The stock market had another strong year in 2024, led by the S&P 500 Index’s (SP500, SPX) 25% return. The index has now returned over 20% for two consecutive years, something that hasn’t happened since 1998-99. The market decline of 2022 seems to be in the distant past, with animal spirits seemingly revived, and speculative pockets re-emerging. That’s a far cry, however, from saying that the market is very expensive or due for a fall. While many stocks do seem to be on the expensive side, the aggregate market valuation is in a “zone of reasonableness,” where it doesn’t pay to have an opinion on the overall market level. Thus, we wouldn’t be surprised if the market fell 20% in 2025, or rose 20% again. How’s that for a forecast?

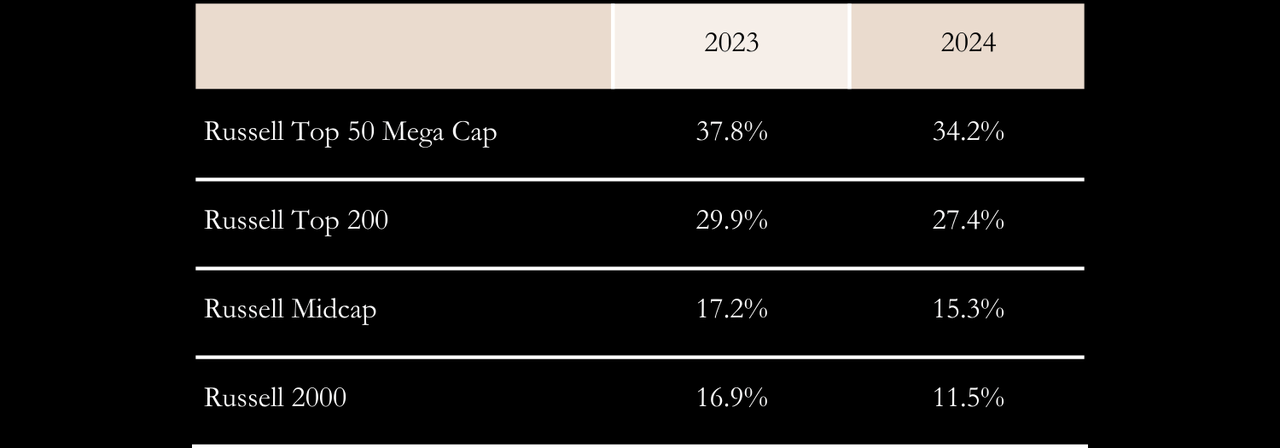

The bigger-is-better theme that we highlighted a year ago continued through 2024. Below is the chart we included in last year’s annual letter, ranking the various Russell indices by market capitalization, and updated to add 2024’s returns.

This is an extraordinary run of stock market performance by the largest companies in the nation (1). A year ago there was the Magnificent Seven. Today, it’s the Elite Eight, with Broadcom (AVGO) having entered the pantheon after a surge in its stock price in 2024. All eight are technology companies, and all eight comprise the U.S. members of the exclusive trillion-dollar club, with market caps over $1 trillion.

The financial community was abuzz in 2018 when Apple (AAPL) became the first company to cross the $1 trillion market cap threshold, but these days, observers seem acclimatized to the astounding size and continued growth of these companies. We find this amazing, given that the dollars now involved are so staggeringly large, it’s hard to put in perspective. Let’s give it a shot.

The Elite Eight have a combined market capitalization of $19 trillion. That is almost two-thirds the size of the United States GDP and equal to the GDP of China, the second largest economy in the world. The $3.7 trillion market capitalization of the largest member, Apple, by itself, if it were a country, would rank as the sixth largest by GDP. In fact, each of the Elite Eight would be among the 20 largest countries in the world by that measure.

Combined, the eight added over $6.4 trillion of market capitalization in 2024, an amount substantially greater than the GDP of Germany, the world’s third largest economy. The amount of added market capitalization of just one company (Nvidia, NVDA) would by itself have ranked as the 10th largest country in the world. Each utterance of their CEOs, every technological or product update, and every notable event that happens on their platforms or with their products seem to be in the news on a daily basis, displaying the enormous influence they now have on world economic affairs, or at the very least, the enormous attention paid to these companies in and outside the investment community. Perhaps their CEOs should have a seat at the table at the United Nations.

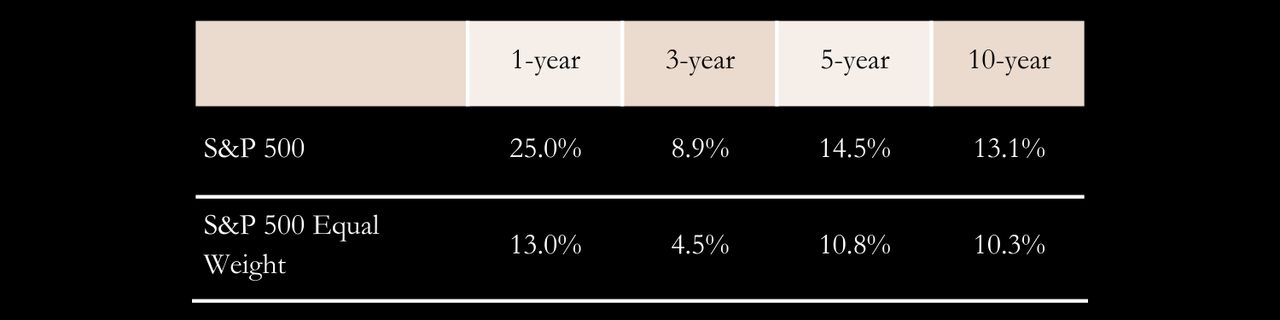

From an investment perspective, the statistic that best sums up the top-heavy nature of the market is the gap between the S&P 500 Index and the S&P 500 Equal Weight Index. The classic S&P 500 Index is a market cap-weighted index; the bigger the constituent company, the bigger the impact it has on index performance. With the S&P 500 500 Equal Weight Index, each company is given equal weight, no matter its size. The S&P 500 Index is the House of Representatives, and the Equal Weight version is the Senate. Below is the annualized performance of the two versions of the index for the more recent periods ending December 31, 2024.

You can see the significant outperformance of the traditional S&P 500 Index over the Equal Weight version for all periods over the past decade. Over the very long-term, however, the two indices tended to track each other much more closely, typically within a fraction of a percentage point of each other.

This historical pattern of narrow divergence has informed the general investment framework we have had since our founding – that if we simply look for the best investment opportunities, regardless of index composition, and do that well, we will outperform the index over time. We aim to beat the index by ignoring the index. We know that there will be periods where we miss out on some trend or another, but we are willing to tolerate those periods, confident that our approach will win out over the long-term.

The recent rise of these new corporate giants has certainly given us some food for thought about this framework. In the past, when concentration increased at the top, we felt certain that gravity would eventually exert its pull, and that the factors that led to the heavy concentration would reverse. Sometimes it was simply over-valuation coming to an end, such as in the early 2000s when the megacap and tech bubble popped. Sometimes it was the unsustainability of inflated profits, such as in 2008 when the banking industry collapsed. And sometimes it was competitive forces accumulating to counter a trend, such as in the 1990s when the media and retail landscape changed enough to shift power away from mass consumer brands towards alternative brands and distribution channels. Often, it was simply that size is its own anchor, as the larger a company gets, the harder it is to continue growing at high rates.

Today’s behemoths feel decidedly different. The strong performance of the biggest companies has led to a level of concentration that is unprecedented, making them harder to ignore. The largest component of the S&P 500 is worth over 7% of the index. The top 10 stocks are hovering at about 40% of the index, materially higher than the previous peak of 27% from early 2000.

The forward price-to-earnings multiples of the stocks mostly range from 23x to 35x, which is certainly on the high side, but not outlandish given the quality of the franchises. Most of the companies do indeed operate in enormous global markets, selling products and services that are ubiquitous in the daily activities of many, or are a critical part of the technological infrastructure that enables those activities. Many of the businesses are quite asset-light, meaning the physical constraints on growth apply less to them than to past corporate behemoths. Many seem also to benefit from scale, widening their moats as they get bigger.

Acknowledging all of this, however, today’s situation with the Elite Eight doesn’t feel different enough for us to abandon our investment framework. We’re not going to lower our hurdle simply because a stock or a group of stocks constitutes a large portion of the benchmark index. Looking at each of the Elite Eight in depth, we’ve either invested or not invested in each based on the risk-reward offered.

Thus, our guiding principle remains: we research each company on its own economic merits, and aim to invest only when we feel that we are clearly receiving more in value than we are paying. We don’t ever want to “default” into an investment, which is effectively what some have suggested to us that we do: if a stock is a large enough component of the index, our default should be to invest in it at a position size equal to its weight in the index. This is the financial equivalent of Pascal’s wager: heads I win, tails I don’t lose much. If we purchase a 36% stake in the Elite Eight, then we effectively neutralize that portion of our portfolio vis-à-vis the benchmark index. Yet, ultimately, this to us seems nothing more than FOMO (2) dressed up in fancy epistemological philosophy, and we reject that path.

That doesn’t mean that we haven’t tweaked how we apply that framework. While we continue to ignore the general index composition, we do recognize that it’s becoming increasingly untenable to let one’s circle of competence grow stale. Societal trends could mean that certain portions of the economy garner a disproportionately larger share of the financial pie for an extended period, and if we don’t have competency investing in a wide swath of the economy, we will operate with a severe handicap. We believe that is what happened to many of our “value investor” brethren who ran into difficulty in the past one or two decades. Warren Buffett wrote this in 1996:

“Intelligent investing is not complex, though that is far from saying that it is easy. What an investor needs is the ability to correctly evaluate selected businesses. Note the word “selected”: You don’t have to be an expert on every company, or even many. You only have to be able to evaluate companies within your circle of competence. The size of the circle is not very important; knowing its boundaries, however, is vital (3).”

We believed these words when we read them almost 30 years ago, and we still believe them to be correct today. But we would add the caveat that the size of the circle is more important than it used to be; it must be wide enough to have at least some overlap with where the majority of value creation is. In the past, value creation was diversified across many sectors – the top eight companies in the index were certain to represent four or five vastly differing industries. But today’s Elite Eight all have in common one thing: they belong to, or are adjacent to, the technology sector. We might ignore the index from the standpoint of having no default positions, but you shouldn’t take that to mean that we’re not paying attention.

New Investments

As noted above, we believe that the general stock market valuation is within a reasonable zone and see no reason to be particularly bullish or bearish. Given where interest rates and valuations are today, though, if we had to make a forecast, it seems likely that an investor in one of the major market indices would reap annual returns over the next decade that fall somewhat below the historical 10% average returns. In that context, it’s not surprising that our cupboards have not been overflowing with attractive investment ideas. Our portfolio turnover remained in the 10-15% range in 2024, with just a few new investments made across our flagship Mid Cap and Large Cap strategies.

Two of our new investments in 2024 were of significant size, and deserve some discussion.

We invested in Keysight Technologies (KEYS) in the middle of the year, and it is now a top 10 holding in our Large Cap strategy. Keysight is the leading manufacturer of electronic test and measurement instruments in the world, with a sterling reputation earned over many decades. It sells a wide array of products, including oscilloscopes, network analyzers, and signal generators, just to name a few, with #1 or #2 positions in the majority of them. The common link is that its products allow for the creation and functioning of all the communication infrastructure that connects the world, including our wireless and landline networks, data centers, and electronic devices. There probably isn’t a single large telecommunications, semiconductor, or technology product maker in the world that doesn’t use Keysight products extensively in its R&D labs.

The company traces its roots back to the 1930s as Hewlett-Packard (HPE). Yes, as Hewlett-Packard. Today, the Hewlett-Packard name is better associated with computers, printers, or even calculators, but those are all product lines that the company entered into years after its founding. The first product that Bill Hewlett and Dave Packard created in their famous Silicon Valley garage was an audio oscillator, used to measure and control sound equipment, a growing necessity in the then-burgeoning field of radio and film. It added many more products to its line-up as it grew, but almost all related to electronic testing and controls. Thus, Hewlett-Packard remained primarily an electronics instrumentation company for the next 25 years. The company entered the computer industry in the 1960s as that nascent industry was developing, and over the ensuing decades, it branched out into dozens of other technology-related product lines.

In 1999, Hewlett-Packard spun out its instrumentation business, newly named Agilent Technologies (A). And then in 2014, Agilent split into two companies, one focused on life sciences instruments and the other on electronic measurement instruments. The latter was christened Keysight Technologies, and is the company in which we recently became a shareholder.

This history is important because the celebrated DNA of Hewlett-Packard remains strong within Keysight – which is commitment to R&D and close working relationships with its customers. Some of this culture got lost in the sprawling Hewlett-Packard conglomerate of the 1990s and 2000s, but it was brilliantly restored by a foresighted executive team when Keysight became an independent company in 2014. Spending on R&D went from 12-13% of revenues to 16%, where it hovers today. By investing heavily in “where the puck was going,” for example, it jumped out to a substantial lead, helping its telecommunications customers upgrade from 4G to 5G. Its commitment to innovation is such that as revenues declined last year, it not only maintained its R&D spending level but increased it. Thus, we expect Keysight to remain in the driver’s seat for the upcoming 6G upgrade cycle and stay on the vanguard of other technological advances in communication standards for the foreseeable future.

Aside from the wonderful management ethos, what attracts us to the business is that its product quality and reputation are a differentiating factor, and customer purchase decisions are not all about price. Its engineer customers are reluctant to switch from brands they are used to, resulting in a limited set of competitors. The five global players that comprise a considerable share of the industry, including Keysight, were founded in 1931, 1932, 1939, 1945, and 1964.

Its instruments are mission-critical for its customers’ research and development efforts, where getting the innovation right is vastly more important than saving very modest amounts of money in the R&D process. There is also a standards-setting effect, where certain protocols and signals are better off when measured using the same manufacturer’s instruments for consistency. If Verizon (VZ) uses Keysight for testing and measuring particular protocols, you better believe that Verizon’s vendors will also lean towards using Keysight. If Microsoft (MSFT) is using Keysight instruments to test the efficacy of its latest data center, Microsoft’s equipment suppliers will also be more inclined to use Keysight.

While Keysight’s revenues have grown nicely over time, there is a cyclical element to it, as the technology cycles that its customers go through wax and wane. A recent such waning caused its stock price to tread water for a few years, and we deemed it attractive enough to build a substantial position.

The other significant investment we made during 2024 was in Lithia Motors (LAD) and Asbury Automotive (ABG). We view each investment independently, but as they operate in the same industry, we can think of them as one large position for purposes of exposure. Together, they constitute a top five holding in our Mid Cap strategy.

Lithia and Asbury own and operate franchised auto dealerships. They are the largest and the 5th largest dealer networks in the country, respectively, with 467 and 153 dealers spread across the attractive demographic regions of the West, Southwest, and Southeast. Franchise dealers can be good businesses. Well-run ones, such as those owned by Lithia and Asbury, earn returns on capital over 15% and, depending on their location, can have minimal local competition for the brand of cars they sell.

While most investors associate franchise car dealers with new car sales, one of the most attractive characteristics of the dealership business model is how they participate in the entire life cycle of a car. A typical dealer will earn about 35% of its profits from the sale of new cars and related warranty and financing, 20% of its profits from the sale of used cars and any related financing, and 45% from aftermarket service and repair. This last segment provides a steady, reliable source of cash flow to the dealer in all economic environments, providing a ballast to cushion the swings that would otherwise result from the cyclicality in car sales. In addition, with the increasing capital needs of auto repair equipment and the shortage of automotive technicians, franchise dealers are finding that they are well-situated against the small mom-and-pop garages that can’t afford to remain invested in the latest gear and technician training.

Franchise dealers have historically been intensely local businesses, without much benefit to scale from owning disparate dealers. However, over time, Lithia and Asbury have both been able to find some modest benefits to their large size, whether it’s sharing best practices across its dealers or insourcing services that previously were done by third parties.

More importantly, the historically local nature of the business means that it is highly fragmented, with over 17,000 dealers in existence in the United States. The largest 10 dealer groups in the country have perhaps 10-12% of the market between them. The other 88-90% represents a vast opportunity for Lithia and Asbury. Both have grown locations primarily through acquisitions, and we anticipate they will continue to do so for many years. The M&A market for dealerships is fairly well established, and the owners of dealers know their worth. So there are no bargain purchase prices available, and we don’t expect there to be. But the ability to improve the operations of an acquired company should allow for adequate returns for Lithia and Asbury.

We also like, however, that both companies are increasingly choosing to buy back stock with the excess capital that they generate. We think that makes all the sense in the world when acquisitions are not readily available at attractive prices, and one’s own stock is trading at a very low multiple of earnings. The latter condition stands true today, and we’re encouraged that at the same time that we made our investment in these two companies, the management teams of both were boosting their share buyback pace materially.

One of the questions that investors appear to be struggling with is that earnings for many franchise dealers, including Lithia and Asbury, have been declining for two years. Covid-related supply restrictions led to unsustainably high prices for both new and used cars. Thus, even as the volume of cars sold fell due to a lack of both supply and demand, dealers realized very high profits per each unit sold in 2021 and 2022. Prices started to come down in 2023, and so did dealers’ profits. We believe that prices are now approaching more normal, sustainable levels, and therefore dealer profits should start to stabilize as well. Regardless of whether we are correct in this assessment of the timing of normalization, we purchased these stocks at a sufficient cushion to long-term value, such that we believe we can withstand some period of further declines in profit margins.

Historically, it hasn’t been unusual for us to have new investments quickly make their way into a top five or 10 holding. But it’s been a rare occurrence these past few years, as we’ve liked the companies we owned, they’ve performed well, and we’ve been (and typically are) reluctant to part with them. Our long-term horizon means we don’t depend on a constant flow of fresh ideas to drive near-term performance, but we like to make sure that we are planting seeds for the future.

Respectfully,

Haruki Toyama, Head of Large and Mid Cap Equity, Portfolio Manager

|

Footnotes 1. The largest companies in the United States are the largest companies in the world. American companies comprise 27 of the top 30 companies in the world by market cap.2. Fear of missing out3. Chairman’s Letter, Berkshire Hathaway, Inc., 1996 Annual Report “Madison” and/or “Madison Investments” is the unifying tradename of Madison Investment Holdings, Inc., Madison Asset Management, LLC (“MAM”), and Madison Investment Advisors, LLC (“MIA”). MAM and MIA are registered as investment advisers with the U.S. Securities and Exchange Commission. Madison Funds are distributed by MFD Distributor, LLC. MFD Distributor, LLC is registered with the U.S. Securities and Exchange Commission as a broker-dealer and is a member firm of the Financial Industry Regulatory Authority. The home office for each firm listed above is 550 Science Drive, Madison, WI 53711. Madison’s toll-free number is 800-767-0300.Any performance data shown represents past performance. Past performance is no guarantee of future results.Non-deposit investment products are not federally insured, involve investment risk, may lose value and are not obligations of, or guaranteed by, any financial institution. Investment returns and principal value will fluctuate.This website is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security.This letter was written by Haruki Toyama, Head of Mid and Large Cap Equities and Portfolio Manager on the respective strategies.Although the information in this report has been obtained from sources that the firm believes to be reliable, we do not guarantee its accuracy, and any such information may be incomplete or condensed. All opinions included in this report constitute the firm’s judgment as of the date of this report and are subject to change without notice. This report is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security.Equity risk is the risk that securities held by the fund will fluctuate in value due to general market or economic conditions, perceptions regarding the industries in which the issuers of securities held by the fund participate, and the particular circumstances and performance of particular companies whose securities the fund holds. In addition, while broad market measures of common stocks have historically generated higher average returns than fixed income securities, common stocks have also experienced significantly more volatility in those returns.Large Cap investing is based on the expectation of positive price performance due to continued earnings growth or anticipated changes in the market or within the company itself. However, if a company fails to meet that expectation or anticipated changes do not occur, its stock price may decline. Moreover, as with all equity investing, there is the risk that an unexpected change in the market or within the company itself may have an adverse effect on its stock. Investing in growth-oriented stocks involves potentially higher volatility and risk than investing in income-generating stocks. The biggest risk of equity investing is that returns can fluctuate and investors can lose money.Investments in midsize companies may entail greater risks than investments in larger, more established companies. Midsize companies tend to have narrower product lines, fewer financial resources, and a more limited trading market for their securities, as compared to larger companies. They may also experience greater price volatility than securities of larger capitalization companies because growth prospects for these companies may be less certain and the market for such securities may be smaller. Some midsize companies may not have established financial histories; may have limited product lines, markets, or financial resources; may depend on a few key personnel for management; and may be susceptible to losses and risks of bankruptcy.Diversification does not assure a profit or protect against loss in a declining market.The S&P 500® is an unmanaged index of large companies and is widely regarded as a standard for measuring large-cap and mid-cap U.S. stock-market performance. Results assume the reinvestment of all capital gain and dividend distributions. An investment cannot be made directly into an index.The Dow Jones Industrial Average® (The Dow®), is a price-weighted measure of 30 U.S. blue-chip companies. The index covers all industries except transportation and utilities.Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Russell Investment Group.Russell Midcap Index is a market-capitalization-weighted index representing the smallest 800 companies in the Russell 1000 Index. The average Russell Midcap Index member has a market cap of $8 billion to $10 billion, with a median value of $4 billion to $5 billion.Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000® Index, which represents approximately 11% of the total market capitalization of the Russell 3000® Index.The Russell Top 50® Mega Cap Index measures the performance of the largest companies in the Russell 3000 Index. It includes approximately 50 of the largest securities based on a combination of their market cap and current index membership and represents approximately 45% of the total market capitalization of the Russell 3000, as of the most recent reconstitution. The Russell Top 50 Index is constructed to provide a comprehensive unbiased and stable barometer of the largest US companies. The Index is completely reconstituted annually to ensure new and growing equities are reflected.The Russell Top 200® Index measures the performance of the largest cap segment of the US equity universe. The Russell Top 200 Index is a subset of the Russell 3000® Index. It includes approximately 200 of the largest securities based on a combination of their market cap and current index membership and represents approximately 68% of the Russell 3000® Index, as of the most recent reconstitution. The Russell Top 200 Index is constructed to provide a comprehensive and unbiased barometer for this very large cap segment and is completely reconstituted annually to ensure new and growing equities are included.Upon request, Madison may furnish to the client or institution a list of all security recommendations made within the past year.Holdings may vary depending on account inception date, objective, cash flows, market volatility, and other variables. Any securities identified and described herein do not represent all of the securities purchased or sold, and these securities may not be purchased for a new account. Past performance does not guarantee future results. There is no guarantee that any securities transactions identified and described herein were, or will be profitable. Any securities identified and described herein are not a recommendation to buy or sell, and is not a solicitation for brokerage services.Madison-665888-2025-01-10 |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here