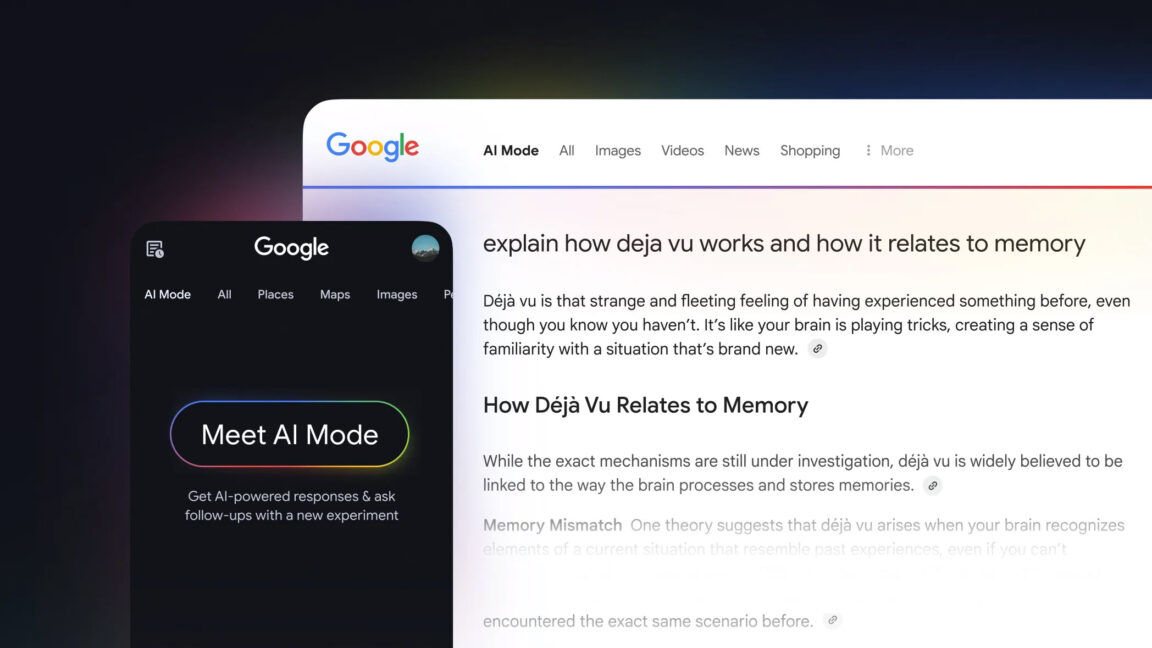

- Chinese tech stocks are rising sharply on new AI announcements.

- Alibaba announced a new AI model that it claims is more efficient than DeepSeek.

- Meanwhile, top-performing US-based AI stocks like Nvidia are struggling.

The AI investing frenzy isn’t over. It’s just migrating.

Chinese AI names have seen major gains in recent days on fresh excitement for newly announced technology. Alibaba has led the way with an 8% gain over two days after unveiling its latest open-sourced AI model, which is said to use less data than its rival DeepSeek.

Here are some of the other most notable two-day moves for Chinese AI stocks:

On the other side of the ledger are US-based AI stocks led by Nvidia, which has dropped 4% over the same two-day period, and is trading 17% lower in 2025. The overall US semiconductor space is approaching a bear market, down 15% from February highs.

It’s fair to say that the losses for US firms has been China’s gain. As American juggernauts spend hundreds of billions of dollars on developing AI technology, China has shown an ability to accomplish similar things at lower costs.

The declines on Thursday weighed most significantly on the tech-heavy Nasdaq Composite, pushing it nearly 3% lower, and bringing its year-to-date loss to more than 6%.

The start of the decline

After the reveal of DeepSeek’s cheaper model jolted US investors in January, doubts have risen over the sustainability of massive AI spending.

While the mega-cap AI “hyperscalers” like Meta, Microsoft, and Alphabet have committed billions to the technology, growing model efficiencies suggest that AI hardware demand might not be as high as expected.

That’s weighed heavily on US chipmakers in recent weeks, and even positive earnings results have failed to shore up faith. Marvell’s slight earnings and guidance beat this week was the latest example of a tepid response to otherwise solid results, with shares plunging over 17% on Thursday.

Macroeconomic uncertainty and concern over high valuations in the US market are fanning the flames of the AI-driven tech bubble bursting.

That’s not the case in China. According to Bloomberg, valuations haven’t soared nearly as high as US peers, with the Hang Seng Tech index trading around 19 times forward earnings.

Other catalysts are also fueling the rally. This week, China’s National People’s Congress gave the country’s tech sector a boost by announcing support for the broad application and development of large-scale AI models.