Ban is first of its kind in Japan.

Time and time again we hear reports of people being taken in by what is known as “special fraud” (tokushu sagi) in Japan. What makes fraud “special” is when the perpetrator never meets their victim face-to-face and instead communicates by telephone, Internet, or even postal mail, impersonating family members, official agencies, or, in some rare cases, Mick Jagger.

The nation’s elderly are at particular risk to this form of crime and year after year are handing over large sums of money to these anonymous criminals. This leaves law enforcement and governments at a loss for how to stem this rampant crime.

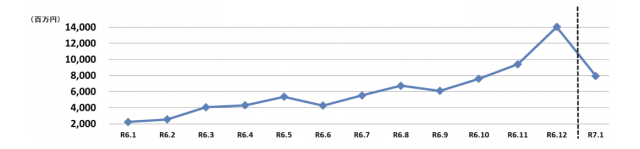

▼ Both incidents and damages took a refreshing drop last January down to a nationwide total of 8 billion yen (US$53M) from a peak of 14 billion ($93M) the previous month.

Image: National Police Agency

Image: National Police Agency

Osaka Prefecture is said to be one of the hardest hit areas when it comes to special fraud, so lawmakers there have taken countermeasures to new heights and issued a ban on seniors using the telephone while also operating ATM machines.

In addition to the ATM phone ban on the elderly, the ordinance, which passed prefectural assembly in a unanimous vote on 24 March, requires all businesses with ATMs installed to hang posters telling everyone to not use the phone and ATM at the same time and set a daily limit of 100,000 yen ($664) on bank transfers made by seniors. Also, places that sell prepaid cards will be required to check that the purchaser is at no risk of being a victim of fraud.

This is the first ordinance of its kind in Japan, but it should be noted that like similar ordinances in the past, like Kagawa Prefecture’s video game restrictions, there are no penalties for failure to comply. However, since the ordinance applies to businesses such as banks, it is likely they will take it seriously as a matter of their own corporate image towards social responsibility. I dare anyone who disagrees to find a Japanese company’s website that doesn’t boast about how they’re adhering to the UN’s Sustainable Development Goals (SDGs) in one way or another.

Comments by readers of the news online largely felt the ordinance was problematic for a few reasons, but many seemed to agree that special fraud is a complicated issue with no easy solutions.

“It’s really infuriating that people’s pensions that they worked so hard to earn are being taken by criminals.”

“They have their work cut out for them. Seniors don’t like to admit they’re being fooled or change their ways.”

“It’s tyrannical to limit senior’s transfers. If they have to use a teller, they should be able to pay the same fees as an ATM.”

“I think just having a rule like this will make bank employees more motivated to get involved, so I think it’s fine.”

“It’s not like young people are immune to fraud either.”

“Talking on a phone at an ATM is annoying anyway. They should ban it for everyone.”

“I just want them to find some way to catch these criminals.”

“How do they even define ‘elderly?’ Are they going to ID us at the ATM?”

As we reported before, Japan Post (which is also a bank) is already taking steps to address the problem, with AI detecting when ATM users are on the phone. The same AI could conceivably be used to detect the users’ ages too. I’d have to wonder how accurate it is though, since I’m one late night away from passing for 65 myself.

Ultimately, special fraud won’t disappear until more sophisticated ways of rooting out the offenders are developed, but until then, hopefully, measures such as this will help to curb the damage they’re causing to society.

Source: The Sankei Shimbun, NHK News Web, Hachima Kiko, National Police Agency

Featured image: Pakutaso

● Want to hear about SoraNews24’s latest articles as soon as they’re published? Follow us on Facebook and Twitter!