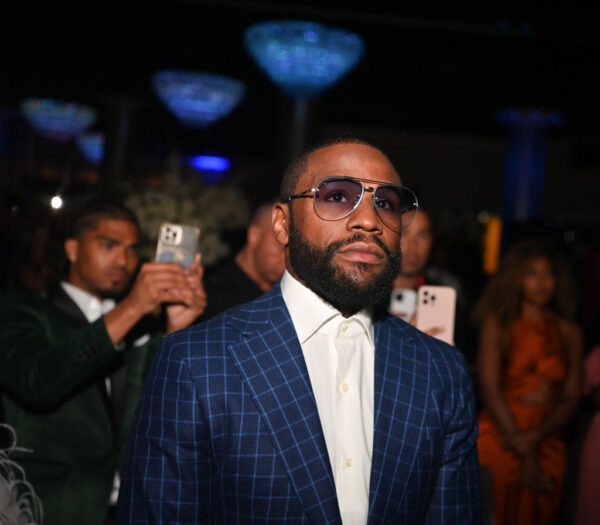

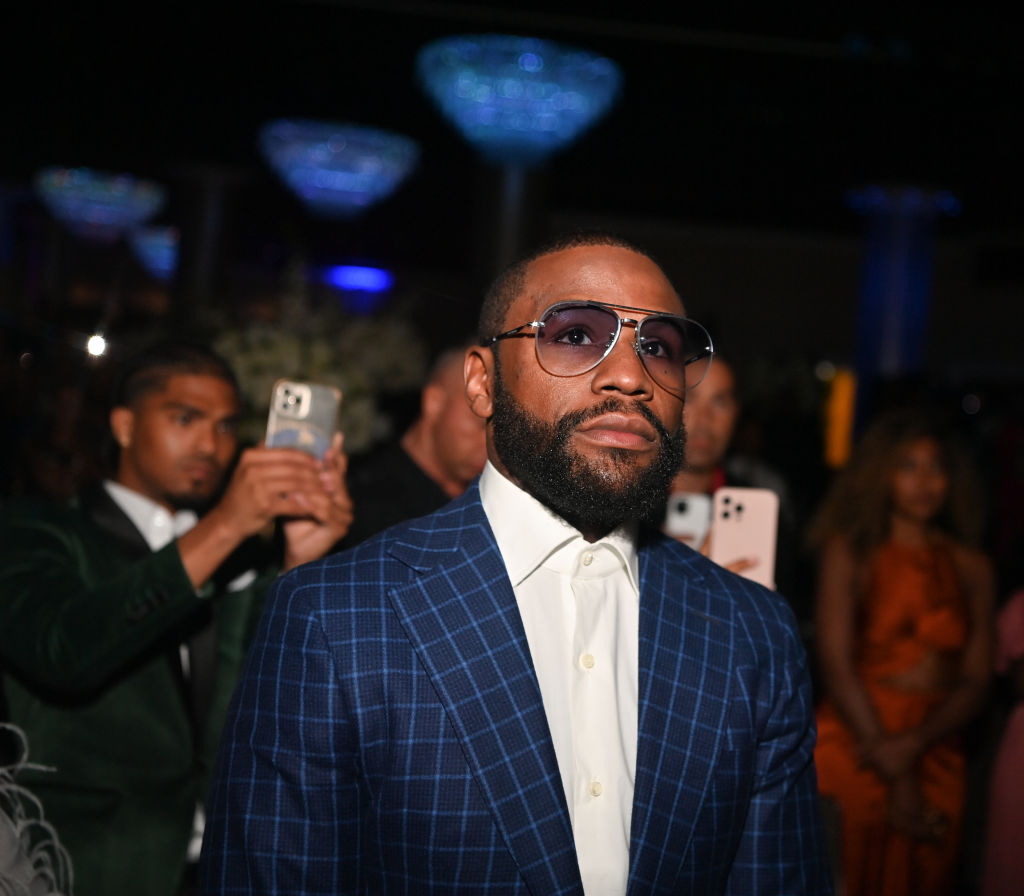

Boxing legend Floyd “Money” Mayweather Jr. made headlines in February with what appeared to be a historic power move in New York real estate.

The undefeated champion took to social media and announced the acquisition of a sprawling portfolio of 62 apartment buildings in upper Manhattan for an eye-popping $402 million. But recent investigations suggest this knockout deal may have been more of a promotional jab than a financial uppercut.

“Guess what? All the buildings belong to me, I don’t have no partners,” Mayweather proclaimed in an Instagram video posted on Feb. 22, which showed him touring several properties.

He continued, “And all the retails down below on my buildings, all of them belong to me too. Guess what? You can do the same. It’s all about making power moves.”

The 48-year-old former champion, who earned his “Money” moniker by generating over a billion dollars during his boxing career, has increasingly positioned himself as a business mogul with interests spanning liquor, nutritional supplements, apparel, and commercial real estate.

The Paper Trail Goes Cold

Fast forward to April, and Business Insider reports that there’s a significant discrepancy between Mayweather’s bold claims and verifiable reality. A month after his announcement, New York City property records show none of the buildings have changed hands. According to multiple experts, these records are typically updated within days of a sale.

More tellingly, the NYC Housing Partnership, a non-profit that partners in many of the properties to help them qualify for tax breaks and maintain affordable housing, stated through a spokesperson: “The Housing Partnership has not been advised of any sale, pending sale, or change in ownership. Generally, the partnership would be advised of the transfer and would be party to the transfer. That has not occurred.”

A Minority Stake in a Majority Claim?

Sources close to the deal paint a significantly different picture than Mayweather’s “no partners” declaration.

The Business Insider reported a person directly involved in the transaction revealed that Mayweather and his Vada Properties had actually purchased “a small minority ownership interest in the portfolio, with options to expand that stake over time or acquire the buildings in their entirety.”

Black Spruce Management, which owns the majority of buildings in the portfolio, offered a carefully worded statement: “Floyd Mayweather continues to be a reliable partner and a great ambassador for affordable housing. To date, Mayweather has performed on all of his obligations.”

The statement notably avoids confirming or denying Mayweather’s full ownership claims.

This isn’t the first time Mayweather’s real estate announcements have raised eyebrows. His February flex follows a pattern of bold big money claims that appear exaggerated upon closer inspection.

In 2022, he claimed that he owns nine skyscrapers in NYC, and wants to bring a casino to the city.

While he says that he is the owner of these buildings, records show that at least in his One Vanderbilt, a 93-story skyscraper in the Midtown Manhattan, he is an investor.

The casino wish also has not been manifested.

When reached for comment by Business Insider, representatives from Mayweather’s property firm, Vada Properties, maintained that the boxer had indeed acquired the portfolio. They suggested Mayweather was drawn to the properties partially because they include rent-regulated apartments, citing his own childhood experience with affordable housing.

“He felt that it’s so cool because: I give back to the community and I make money,” said a person claiming to represent Mayweather’s business interests. “And once that clicked in his head, he is like, I want to buy it all.”

The Business Beyond the Ring

While Mayweather’s 50-0 record and 15 major world championships across five weight classes secured his legacy in boxing, his post-fighting career has been characterized by ambitious business ventures and extravagant displays of wealth.

For the boxer who once purportedly made $275 million from a single fight against Conor McGregor, the distinction between owning a small stake with future options and outright ownership of a $402 million property portfolio might seem inconsequential.

But in the world of commercial real estate, such distinctions matter — especially when shouted out to 28 million Instagram followers as investment inspiration.

:max_bytes(150000):strip_icc():focal(352x167:354x169)/Chris-Evans-Surprised-a-Captain-America-Superfan-When-He-Completed-His-Tattoo-Tribute-040325-f7d9568c5e234503bb74412ea53876b6.jpg)