Dear Partners,

We are proud to announce the launch of our third fund on April 1st: Protean Aktiesparfond Norden. It combines the low fees of index funds with the potential of active management to outperform the index. The best of two worlds.

In addition, we will make the already low fee even lower when the fund grows bigger, sharing the scale advantages.

Aktiesparfonden (the Equity Savings Fund) will focus on Nordic companies with proven business models, solid returns on interest-bearing capital, and profits that translate into cash flow. By avoiding companies with unsound financial risk-taking, aggressive or dishonest accounting, and misdirected capital allocation—three factors that often go hand in hand—we reduce the risk of spectacular missteps.

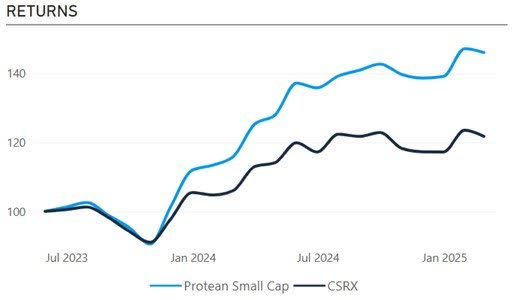

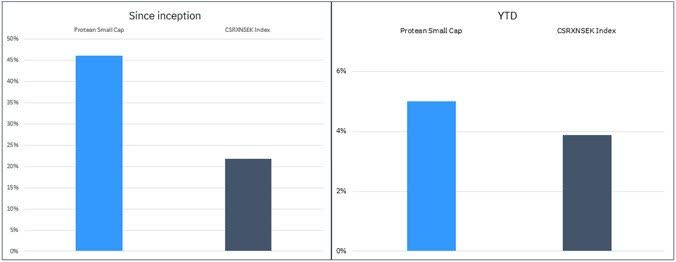

Protean Small Cap beat its benchmark (again) in February. It returned -0.8%, outperforming its index by 0.7%%. Since launching in June 2023, it has gained 46.1%, which is 24.3% ahead of the Carnegie Nordic Small Cap Index.

The hedge fund Protean Select returned 0.2% in February. We are approaching the 3-year mark in April, and since launch the fund has returned 29.2% with less than a third of the market’s volatility.

This month’s letter elaborates on Aktiesparfonden, what’s going on in the world, Dugin and Bannon, a Nordic Union, Lindex and Maersk (OTCPK:AMKBY), Fasadgruppen and OssDsign (OTC:OSSDF).

Thank you for being an investor!

// Team Protean

Introducing Aktiesparfonden

On the 1st of April we will launch Protean Aktiesparfond Norden, with Richard Bråse as lead Portfolio Manager. The fund combines the low fees of index funds with the potential of active management to outperform the index.

The concept comes from the very essence of Protean Funds: we manage capital the way we want our own capital to be managed.

To start, the fee is 0.5% for direct investors. Through distributors like Nordnet and Avanza, the fee is 0.75%. As the fund’s managed capital grows, the fees will be reduced even further.

With a significantly lower fee Aktiesparfonden will have an unfair advantage to typical actively managed funds when it comes to generating long-term returns. One percentage point may seem small, but over time, that percentage point compounds and has a monumental impact on total return. The structure is created to provide the best possible returns for unit holders, not to maximize profits for the fund company or its distributors.

A new concept, but an old name

The launch of Aktiesparfonderna (Equity Savings Funds) in 1978 became a catalyst for stock market interest and mutual fund savings in Sweden. With strong incentives, the government encouraged monthly saving in equity funds.

In 1984, Allemansfonderna (People’s Funds) were introduced, stealing the spotlight, and when Sweden implemented the EU’s directives on equity funds in the early 1990s, the Aktiesparfonderna faded into obscurity.

The name is an homage to long-term monthly investing in stocks.

Investment strategy

Protean’s equity fund will invest in Nordic companies with proven business models, solid returns on interest-bearing capital, and profits that translate into cash flow. By avoiding companies with unsound financial risk-taking, aggressive or dishonest accounting, and misdirected capital allocation—three factors that often go hand in hand—we reduce the risk of spectacular missteps.

The goal is to generate higher returns than the stock market over time, in an unspectacular manner.

Volatility as an opportunity

The price of stocks is far more volatile than their justified value, based on available information. For long-term investors, this volatility is not a risk, but an opportunity. Investors who can act with a long-term perspective and the integrity to go against prevailing market trends and investor sentiment can leverage the natural time arbitrage in the stock market. The sharper our view of a company’s resilience and long-term potential contrasts with the prevailing perception, the better.

The Equity Savings Fund does not invest in stocks in the hope of short-term price increases. We invest because a company’s value creation will translate into strong long-term returns if we pay the right price. It all comes down to buying the right business at the right price.

If we are more right than wrong, the outcome will be good.

Is this really happening?

Sitting down to write this month’s letter it struck me: the potential reader may not be at all interested in my takes on the rupture of the global post-1945 order. Sadly, the world order is interested in you. And your portfolio. Having a bigger picture view on the structural forces impacting markets, policy and capital flows is important.

We take our fiduciary duty seriously. Our promise to optimize for performance and to be adaptive means we vow to, not only react to changes, but to try and protect our capital and potentially profit. This means we spend time on the minute details of annual reports and cash flow statements, but also on the bigger picture. I venture it is particularly important when in a state of heightened flux. Like right now.

The conclusions from the January Partner Letter still stand. Reduced predictability (read: less trust in the rule of law and established norms) lead to higher risk premia, and therefore likely both lower general asset prices (future cash flows are harder to predict) and volatility (a neo-Patrimonialism system is difficult to predict, and prone to sudden shifts and second-guessing).

This has so far not really played out as anticipated. Given our investable universe is Scandinavia, the local markets have benefitted from a substantial flow-driven shift from US assets, buoying the prices of European firms.

The playbook we see in the US is an initial boost to asset prices from de-regulation and expansionary policies, followed by a long-term institutional decline and increased regulatory uncertainty, paired with inflation policy distortions (how long will the Fed be considered independent?). It seems we are still in the early innings.

Being entirely honest, the events of the past weeks – crowned by the US VP J.D. Vance Munich speech and the ongoing astonishing social media feed of several high-ranking US officials – have a meaningful impact on how I view the world. It has been particularly painful as the Dream of America has been a staple of any right-leaning Scandinavian youngster for the past, what, 70 years?

Disassembling the American Dream

We have been marinated in the soft power of American culture for generations. Star Wars, Friends, Bruce Springsteen, the glitz of the West Wing (incidentally my favourite TV show during my Political Science major) and the famed institutions like the Supreme Court, created to uphold the Constitution. It takes generations to build, but – alas – only months to disassemble.

US politics have always been a conundrum. A diverse collection of independent states, only united in the American dream of anything is possible if you work hard enough. I’m wondering whether (of all the stupid things to happen recently) the emphatic cancellation of the American dream is the most troubling one.

On the base of the Statue of Liberty there is a poem by Emma Lazarus:

Give me your tired, your poor, your huddled masses yearning to breathe free, the wretched refuse of your teeming shore.

I can hear the populist chorus: “OMG that’s so weak, so woke! So NOT America first!”. How long will it be allowed to remain?

Neo-Patrimonialism

Blurring the line between the state and the individual in charge brings some interesting problems. One is how do you derive legitimacy for your leadership? If it doesn’t rest in bureaucratic proceduralism, one must argue you – and only you – are the savior and protector of the people. This is exactly what Trump is doing, in his own words: “He who saves his Country does not violate any Laws.”

With blatant nepotism and a transactional approach benefiting not only affiliated businesses and cronies, but family members, this is (‘fast’) approaching what political scientists have labeled neo-patrimonialism. Punishing enemies via government institutions, using the state to monetize power. The list goes on. The historian will note that this was the typical modus operandi of the pre-modern era, and one could be excused for thinking the (previously) Western ideals had moved patrimonialism to the scrap heap centuries ago. Apparently not.

What is “the West” even anymore, if we suddenly do not agree on what values are worth fighting for?

And let’s not delve too deep in the announcements of a sovereign wealth fund (umm… the US is a heavily indebted country?) and strategic crypto reserve (fanning the flames of debasement of the USD – likely driving higher inflation and loss of trust in the financial system). Since the plan – if there is one – seems to be to destabilize the entire political-economical system, I guess it can be argued it’s entirely “in line”.

Dugin and Bannon

No, it’s not the two crows from Norse mythology. Neither is it the criminal master minds from the most recent James Bond movie. These two gentlemen, I think, form the basis of the recent Putin-Trump embrace. Just as Steve Bannon has been the strategist behind, and probably the designer of, Trump’s agenda and rickety ideological overgrowth, Alexander Dugin has inspired and justified Putin’s expansionary policies.

The commonalities are striking. Both share a deep opposition to Western liberalism (but for different reasons), a belief in nationalism over globalism and a desire to reshape global politivs by empowering traditionalists and nationalist forces.

European exceptionalism?

Like many have said before, why should Europe not be able to stand up properly to a Russia with a tenth of the GDP and a third of the population?

The glass-half-full interpretation of recent events is that it galvanizes the European continent to action. Structural changes take time and are not without pain – particularly when you have a group of countries that includes belligerent characters like Victor Orban and Giorgia Meloni.

Just to put things into perspective, the US spends 800bn EUR on defense every year. That is three times the entire EU27. When it comes to R&D the numbers are even worse: the US outspends the EU by a factor 12x.

Isolating Sweden here is not flattering. We spend 0.16bn EUR on R&D. There is an opportunity here for public-private partnerships, strengthening product and capacity development. Something that throughout history, if managed well, has created growth and benefited society via innovations and increased productivity. As but one example, remember that the internet emanated from DARPA.

A Nordic alliance?

If one thing can be learned from recent developments, it is that regardless of the historical strength and cultural fusion of alliances, they cannot be allowed to replace self-sufficiency. The logical thing for any nation state is thus to make sure it can protect itself, and only after that seek alliances. The Scandinavian countries share a lot of things. History, borders, languages, businesses and culture. I foresee a closer relationship in the years ahead. It makes sense. Are we seeing the first time in centuries when the prerequisites for an emerging Nordic Union are actually in place? Personally, I wouldn’t mind voting for Alexander Stubb.

I’m mildly surprised to see stock markets taking this seismic geopolitical shift in stride and see few reasons to position ourselves other than cautiously.

Again – No Politics in the Portfolio

It deserves repeating: a portfolio is a very poor weapon to point at moral and political cognitive dissonances.

We consider our job to ponder the direction of the world and gauge potential impacts on asset prices. This is why one team member is travelling to the US and Mexico in a few days, attending meetings with companies, politicians, journalists and ambassadors. Keep the finger on the pulse. Keep calm and carry on.

Protean Small Cap

– Carl’s update for February

Protean Small Cap returned -0.8% in February. That is 0.7%-points ahead of the CSXRN (SEK) benchmark index for the month. This puts the fund 24.3% points ahead of our index (CSRXN SEK) since inception. The fund now manages ca. SEK540m. Thank you for your trust.

While we did outperform in February, it didn’t really feel so. We got caught up in an unnecessary number of dramatic moves during the month, and the portfolio dispersion was huge.

Fasadgruppen became our big loser during the month. We have seen this Swedish provider of RMI services, mainly improving the facades of buildings, as a play on the positive impact lower interest rates should have on this type of investments. That thesis proved too simplistic in a near-term context, as margins collapsed in the fourth quarter. We usually refrain from putting the blame on someone else than ourselves, but the magnitude of the margin decline in the quarter raised our eyebrows, especially given that this is a backlog-driven business. As the business holds a considerable amount of leverage, the share price fell 54% during the month.

We won’t echo that famous line about Denmark from Shakespeare’s Hamlet, but the Danish trio Nilfisk (OTC:NLFKF, -17%), Lundbeck (OTCPK:HLBBF, -9%) and Bavarian Nordic (OTCPK:BVNKF, -15%) didn’t help us much during February. Nilfisk underwhelmed with their Q4 earnings, and a lukewarm 2025 guidance became a disappointment. This producer of professional cleaning equipment has a decent business. Margins are relatively stable as product investments are offset by savings and with recent product introductions, growth should improve. Valuation is very low with around 7-8x EBITA for this year. The share is trading at levels seen in 2020 when the debt situation was dire.

Lundbeck and Bavarian got caught up in the DOGE instilled fears about healthcare spending and the attractions we see in both these businesses (new product momentum, strong cash flows) weren’t in focus during February.

Winners? Our biggest was 4C Strategies (+76%). We bought into 4C in November last year, finding absolute valuation levels intriguing for a product leader with global footprint. They provide training software mainly for the military. The share rallied during the month due to a major contract signing, a decent Q4 report and the sharply improved sector sentiment.

We were also helped by the care operators Ambea (+19%) and Humana (HUM, +30%). We bought in to Humana in January when the share was suffering from a sell-down from a major owner. The share has been at a discount to its sector peers due to their turbulent exposure to personal assistance, but an improved earnings momentum during 2024 had failed to get noticed by the market until the Q4 report underlined that earnings momentum will continue in 2025.

Ossdsign (+33% percent)continue to post very impressive growth rates, growing 16 percent sequentially with a gross margin of 97 percent. Their synthetic bone graft Catalyst is gaining market share in a pace that makes us remember the early days of Bonesupport’s entry into the US market.

We have added a mid-sized position in Asmodee. This is a combination of a publisher and distributor of tabletop games, a category which includes board games and trading cards. The combination of owning some of the products, acting as a publisher of others, and distributing many more gives Asmodee a very strong market position. The recent spin-off from Embracer will gradually bring focus to the strong historical track record of Asmodee, who has acted as a consolidator in this fragmented market. We think M&A can become a driver for Asmodee again, as they are in control of how to use their own cash flow generation.

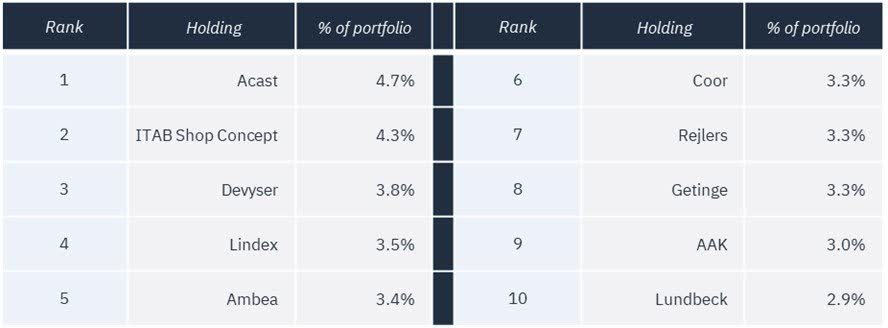

The ten largest positions in Protean Small Cap as we enter March are:

Protean Select

– Pontus’ update for February

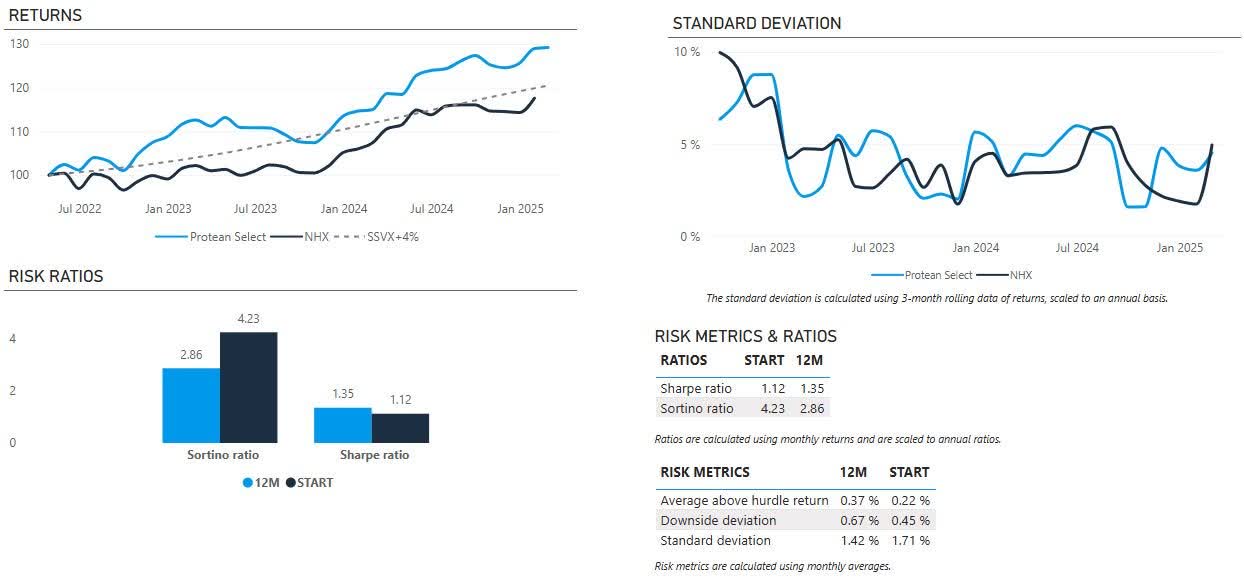

| *We illustrate our performance by showing a comparison with the NHX Equities index. This is an index constructed from the performance of 54 Nordic hedge funds focusing on equity strategies. NHX is published after our Partner Letter, so updates with one-month lag in the chart above. We aim to have positive returns regardless of the market, but no return is created in a vacuum, and a net-long strategy will correlate. Our hurdle rate is 6.3275% annualized (4% + 90-day Swedish T-bills). All figures are net of fees and ratios in the above charts are calculated using monthly returns. |

Protean Select returned 0.2% in February. Since inception in May 2022 the fund has generated performance of 29.2%, with low volatility.

Top contributors were long positions in Ambea, Essity (OTCPK:ETTYF) and RaySearch (OTCPK:RSLBF). Notable detractors were Fasadgruppen, OMX index futures and Bavarian Nordic.

We exit February with 21% beta-adjusted net long exposure and 121% gross exposure (adjusted for cash and cash equivalents). The portfolio remains diversified, with no single position >4% of assets.

Too cautious too early?

The cautious positioning served us poorly during February, as we underestimated the mechanical effects of the US-European reversal, which caused losses from our hedges. In addition, we suffered a handful of dramatic stumbles in a few smaller positions like Biotage (OTCPK:BITGF), Fasadgruppen and Elekta (OTCPK:EKTAF).

This is the annoying thing about owning 40+ stocks: there’s always – always – a few that you get completely wrong in the short term. What do we do? Reassess our thesis considering new information. Does it change our thesis? Act accordingly.

Maersk

We are short Maersk. A top-down reason is the increased uncertainty, and likely growth-shock, that comes from the tariff-happy US President. But there is a whole lot more to dig into. For starters the container shipping market is oversupplied and looks increasingly so over the next few quarters. This puts additional pressure on rates that have already started a precipitous decline in recent weeks.

Volumes have so far been strong this year, driven by front-loading of cargoes to avoid said tariffs. This will come to an end. We think Maersk Ocean is likely loss-making in H2 2025.

The new Gemini network leaves a few question marks, as does Maersk’s outlook of 4% volume growth and 95% utilization. When the Red Sea situation is resolved, it will add several percentages of capacity on the Asia-Europe trade.

The one thing they have going for them is a (currently) healthy balance sheet. There is an ongoing 2bn USD buy-back, which absorbs about 12% of daily volumes. Perhaps this is what drove the stock by 17% during February?

Optically, the stock looks “cheap”, but if you open the hood, you find one of the riskiest businesses around – global trade lanes have historically been protected by US naval forces, guaranteeing free trade. Now the US is scaling back and focusing on US manufacturing. What are the odds of these giant container ships ending up as literal stranded assets in a few years’ time?

Maersk’s historical capital allocation does not instill confidence. Aggressively buying back its own stock at these levels could very well be the next example.

Maersk has the potential to head south in the blink of an eye. The risk/reward for a short position looks attractive.

Lindex

We hold a decent sized position in Lindex. This Swedish clothing retailer has been hidden within troubled Finnish department store business Stockmann since 2007. As Lindex has outperformed Stockmann (to put it mildly), the company has seen fit to change the name for the entire group to Lindex and initiate a review of the loss-making department stores.

We think Lindex is severely undervalued. The margins are industry leading, the e-commerce business is growing, and the assortment, which is dominated by underwear and kids clothing, has both low fashion risk and low returns. The company is ramping up a new warehouse, fully funded by own cash flows, and has taken several significant investments in IT and shop modernization in 2023-2024.

We think a re-valuation of Lindex is around the corner, as the last debt restructuring in Stockmann comes to an end and the fate of the department stores is decided. We caution against believing a Stockmann divestment will generate any proceeds to Lindex. Rather, an accompanying cash buffer could be included in the divestment, like other similar divestments of flailing department stores in the Nordics.

After all, what is persistent negative free cash flow worth? Even if accompanied by a cash outlay (Lindex is debt free on an IFRS-adjusted basis), it would be a meaningfully positive event, as focus can turn to Lindex’s well-invested and positioned operations, and severe undervaluation.

The monthy reminder

We optimize for performance, not for convenience, size, or marketing. You can withdraw money only quarterly (monthly in Small Cap). We tell you very little about our holdings. Our strategy is tricky to describe as we aim to be versatile. A hedge fund can lose money even if markets are up. We charge a performance fee if we do well. You do not get a discount if you have a larger sum to invest. We do not have a long track record.

Thank you for being an investor.

Pontus Dackmo, CEO & Investment Manager

Protean Funds Scandinavia AB

| DISCLAIMER: Investments in a fund can both increase and decrease in value. You are not guaranteed preservation of invested capital. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here