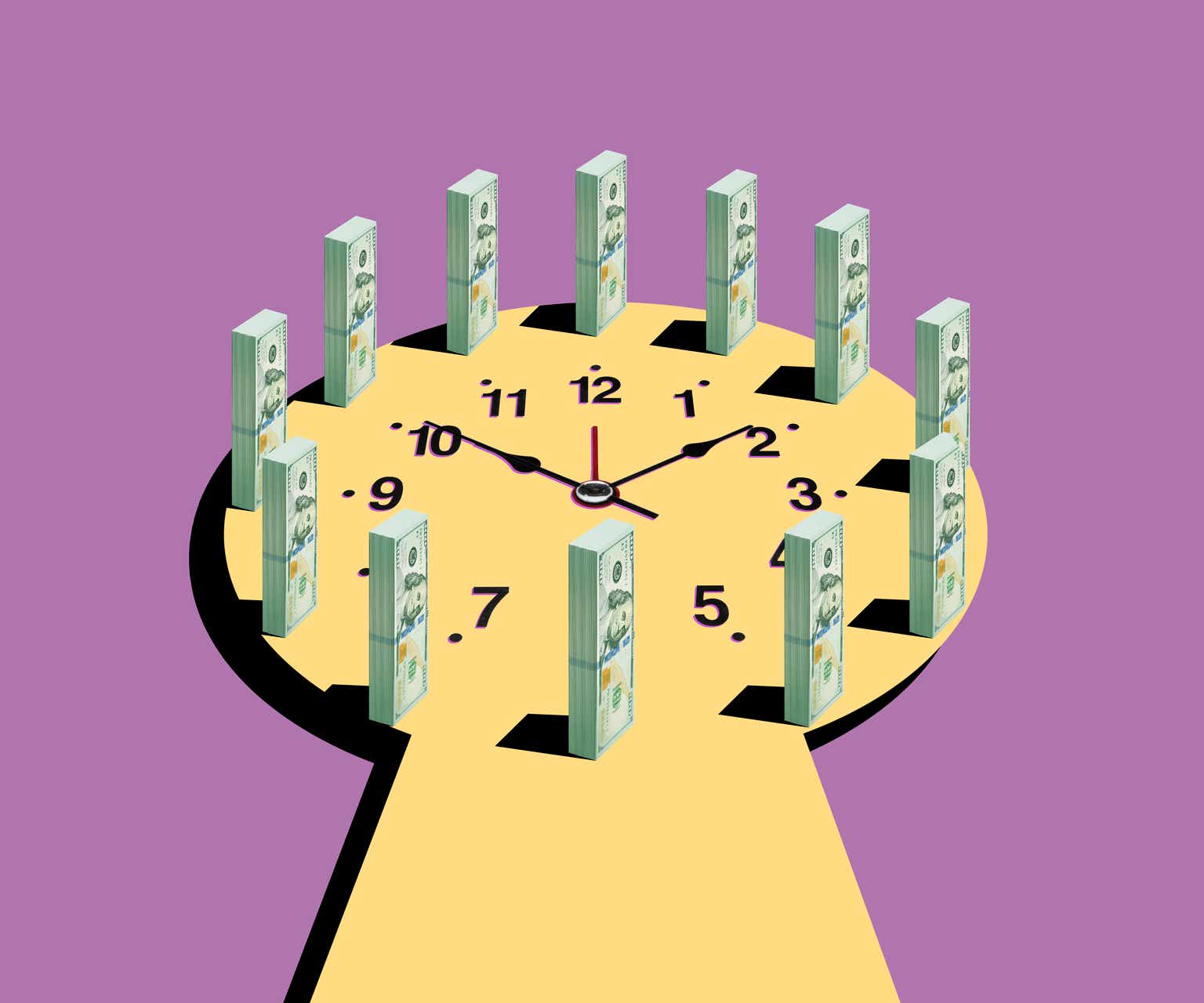

- The stock market has surged since Trump’s election win, driven by the prospect of tax cuts and deregulation.

- Some trades have been more obvious than others, with bitcoin and Tesla stock rallying.

- Yet, some under-the-radar names are also up on the prospect Trump’s proposals provide a boost.

The stock market has surged since Donald Trump’s election win this month, with the major index averages initially popping about 4% on the prospects of lower tax rates, deregulation, and a boom in corporate mergers.

Trump’s campaign promises have boosted everything from bitcoin to the US dollar to Tesla stock. But some under-the-radar stocks have also seen big gains since Election Day, driven by everything from a changing media landscape to the views of President-elect Trump’s cabinet picks.

From private prisons to student loan companies, here are 10 under-the-radar stocks that have jumped since Trump’s election win.

- Fox Corporation

Roy Rochlin/Getty Images

Ticker: FOX/FOXA

Market valuation: $20.3 billion

Gain since Election Day: 8%

Fox Corporation owns the media properties including Fox News, which has enjoyed strong ratings since Trump’s election win. Fox News has seen viewership soar in the weeks following the election, while competitors CNN and MSNBC have sharp declines in viewers.

- Fannie Mae and Freddie Mac

Kevin Lamarque/Reuters

Ticker: FNMA and FMCC

Market valuation: $3.9 billion and $2.1 billion

Gain since Election Day: 132% and 152%

The preferred shares of the government-sponsored mortgage finance giants Fannie Mae and Freddie Mac have jumped sharply since Trump’s win.

That’s because investors are betting that his second term will result in the long-await privatization of the firms after a decade and a half of government control following the 2008 financial crisis. While the effort stalled in Trump’s first four years in office, mortgage market players are hopeful that this time may bring the so-called “recap and release” of the government-sponsored enterprises.

- Henry Schein

LGK/Getty images

Ticker: HSIC

Market valuation: $9.2 billion

Gain since Election Day: 2%

While dental supply company Henry Schein is up only 2% since the election, it’s up 11% since Trump named Robert F. Kennedy Jr. as his pick to lead the Human Health and Services Department. RFK Jr. has said he would advise municipalities to remove fluoride from water supplies.

Public health officials say the widespread use of fluoride in the US water supply helps prevent tooth decay. Investors, therefore, are likely betting that a push to remove the mineral from drinking water could lead to increased cavities and a higher need for dental health services, helping boost Henry Schein’s business.

- Sallie Mae

Paul Morigi/AP Images for Reading Is Fundamental

Ticker: SLM

Market valuation: $5.1 billion

Gain since Election Day: 12%

Sallie Mae is an administrator of student loans. Investors are likely betting that President Biden’s student loan forgiveness plans will end shortly after Trump’s inauguration in January.

According to data from the Department of Education, Biden’s Administration was able to forgive $166.5 billion worth of student loans even as legal challenges derailed the President’s plan for across-the-boar cancellation. That weighed on shares of student loan servicers over the last four years, and investors are laying bets that their fortunes are about to change.

-

Geo Group and CoreCivic

Associated Press

Ticker: GEO and CXW

Market valuation: $3.9 billion and $2.4 billion

Gain since Election Day: 95% and 62%

Geo Group and CoreCivic operate private correctional and detention facilities. Those facilities could be used more by the federal government if President-elect Trump follows through with plans to deport millions of immigrants, who would have to be detained before they are returned to their country of origin.

- Cameco

REUTERS/Arnd Wiegmann

Ticker: CCJ

Market valuation: $34.6 billion

Gain since Election Day: 16%

Cameco mines and distributes uranium for nuclear power plants. Nuclear power generation has already seen something of a renaissance amid the AI boom, and the energy source could boom more under Trump.

The President-elect’s pick for Energy Secretary, Chris Wright, has previously made comments supporting nuclear power, stating shortly before the election that the US should increase nuclear’s share of overall power generation from 4% to 10%.

Wright also serves on the board of Oklo, a nuclear power company backed by OpenAI founder Sam Altman.

- Grand Canyon Education

LawrenceSawyer/Getty Images

Ticker: LOPE

Market valuation: $4.7 billion

Gain since Election Day: 17%

With President-elect Trump eyeing big changes to the Department of Education, for-profit institutions may stand to benefit in his second term.

“Specifically, the for-profit college stocks could see the risk of revised gainful-employment rules removed,” BMO analyst Jeffrey Silber wrote in a note shortly after the election.

That rule requires for-profit schools to prove that their degrees come with adequate employment benefits for graduates.

Grand Canyon Education has been under particular scrutiny during Biden’s term. The Federal Trade Commission sued the company in 2023 for deceptive practices related to costs and marketing itself as a non-profit.

- Regional bank stocks

REUTERS/Lucas Jackson

Ticker: KRE ETF

Gain since Election Day: 11%

Regional bank stocks represented by the SPDR S&P Regional Banking ETF have surged on the promise of deregulation in the financial sector under a second Trump presidency.

Investors see a looser oversight environment, with the potential for the post-2008 rules regime to be dialed back, allowing for more dealmaking, more lending, and higher profitability.