Listen below or on the go on Apple Podcasts and Spotify

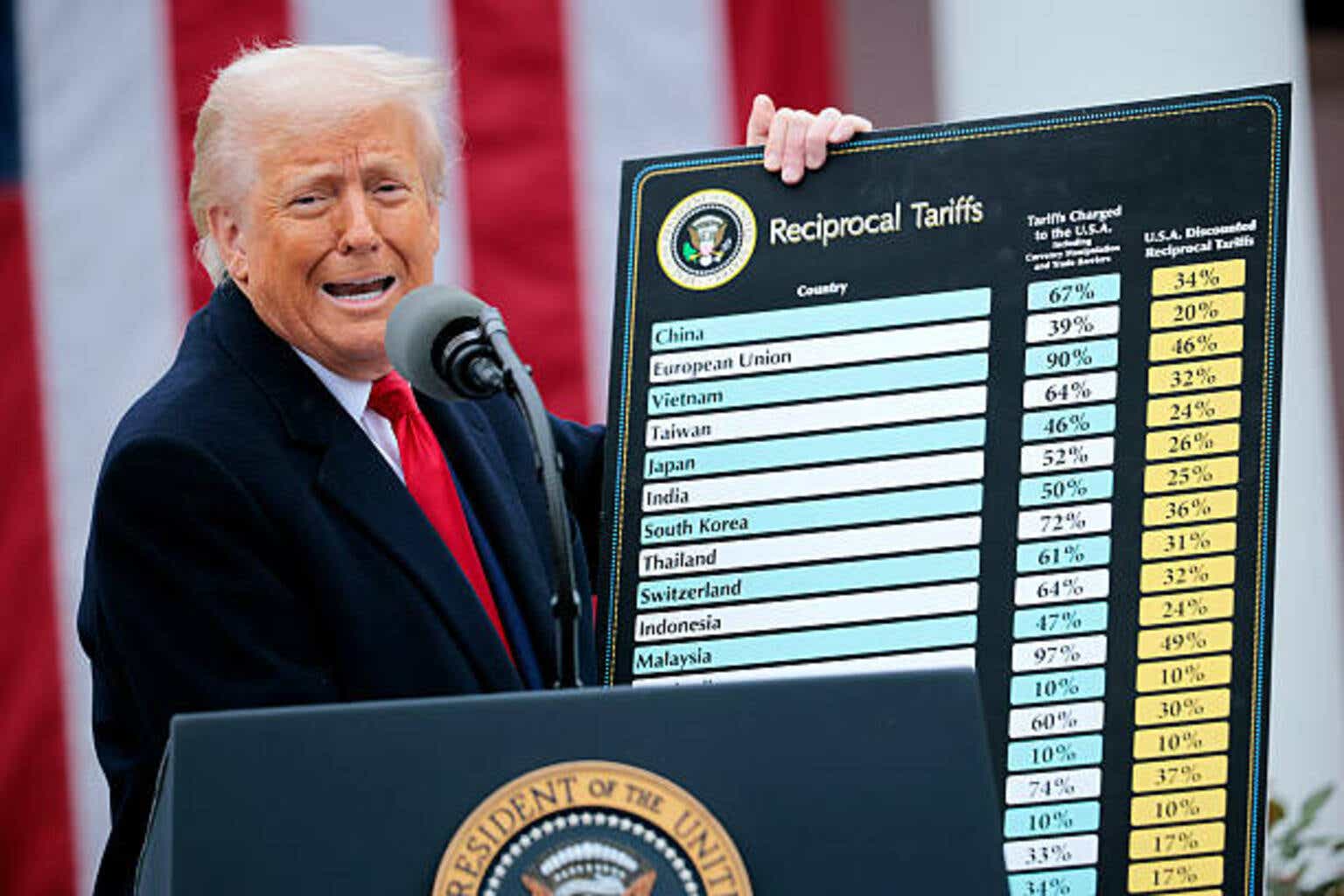

Stock market tanks after Trump’s global tariff announcements. (0:15) Tariff formula baffles experts. (1:32) Odds of a U.S. recession jump. (2:40)

This is an abridged transcript of the podcast:

Our top story so far is our only story – tariffs: It’s tariff day +1 and markets are tumbling – but off their lows.

The major stock averages (NYSEARCA:SPY) (QQQ) (DJI) are all down more than 3% as a flight to bonds pushes yields down. The 10-year Treasury yield (US10Y) is bumping up against 4%.

“In short, the tariffs put in place last night were extraordinary both in terms of scale and in how they were calculated, with President Trump announcing reciprocal tariffs under the International Emergency Economic Powers Act (IEEPA) as he declared a national emergency over the trade deficit,” Deutsche Bank’s Jim Reid said.

“Markets, caught off guard by the severity of Trump’s tariffs, reacted dramatically,” Jacob Falkencrone, global head of investment strategy at Saxo Bank, said Thursday.

“This was the worst-case scenario for tariffs and were not priced-into the markets, which is why we are seeing such a risk-off reaction,” Sanctuary Wealth’s Chief Investment Strategist Mary Ann Bartels said about stocks.

Oil prices tumbled more than 5% on concerns about a global trade war recession.

“The tariffs were bigger than expected,” UBS commodity analyst Giovanni Staunovo said. “The question now is how other nations will respond, including whether we will see stimulus measures.”

So, how were these new tariffs calculated.

According to the U.S. Trade Representative (USTR), “reciprocal tariffs are calculated as the tariff rate necessary to balance bilateral trade deficits between the U.S. and each of our trading partners.”

“This calculation assumes that persistent trade deficits are due to a combination of tariff and non-tariff factors that prevent trade from balancing. Tariffs work through direct reductions of imports,” the agency said.

They also provided a formula with a lot of Greek letters (available in our story), but what it boils down to is that the tariff percentages are trade deficit divided by imports.

Scott Lincicome, vice president of general economics at the Cato Institute, called the reciprocal rate calculations “utterly detached from reality.”

“President Trump thinks the trade deficit is a national emergency. To wit, the ‘formula’ behind the so-called reciprocal tariffs is simply a function of bilateral trade deficits. Contra Trump, the trade deficit is not inherently bad; and imposing tariffs won’t reduce it anyway,” Erica York, vice president of federal tax policy at the Tax Foundation, said.

On the economic front, the odds of a U.S. recession this year have surged to 54%, according to New York-based financial exchange and prediction market Kalshi. That’s the highest level since late September last year.

Kalshi also noted that U.S. recession odds in Q1 2025 had been as low as 17%.

According to Fitch Ratings, Trump’s tariffs result in an overall U.S. effective tariff rate last seen over a century ago in 1909. They also “significantly” raise U.S. recession risks.

JPMorgan’s Michael Feroli said: “The president’s highly anticipated tariff announcement … delivered at the very hawkish end of the range of expected outcomes … By our calculations this takes the average effective tariff rate from what had been prior to (yesterday’s) announcement around 10% to just over 23%,”

Feroli also said that the reciprocal tariffs could boost personal consumption expenditure prices by 1% to 1.5% this year.

In the Wall Street Research Corner, Sanctuary Wealth’s Chief Investment Strategist Mary Ann Bartels says: “The Trump administration has outlined the ‘worst-case scenario’ on tariffs, thrusting the S&P 500 (SP500) into risk of correcting as much as 20%.”

“This was the worst-case scenario for tariffs and were not priced-into the markets, which is why we are seeing such a risk-off reaction,” she said. If the S&P can’t hold 5,500, investors may see the index drop by another 5% to 10%, to a bottom of 5,200-5,400.

“We’re expecting rocky markets for the next few months, and through the end of the first half of the year. We have already seen a 10% correction, and there is a risk of a 15%-20% correction now.” she added.

And BofA says tariffs could hit the S&P 500’s operating income by 32% if there is equal retaliatory force.

In addition, “prolonged negotiations could stall activity spiraling into a recession … Calls to boycott U.S. goods could ramp further. But pricing power and currency moves can mollify tariff impacts,” she said.

Read the full article here