencies that have since been attributed to excessive executive compensation, draining the companies’ assets through affiliates, and just plain bad management.”

While excessive litigation has long been pointed at as one of the main reasons behind Florida’s insurance crisis, Quinn said that the role it played in recent rate hikes has been inflated, “as evidenced by the fact that two years after the passage of pro-insurer/anti-consumer ‘tort reform’ laws, the state of Florida has still among the highest insurance premiums in the country.”

What has been hailed as the stabilization of the Florida market, Quinn said that it’s the return of insurers attracted by the possibility “to take advantage of policyholders with limited consequences.” According to Quinn, there is nothing to suggest any of “the behind-the-scenes dynamics” exposed in the 2022 report have changed.

Photo Illustration by Newsweek

What Impact Did Insurers’ Money-Shifting Have?

For Birnbaum, the money-shifting operated by Florida insurers played a part in the crisis of the past few years, when premiums skyrocketed and availability shrank across the state’s market.

“The major causes of the crisis were thinly capitalized insurers getting bogus financial ratings from Demotech and companies not being able to sustain catastrophe losses because they had little capital and relied heavily on reinsurance,” he said.

“When reinsurance prices skyrocketed and supply shrank, these insurers’ business models failed.

The problems in the Florida market, according to Birnbaum, stemmed from huge catastrophe exposure and “the Legislature letting insurers do what they want in terms of cutting coverage and requiring massive deductibles.

“The model of massive reinsurance coupled with massive funds siphoned to affiliates played a role because several of these insurers failed.”

Quinn believes that the impact of the money-shifting revealed in the 2022 report was especially devastating for seniors on a fixed income and working-class families.

“Many people have left the state citing unaffordable insurance premiums as the cause. This has even had a dramatic impact on the Florida real estate market, which some analysts are predicting is on the verge of collapse,” he said.

“To add insult to injury, not only Florida citizens are being asked to pay among the highest insurance premiums in the nation, but Florida insurance companies have among the worst claims-paying history, with a significant percentage of consumer complaints against insurance companies in the nation being against Florida insurers.”

Have Things Changed Since The 2022 Report?

While Florida regulators have said that things are different compared to the time referred to in the 2022 report, with more oversight and regulation in place, Quinn is skeptical.

“You can have all the laws and regulations you want, but if the state regulatory and law enforcement agencies do not enforce them, they have no use, and bad actors will abuse the system,” he said.

“To be clear, the state of Florida regulatory and law enforcement agencies are weak on insurance.”

This weakness, according to Quinn, has been the untold story of the state’s insurance crisis of the past few years.

“The crisis could not have happened unless it was allowed to do so by those whose responsibility it is to protect the citizens of Florida from these types of underhanded manipulations,” Quinn said.

In recent months, Florida regulators have welcomed Citizens’ depopulation efforts and celebrated the approval of new insurers to enter the state’s market as signs that tort reform had worked, and the market is stabilizing. But to Birnbaum, “the claims by the governor [Ron DeSantis] and OIR that the ‘market is stabilizing’ are a sham.”

According to the economist, “the new entrants to the market are all using this same approach of getting policies from Citizens—with no acquisition costs—and relying massively on reinsurance and services from affiliates, just as outlined in the executive summary.”

Birnbaum added: “The new entrants are using a tried-and-true method to mint money with no risk by siphoning massive percentages of premium to affiliates. Florida consumers have not seen any meaningful rate relief. When reinsurance costs jumped, so did the cost of primary insurance. Those costs have not come down and neither have premiums. If litigation was truly the cause of skyrocketing premiums, then why haven’t premiums dropped significantly with ‘tort reform?'”

According to NerdWallet’s latest data, homeowners insurance costs an average of $2,625 a year for $300,000 worth of dwelling coverage in Florida, higher than the national average of $1,915.

The answer for Birnbaum and Quinn is that litigation was never a major driver of insurance premiums in Florida, “catastrophe risk and insurers excluding coverage were the reasons,” Birnbaum said.